Explore new growth opportunities through Asia ex Japan REITs ETFs

Learn more about this financial instrument and how it could potentially help hedge against inflation.

When it comes to portfolio diversification, investors may consider exploring differentiated avenues of property investment. Photo: Nikko Asset Management Asia

Real estate investing has long been of keen interest to investors in Singapore, and often features as a mainstay strategy in growing one’s wealth. Even as higher private property taxes and rising interest rates threaten to dampen investor sentiment, analysts continue to anticipate strong demand for other real estate asset classes.

To better manage risks, investors may wish to explore differentiated avenues of property investment. An option is real estate investment trusts (REITs) – companies that own, operate or finance income-generating real estate. REITs invest in a range of real estate properties, such as apartment buildings, cell towers, data centres, hotels, medical facilities, offices, retail centres and warehouses. Through REITs, retail investors can acquire shares in commercial real estate portfolios.

UNDERSTANDING ASIA EX JAPAN REITs

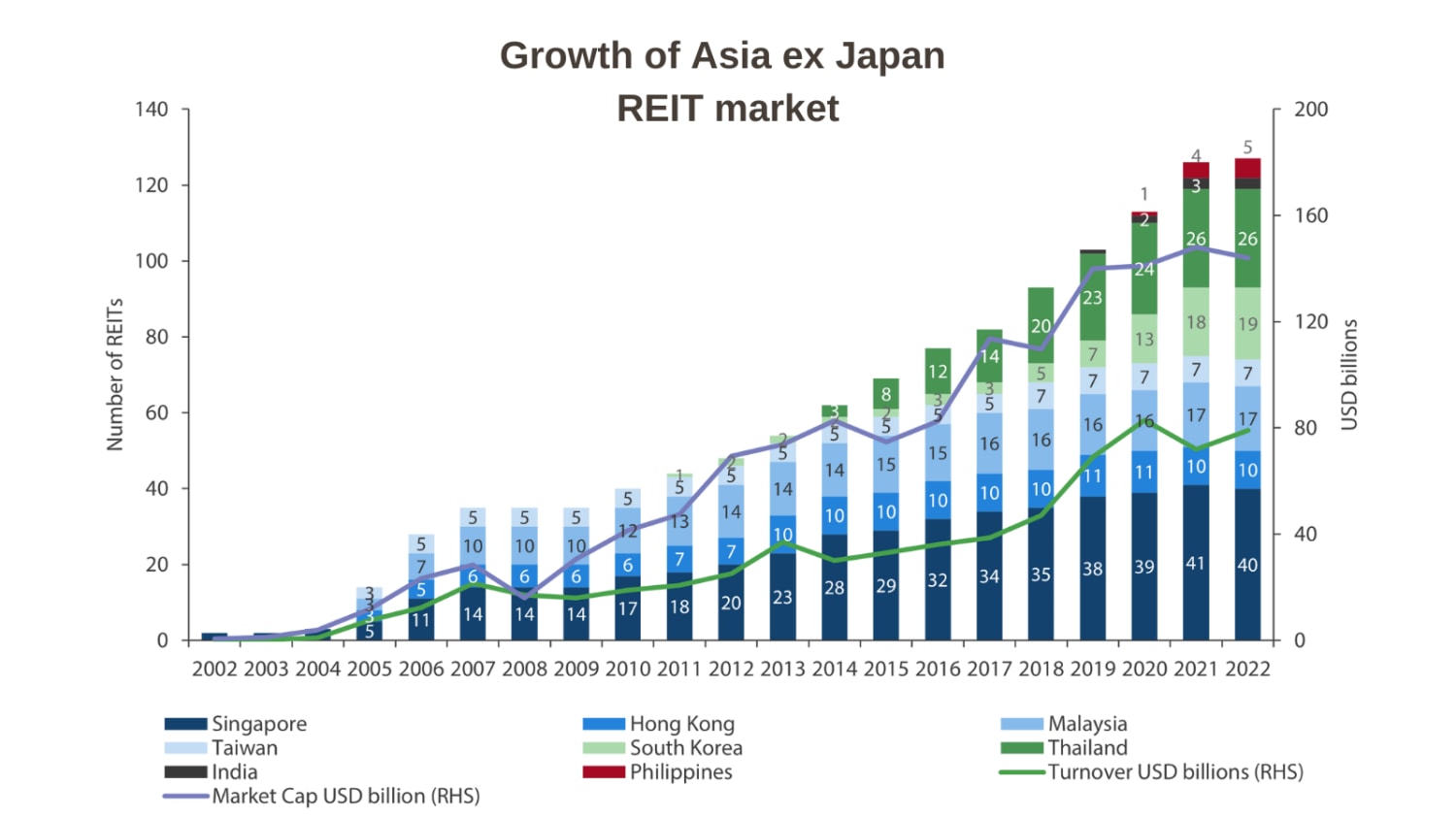

According to Mr Winston Lum, senior portfolio manager from Nikko Asset Management Asia (Nikko AM Asia), Asia (excluding Japan) REITs are one of the fastest-growing asset classes over the last two decades. “Asia ex Japan REITs could be an avenue to a raft of opportunities that have arisen in the region on the back of rapid urbanisation, a growing middle-class consumption and a rebound in tourism,” he said.

As of Mar 31, there are more than 120 REITs in the Asia ex Japan region.

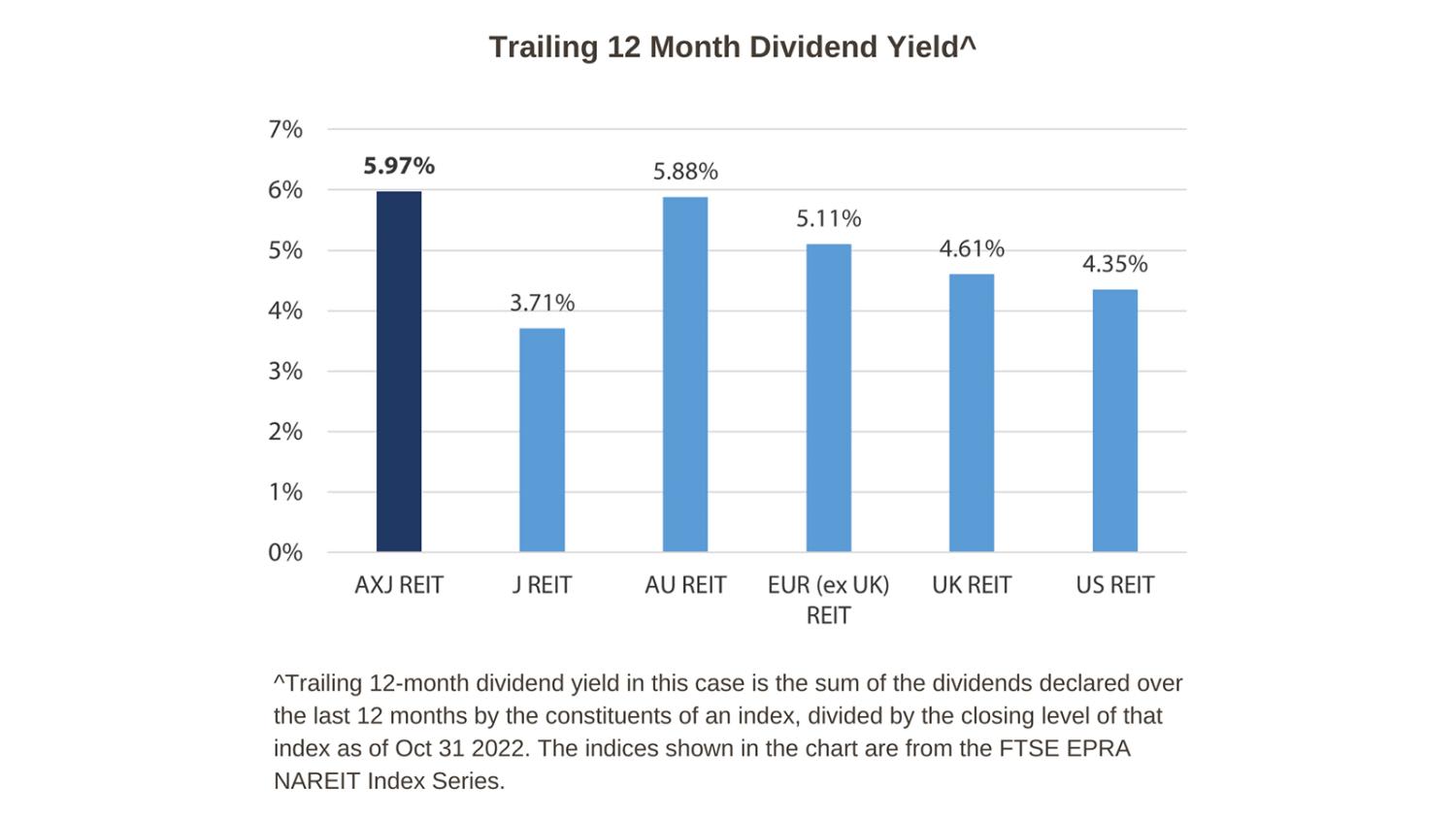

Asia ex Japan REITs can also be effective as an inflation hedge, said Mr Lum. He explained: “The underlying leases of Asia ex Japan REITs are shorter than those in developed markets. As inflation takes hold through higher prices of goods, landlords can raise rents as their leases are renewed to align with inflationary trends.”

Furthermore, the assets of Asia ex Japan REITs are often located in markets with stronger GDP and economic growth prospects. “Stronger growth gives tenants better financial capacity to pay higher rents,” shared Mr Lum.

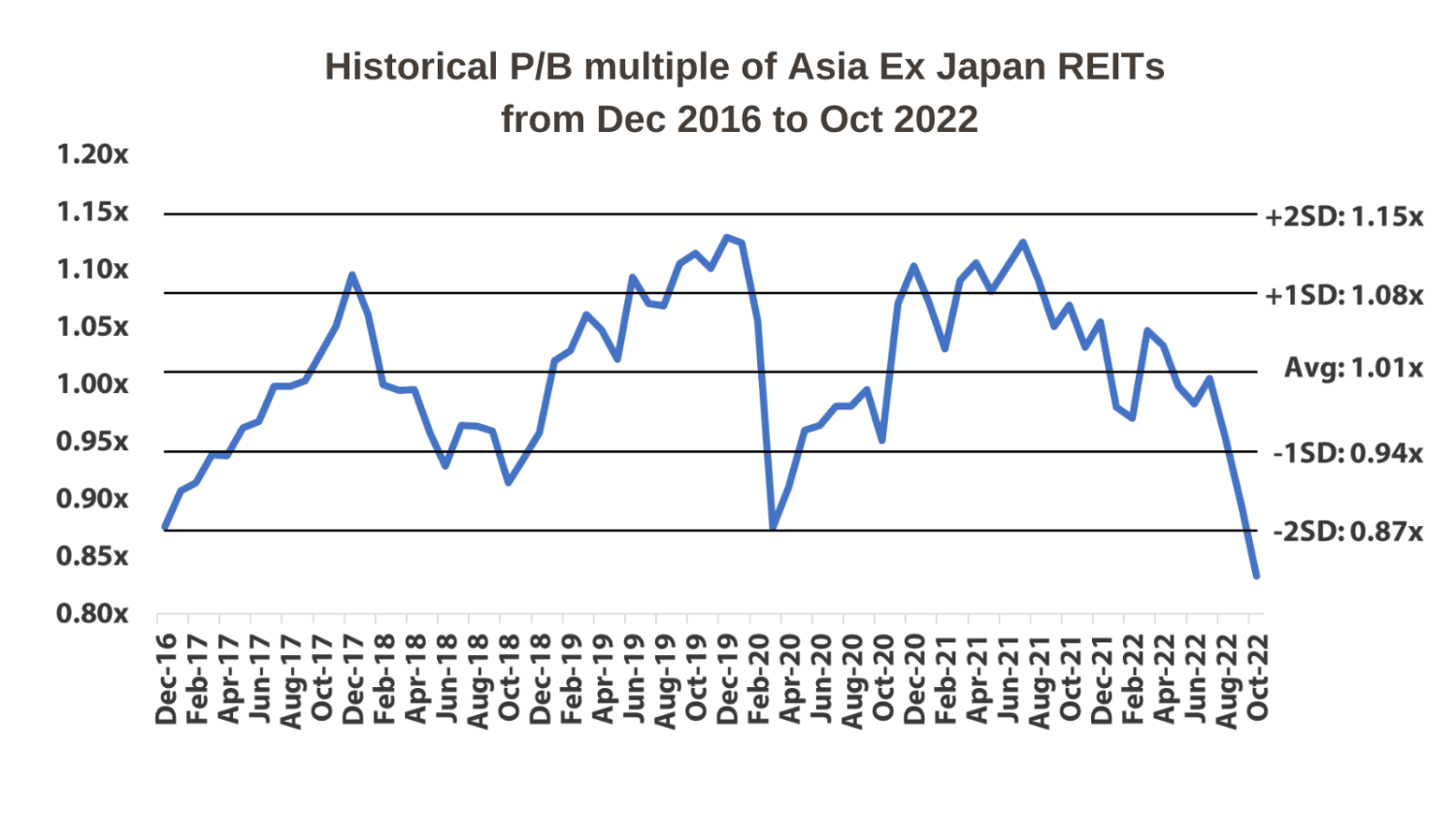

As with all investments, investing in Asia ex Japan REITs is not without its risks. “A recession in the United States and in Asian economies ex Japan, as well as US interest rates rising more than expected could impact the performance of Asia ex Japan REITs,” shared Mr Lum.

ACCESSING ASIA EX JAPAN REITS THROUGH AN ETF

Apart from putting money into individual REITs, investors can consider buying into REITs through an exchange traded fund (ETF). The former pools investors’ money into a portfolio of income-generating real estate assets, while the latter aggregates money into a portfolio of REITs by tracking a specific REIT index.

“REIT ETFs allow investors to passively invest in REITs without having to pick and monitor individual REITs. This investment type is also professionally managed – portfolio rebalancing and corporate actions are taken care of by the ETF issuer,” said Mr Lum.

He added that these factors make REIT ETFs well-suited for beginner investors who may not have the requisite knowledge to pick individual REITs, and time-starved investors who lack the bandwidth to actively manage a portfolio of individual REITs.

“Another benefit of having access to a portfolio of REITs is that investors can achieve diversification with lower investment quantum and lower costs. Additionally, investors have the opportunity to tap into a range of Asia ex Japan REITs, which are one of the fastest-growing asset classes in terms of depth and breadth of offerings,” said Mr Lum.

BUYING INTO A REIT ETF

Investors looking to buy into a REIT ETF should note that the financial instrument will incur ETF management fees, on top of the individual REITs’ management fees. “To cover the payment of management fees and other fund expenses, a REIT ETF will always provide returns close to, but lower, than the index that it tracks,” said Mr Lum.

This can potentially be mitigated by choosing a REIT ETF that prices its management fee competitively. One option to consider is the NikkoAM-StraitsTrading Asia ex Japan REIT ETF. It is the largest REIT ETF currently listed on the SGX market, with S$350 million worth of assets under management as of Oct 31, 2022.

The ETF provides affordable access to a broad portfolio of Asia ex Japan REITs, with a management fee of 0.5 per cent and total expense ratio capped at 0.55 per cent. It also pays out quarterly dividends to investors*. The ETF tracks the FTSE EPRA Nareit Asia ex Japan REITs 10 per cent Capped Index, which has been carved out of the FTSE EPRA Nareit Global Real Estate Index Series – the latter is widely used by institutional and retail investors as a global benchmark for listed real estate assets.

Fund manager Nikko AM Asia has had a long legacy as one of Asia’s largest asset managers. The organisation was recently recognised by financial digital platform The Asset for being the best ETF provider in Singapore in 2022.

Singapore investors can invest in the NikkoAM-StraitsTrading Asia ex Japan REIT ETF with a lump sum of cash or via a regular savings plan with local banks, including DBS Bank and POSB, from S$100 a month. As the ETF is included under the Central Provident Fund (CPF) Investment Scheme, funds from one’s CPF Ordinary Account can be used to invest in the ETF, as an alternative to directly purchasing shares off the market.

Keen to learn more? Visit NikkoAM-StraitsTrading Asia ex Japan REIT ETF.

*Distributions are not guaranteed and are at the absolute discretion of the manager.

This document is purely for informational purposes only, with no consideration given to the specific investment objective, financial situation and particular needs of any specific person. It should not be relied upon as financial advice. You should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

Past performance or any prediction, projection or forecast is not indicative of future performance. The value of units and income from them may fall or rise. Investments in the Fund are subject to investment risks, including the possible loss of principal amount invested. You should read the relevant prospectus (including the risk warnings) and product highlights sheet of the Fund, which are available and may be obtained from appointed distributors of Nikko AM Asia or at nikkoam.com.sg before deciding whether to invest in the Fund.

Nikko AM Asia accepts no liability for any loss, indirect or consequential damages, arising from any use of or reliance on this document. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Nikko Asset Management Asia Limited. Registration Number 198202562H.

Read the full disclaimer.