Start planning today for a brighter tomorrow

Take control of your financial future with OCBC’s wealth-building solutions and free financial planning tools.

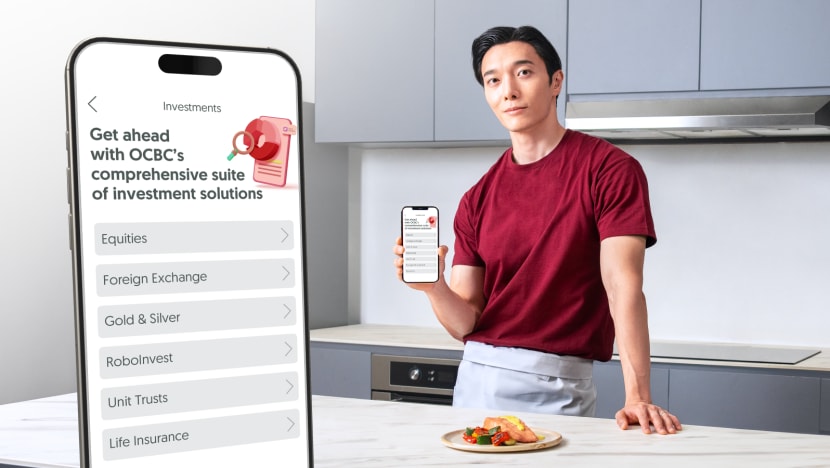

Celebrity chef Lennard Yeong understands that fulfilling his ambitions requires financial planning beyond a monthly pay cheque. Photos: OCBC

This audio is generated by an AI tool.

With his stylish food videos and collaborations with major brands, Mr Lennard Yeong seems to have found the perfect recipe for success. But the journey from a steady nine-to-five job to becoming a celebrity chef, content creator and entrepreneur wasn’t as simple as whipping up a dish.

After reaching the finals of MasterChef Asia in 2015, Mr Yeong returned to his engineering career while carefully considering how to pursue his culinary dreams. He continued to hone his skills in the kitchen, but soon realised that fulfilling his ambitions required more than just passion – it needed financial planning beyond a monthly pay cheque.

This is a challenge many face. According to the OCBC Financial Wellness Index 2024, only 44 per cent of Singaporeans are on track to meet their investment goals. To support new investors and individuals like Mr Yeong, OCBC offers a suite of user-friendly financial planning tools as well as investment and insurance solutions. Available through its website and revamped banking app, these resources form part of a three-step future-planning process that empowers users to explore investment solutions at their own pace and build confidence in growing their wealth.

STEP 1: KNOW WHERE YOU ARE AT

To achieve your goals, it’s important to establish your starting point. A clear understanding of your current financial situation helps you decide the right steps and actions needed to move ahead decisively.

To simplify this process, consider keeping track of all your finances in one place. This gives you an accurate, big-picture view of your net worth, including assets and liabilities, whenever you need to. Tools like OCBC Financial OneView, Money Insights and Insurance Guided Journey can help assess your net worth, provide an overview of your spending and assess if your insurance coverage is sufficient.

Understanding where your money goes can help you shape a budget that fits your lifestyle while keeping your long-term goals in sight. With Money Insights, you can track your top spending categories and set budgets by category or month. If you’ve been indulging in too much bubble tea, you’ll get an alert before your takeaway budget gets stretched too thin.

OCBC Financial OneView, powered by Singapore Financial Data Exchange, lets users track their finances across participating banks and insurers, as well as the Singapore Central Depository, Central Provident Fund, Housing Development Board and the Inland Revenue Authority of Singapore. With personalised data insights, you can make better-informed decisions about your financial planning.

Insurance Guided Journey enables clients to view their insurance policies while helping them assess their required coverage, based on guidance from Life Insurance Association.

STEP 2: SEE WHERE YOU ASPIRE TO BE

Now, it’s time to set your goals, whether that’s buying your dream home or starting a business. To stay grounded, it’s important to develop a clear strategy that addresses both your short-term needs and long-term aspirations.

Tools like OCBC Life Goals and Saving Goals can help you create a clear financial roadmap.

With the OCBC app, setting a savings goal is straightforward. Your money is automatically set aside on a schedule you choose – there’s no need to open a separate account.

OCBC Life Goals offers a methodical approach to longer-term ambitions, like funding your retirement or your child’s education. It estimates your current financial resources and calculates how much you’ll need to save or invest to reach those goals.

For Mr Yeong, OCBC Life Goals has been especially helpful. “It’s a step-by-step guide that helps me calculate how much I need to achieve my dream retirement lifestyle,” he said.

STEP 3: GET AHEAD WITH CONFIDENCE

To continue building your wealth, consider leveraging OCBC’s extensive range of investment solutions – one of the most comprehensive offerings on a single app in Singapore.

Be it equities, foreign exchange, gold and silver, unit trusts or robo-investing, OCBC makes it simple to create a portfolio tailored to your financial goals. It’s easy to diversify your investments, whether you’re starting with just S$35* or looking to grow an existing nest egg into something more substantial.

You can expand your portfolio into precious metals with the OCBC Precious Metals Account, without the hassle of handling physical assets or incurring sales charges and custody fees. The instant account set-up enables you to start trading gold or silver with as little as 0.01 ounces (0.31g), in Singapore dollars or foreign currencies, anytime via the OCBC app.

For added financial security, OCBC offers a wide range of insurance products to protect and grow your wealth. From planning for retirement to preparing for life’s uncertainties, there’s a protection solution to suit your needs at different life stages.

Reflecting on his investment journey via the OCBC app, Mr Yeong likened it to the early days of his career-building in Singapore’s vibrant culinary scene: “Just as I experiment with different ingredients while cooking, as a new investor, I really appreciated being able to explore a wide range of investment solutions at my own pace, even with a smaller budget at the time.”

While everyone’s dreams may differ, one thing is universal: We could all use a helping hand in financial planning – and a head start in reaching our goals.

Start planning with OCBC today. From now till Dec 31, 2024, enjoy up to S$908 cash rewards on selected investments and insurance products – ranging from unit trusts, robo-invest, precious metals, foreign exchange, Explorer Travel Insurance and GREAT Term Guard. New customers can get additional cash of up to S$50 for each product. T&Cs apply; limited quantities of cash rewards available.

*Diversify your portfolio from as little as 0.01 ounces of gold or silver, for less than S$35. As of Aug 31, 2024.

This advertisement has not been reviewed by the Monetary Authority of Singapore. Investments are subject to investment risks, including the possible loss of the principal amount invested. This is for general information and does not take into account your particular investment and protection aims, financial situation or needs. You should seek advice from a financial adviser before committing to a purchase. Otherwise, you should consider the suitability of the investment. Protected up to specified limits by SDIC. GREAT Term Guard and Explorer Travel Insurance are provided by The GREAT Eastern Life Assurance Company Limited.