Beyond the card: Unlocking access to digital payments for consumers and businesses

Visa is enabling innovation by setting global standards and helping disruptors in fintech scale their businesses.

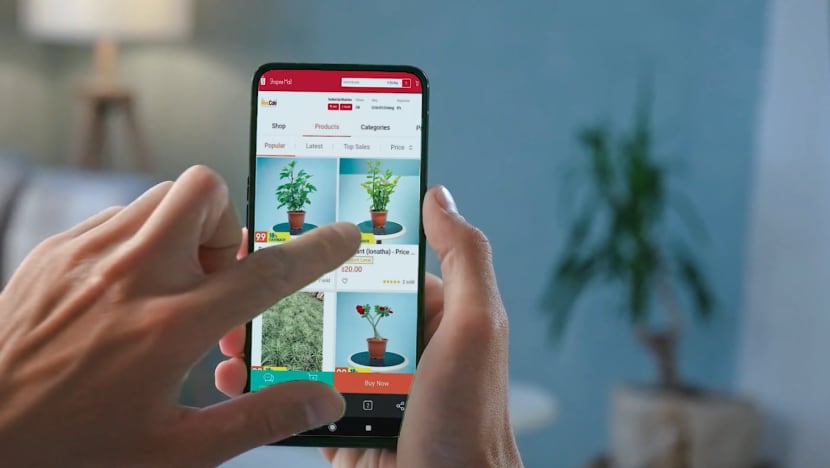

Visa offers consumers fast, seamless, and secure ways to pay. Photos: Visa

The COVID-19 crisis has dramatically boosted the use of digital payments, as more people turn to contactless payment options and online shopping. According to Visa’s Consumer Payment Attitudes Study 2021, Singaporeans believe that the pandemic has accelerated the country’s transition to a cashless society by four years.

Visa aims to use the power of its network to spark positive change in communities. Video: Visa

Keeping pace with these rapid transformations, Visa is leveraging its diverse capabilities to bring about global economic inclusion. “Even with money increasingly moving in new ways, Visa’s mission remains the same – to enable individuals, businesses and economies to thrive,” said Mr Kunal Chatterjee, Visa’s country manager for Singapore and Brunei.

CHAMPIONING SECURITY

Visa is guided by the principle of responsible innovation – this means developing products and services with privacy and security considerations from the get-go. Over the last five years, the brand has invested US$9 billion (S$12.12 billion) to boost cybersecurity and combat fraud.

One of its solutions – Visa Advanced Authorisation – analyses more than 500 data elements to generate a risk score for each transaction. According to Mr Chatterjee, this move has helped banks prevent an estimated US$26 billion in fraud globally in fiscal year 2021.

With an uptick in e-commerce transactions, Visa has introduced solutions that offer both payment security and customer convenience. For instance, Visa Secure, supports 10 times more data exchange between banks, businesses and consumers. In this instance, the use of dynamic data such as IP address, type of device and location gives banks and businesses higher confidence that transactions are genuine as compared to static data such as one-time passwords sent via text message.

An advocate of tokenisation, Visa has also supported the development of a tokenisation framework for the payments industry, which has catalysed innovations in digital wallets such as Apple Pay and Samsung Pay.

“As we develop new ways to pay with devices, apps and consumer products, security cannot be an afterthought because no product or service can succeed at scale without trust,” shared Mr Chatterjee.

KEEPING AHEAD OF EMERGING TRENDS

Among the payments trends that have emerged in recent years, Buy Now Pay Later (BNPL) solutions have shown brisk growth, with rising interest and use among consumers. Yet, they remain a fraction of the total industry’s payments volume, estimated by Visa to be about US$100 billion to US$150 billion.

Visa is bringing scale to the BNPL space via a two-pronged strategy. Firstly, with its instalment rollout, Visa gives banks the ability to extend a BNPL option to consumers on an existing credit line or to businesses that can offer the option to customers at the point of sale. This solution is currently being employed by HSBC Malaysia and ANZ Australia, and is also available to banks in Singapore.

Secondly, Visa partners BNPL fintechs to extend their offerings to wherever Visa is accepted. This means that BNPL companies do not need to cut individual deals with selected merchants, while merchants have the opportunity to gain access to a global playing field.

SUPPORTING DISRUPTION

As a new generation of startups in fintech and BNPL is poised to radically transform the payments space, Visa aims to help its partners expand their payment capabilities and reach new market segments.

“All of the different players in digital payments are helping to grow the size of the pie, and we ultimately have the same objective – to expand access to digital payments. Visa provides a foundation for innovation by setting global, interoperable standards and helping disruptors scale,” said Mr Chatterjee.

“As digital payments evolve, so have we. Visa is going beyond plastic cards that exist in wallets to virtual cards that live in a variety of applications and locations, powering many of the payment experiences that Singaporeans are familiar with – from e-commerce, BNPL, contactless, QR payments, ride hailing to even paying for our bus and train rides.”

POWERING THE FOURTH PAYMENT REVOLUTION

The COVID-19 pandemic has pushed more Singapore consumers to shop online for the first time through websites, apps and social media channels. Recognising the opportunity, Visa signed a five-year strategic partnership with Shopee in 2020 to offer users fast and secure payment as well as to support merchants in digitalising their business.

To ensure digital inclusion for all, Visa has partnered the People’s Association since 2018 to provide hands-on training on digital payments and e-commerce for seniors.

The company is also helping organisations digitalise business-to-business payments with physical and virtual business payment cards – a simple and easy way for businesses to start their digital journey.

Discover how Visa is enabling people, businesses and economies to thrive in an ecosystem with far-reaching benefits.