Impact of inflation on Americans linger on, amid US’ economic headwinds in 2023

To bring inflation under control, the Federal Reserve had put the United States on multiple interest rate hikes, raising them 11 times over the course of the year.

This audio is generated by an AI tool.

NEW YORK: Inflation has affected many in the United States this year, from traders on Wall Street to everyday shoppers.

The economy has undergone rounds of interest rate hikes to ease price pressures, and these have in turn presented their own side effects.

While the threat of recession has seemingly blown over, the past year has been full of economic headwinds.

PRICE PRESSURES PERSIST

Year-on-year consumer prices have fallen in the US since hitting a peak of 9.1 per cent in June last year.

However, the impacts of price pressures still persist.

“Inflation is a lot, and spending money on free time, sports and other activities have been affected a lot,” one shopper told CNA.

A 20-year-old shopper, who just entered the workforce full-time, said “groceries are way more expensive”.

Another shopper told CNA that “we haven’t been able to travel as much as we normally do” due to the higher costs.

Inflation has also been an unappetising reality for diners this year, with the cost of dining out at restaurants staying high, despite cooling price pressures.

“When you look at restaurant prices, I think it has to come down. There are some supply chain dynamics (and) some other factors that might be behind that, but it has been a little slower to moderate than grocery,” Mr R.J. Hottovy, head of analytical research at location analytics firms Placer.ai, told CNA.

“I think that’s why we’re seeing some channels shift away from restaurants into other lower priced grocery channels.”

BRINGING INFLATION UNDER CONTROL

To bring inflation under control, the Federal Reserve had put the US on multiple interest rate hikes, raising them 11 times over the course of the year.

It has currently settled on a target range of between 5.25 and 5.5 per cent.

The Fed has had to perform a delicate balancing act this year, slashing inflation without slipping the economy into reverse.

Many analysts believe the US will achieve a so-called “soft” economic landing and avoid a recession, but not without some pain to the public.

Goldman Sachs is pricing in just a 15 per cent chance of recession over the next 12 months, and expects the economy to expand 2.1 per cent next year.

However, the US central bank is not expected to lower interest rates any time soon, which could continue to impact sectors like real estate.

Mortgage rates had hit a more than two-decade high of over 8 per cent in October, due in large part to elevated borrowing costs.

REAL ESTATE MARKET HIT

Serhant realtor Alex Abrahamson told CNA that high interest rates have led to some price cuts which benefit cash buyers.

However, the current economic landscape has closed the door for many prospective buyers.

“It might essentially mean that you’re going to, unless you have a big down payment, be paying pretty expensive monthlies, and it’s a harder barrier of entry for first time home buyers as well. So I think those are the things that those mortgage rates can affect,” said Mr Abrahamson.

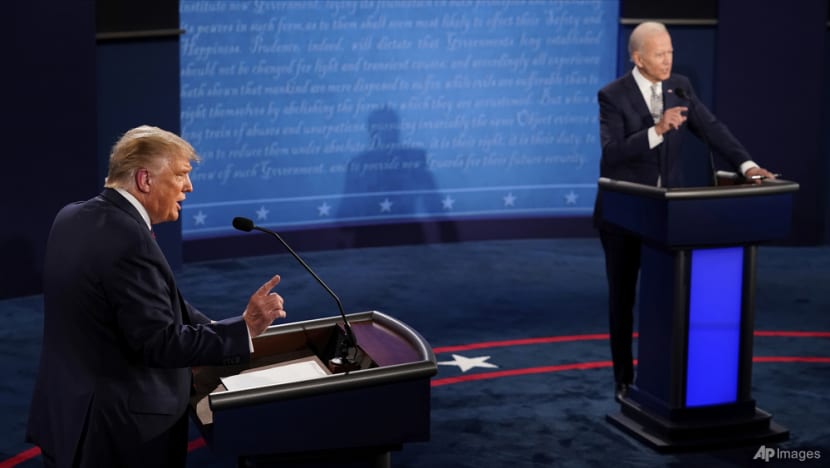

Heading into an election year, the fight against inflation and the state of the economy can have significant consequences on the results.

Americans will vote in the presidential election next year, with the race shaping up to be a rematch of the 2020 contest between current President Joe Biden and his predecessor Donald Trump, who are both emerging as frontrunners in their respective parties.

“If we continue to have high inflation rates and the electorate believes the economy is just spluttering along, that will work against the current administration,” Mr Sam Stovall, chief investment strategist at CFRA Research, told CNA.

He noted that historically, however, the stock market has done “very well” going into an election year of a first-term president seeking re-election.

Federal Reserve chair Jerome Powell has said he is not confident that enough has been done to bring inflation down to its 2 per cent target.

Consumers in the US will be hoping that he is wrong, and that their money will soon start stretching a little bit further.