France leads Europe’s push to reduce reliance on China for rare earths

A new rare earths production facility being built in France is expected to supply 15 per cent of the global market for heavy rare earths by the end of next year.

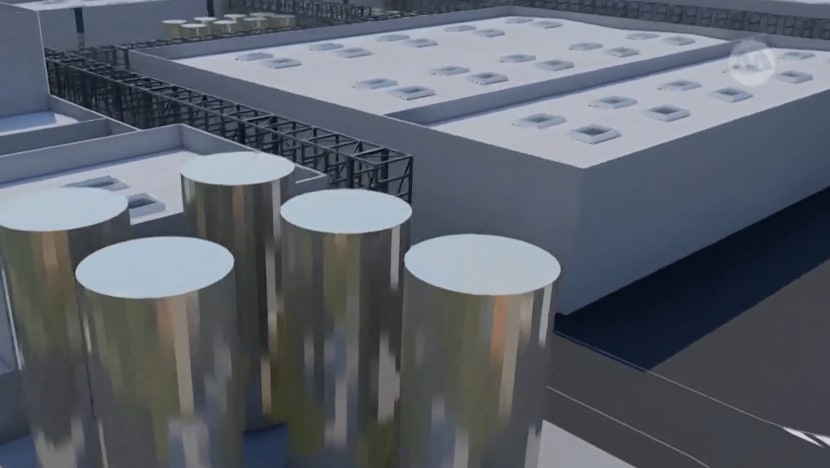

An artist's impression of the upcoming rare earths production facility in the southern French village of Lacq. (Screenshot: Caremag)

This audio is generated by an AI tool.

LACQ, France: As Europe’s need for rare earths in the green energy and automotive sectors continues to grow, it is racing to lessen its reliance on China – a strategic vulnerability long flagged by European Union policymakers.

France has now become the continent’s leading player in efforts to develop a homegrown rare earth ecosystem.

A new production facility in the southwestern French village of Lacq is expected to supply 15 per cent of the global market for heavy rare earths by the end of 2026.

The US$245 million plant is being developed by French company Caremag, a subsidiary of rare earth specialist Carester.

Once operational, it will be Europe’s first large-scale rare earth separation facility, combining recycling of end-of-life equipment with imported mined concentrates.

“With Caremag, we will be able to produce 600 tonnes of heavy rare earths and then we will produce 15 per cent of the worldwide demand of these very specific rare earths which are critical for the ecologic transition,” said Carester’s founder and chief executive Frederic Carencotte.

Rare earth elements are essential for the production of mobile phones, electric vehicles, wind turbines and other green technologies.

According to the EU Joint Research Centre, demand for rare earths for certain clean energy technologies will increase fivefold by 2030.

However, China currently dominates the market, accounting for over 90 per cent of the world’s refined rare earth minerals and the vast majority of rare earth magnets.

With no active rare earth mines in Europe, firms like Caremag are focusing on recycling and building partnerships in Asia to reduce dependency.

“Today we already have 70 per cent of our product which is booked and we work mainly with Japan, and also we have signed a long-term contract with Stellantis,” said Carencotte, referring to the world’s fifth-largest automaker.

Caremag’s plant is partly backed by the Japan Organization for Metals and Energy Security and Japanese trading house Iwatani.

“Our goal is really to sign long-term contracts with people who have long-term views about the security of supply,” Carencotte added.

BROADER ECOSYSTEM

France's appeal lies in its mix of government support, EU policy alignment – particularly the Critical Raw Materials Act – and access to abundant low-carbon nuclear energy, making it an attractive destination for industrial investment.

The Caremag plant is part of a broader rare earths ecosystem emerging in Lacq.

British company Less Common Metals is investing US$129 million in a nearby plant to produce rare earth metals and alloys.

“France offers a stable and industrially advanced environment with a strong commitment to strengthening European supply chain sovereignty,” Grant Smith, chairman of Less Common Metals, told CNA in a statement.

Belgian chemicals firm Solvay has also launched a rare earth production line for permanent magnets in France, while expanding its west coast plant where it has processed rare earth metals for nearly 80 years.

European companies aim to produce 1,000 tonnes of rare earth magnets a year by 2027.

Although this remains a long way from challenging the 16,000 tonnes that Europe needs from China each year, these recent advances mark a significant step toward greater supply chain resilience.