Mastering more than payments: How Mastercard is safeguarding the digital ecosystem

By enhancing digital security standards, the global technology company drives trust, safety and inclusion for businesses and consumers alike.

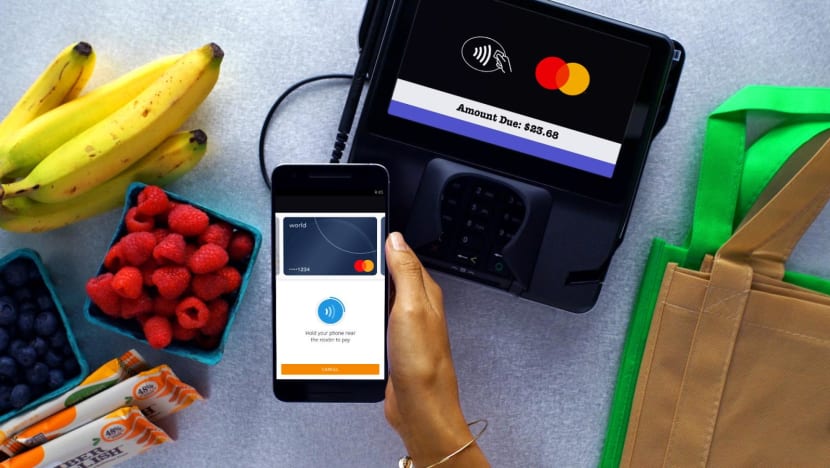

To safeguard digital interactions, Mastercard invests heavily in cybersecurity and identity verification capabilities. Photos: Mastercard

This audio is generated by an AI tool.

For today’s digital-first customers, making an online purchase with a card often involves little more than a simple click. Yet, behind this apparent simplicity lies a complex story of technology and security.

According to global consultancy Bain & Company’s e-Conomy SEA 2023 report, Southeast Asia’s digital economy delivered US$100 billion (S$134 billion) in revenue this year, with digital payments making up more than 50 per cent of transactions. Building a secure digital ecosystem has become a priority for the region, especially in light of escalating cybersecurity threats amplified by rapid technological advancements. Between 2021 and 2022, Southeast Asia witnessed an alarming 82 per cent surge in cybercrimes.

Mr Safdar Khan, division president of Southeast Asia at Mastercard, pointed out the growing sophistication of these crimes. “Bad actors are leveraging technologies like artificial intelligence (AI) to carry out cybercrimes such as phishing and data theft, making it more challenging to detect and prevent such attacks. As Southeast Asian economies become increasingly intertwined, systemic cyber risk is projected to rise across the region.”

The ramifications of these threats extend beyond immediate financial losses. They disproportionately affect vulnerable segments of society and can erode trust in the digital ecosystem in the longer term. “This will not bode well for economies looking to drive greater digital inclusion. The loss of trust or the emergence of mistrust in technology may impede the open, global collaboration essential for driving innovation,” said Mr Khan.

In building a robust foundation for trustworthy digital growth across the region, businesses and organisations must prioritise investments in cutting-edge technologies – such as AI, machine learning and behavioural analytics – to ensure safer and more seamless digital transactions.

IN THE BUSINESS OF TRUST

As the pace of digital and technology adoption accelerates, security has emerged as the primary factor influencing consumers’ choice of payment methods. Mr Khan sees this as both an opportunity and a challenge for businesses. “Those that are able to safeguard their customers and gain their trust are poised to gain a competitive advantage,” he shared.

In the past five years, Mastercard has invested over US$7 billion in cybersecurity and identity verification capabilities, and developed robust security measures to protect digital interactions.

For instance, it has augmented traditional fraud monitoring methods with machine learning models, resulting in precise fraud detection without impacting genuine transactions. Its AI-driven systems can accurately analyse individual spending patterns and highlight anomalies that may be indicative of fraudulent activities. An example is Mastercard’s Consumer Fraud Risk solution that leverages a unique network view of account-to-account payments, along with AI models and insights, to enable banks to predict scams in real time.

Another AI capability in its arsenal is Decision Intelligence, which examines multiple data points in a card transaction – be it in-person or online – such as time and location of a purchase, as well as profiles of the merchant and consumer. The system then calculates a risk score in milliseconds and shares it with the banks to assist them in their approval decision, helping to prevent fraud on transactions processed across the Mastercard network.

The surge in online transactions has also raised consumer expectations for businesses and financial institutions to ensure security without compromising on user experience. By using behaviour analytics and passive biometrics (such as a person’s writing style, mouse movements or phone-holding patterns), Mastercard’s NuDetect empowers businesses to verify the user behind the device unobtrusively.

To address the issue of fraudulent account creation, a common scam tactic, Mastercard’s Ekata verifies user’s dynamic identities – such as email address, phone number, residential address and IP address – and detects signs of stolen identities in real time using proprietary identity engine and identity graph technologies. This helps businesses to assess and prevent potential fraud at the very start of digital interactions, such as during account creation or guest check-outs.

Thanks to AI-powered cybersecurity solutions such as these, Mastercard has prevented over US$35 billion in fraud losses globally over the last three years.

EMPOWERING MSMES FOR A DIGITAL FUTURE

In Southeast Asia, micro, small and medium enterprises (MSMEs) form the backbone of the economy, accounting for over 97 per cent of businesses in the region and contributing an average of 40.5 per cent of gross domestic product in every one of its nations.

With more small businesses going online, security must be “baked into the foundation of every digital product or solution”, said Mr Khan. “Whether it’s a tech start-up or a home baker taking orders online, MSMEs need to ensure that their systems are secure and that their customers are protected at every step of the consumer journey.”

An obstacle for MSMEs venturing into the digital economy is the scarcity of skilled cybersecurity personnel and the financial burden of implementing and sustaining innovative technological solutions.

Mr Khan advises these enterprises to adopt a “start small, think big” strategy, emphasising the crucial role of partnerships with established organisations to access essential resources and expertise. “Furthermore, these partnerships open doors to an expanded customer base while offering insights into vital areas such as compliance, funding and regulatory requirements,” he added.

Mastercard has collaborated with both public and private partners to establish rigorous security standards and practices spanning various industries. To empower MSMEs on their growth journey, initiatives such as the Mastercard Trust Centre – which offers online educational resources on cybersecurity best practices and preventive tools – and start-up engagement programme Start Path demonstrate the company’s dedication to fostering a secure digital environment. Start Path helps startups commercialise their ideas more quickly with Mastercard’s technology, solutions, expertise and network. In the last five years, Start Path has guided more than 20 cybersecurity-focused start-ups across the world.

Said Mr Khan: “At Mastercard, it is both our business strategy and social responsibility to ensure that people and businesses have access to the networks, tools and solutions that can help them achieve financial and digital security.”

Check out Mastercard’s suite of cybersecurity solutions for businesses and financial institutions.