exclusive Asia

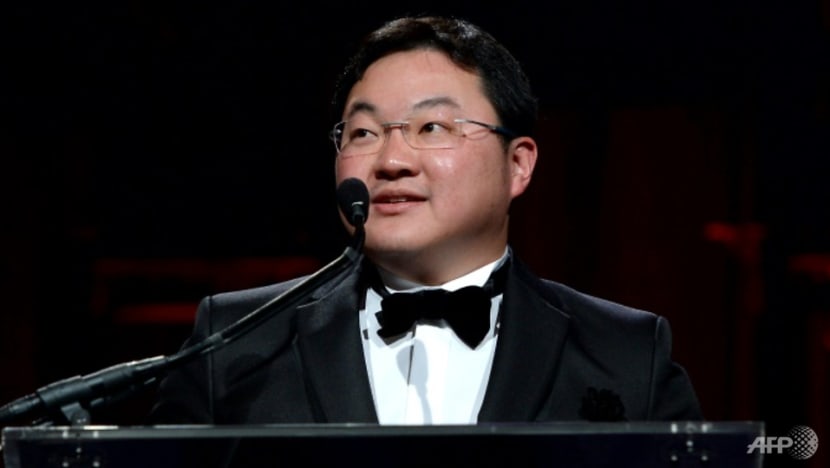

Fugitive Jho Low, US Justice Department reach fresh pact to try to wind down 1MDB forfeiture case

The Department of Justice, Jho Low’s family and the family’s trustee are seeking “to reach a global, comprehensive agreement that forever resolves the United States’ civil, criminal and administrative asset forfeiture actions” of monies and assets traceable to 1MDB, according to documents reviewed by CNA.

This audio is generated by an AI tool.

KUALA LUMPUR: The United States Department of Justice (DOJ) has entered into a confidential agreement with fugitive financier Low Taek Jho in a bid to reach a global settlement – and possibly a final chapter – to the years-long asset forfeiture campaign tied to the corruption scandal at 1Malaysia Development Bhd (1MDB).

The global settlement agreement would “forever (resolve) United States’ civil, criminal and administrative asset forfeiture actions or proceeding relating to the disposition” of assets tied to 1MDB, according to documents reviewed by CNA.

According to the documents as well as executives close to the situation, the DOJ signed a confidential agreement in early June with Low’s family lawyers and their financial trustees.

It would involve surrendering assets previously identified by the authorities, as well as those not previously claimed or captured by prosecuting agencies worldwide, under a fresh settlement plan.

It is a deal that could bring closure to one of Washington’s longest-running asset forfeiture cases that former US Attorney General Jeff Sessions described as “kleptocracy at its worst”.

The agreement to try and reach a global settlement was signed by Margaret A. Moeser, Acting Chief of the Money Laundering and Asset Recovery section in the Criminal Division of the DOJ, lawyers for the Lows’ financial trustee and Low’s family lawyer Robin Rathmell of law firm Kasowitz Benson Torres.

The confidential agreement, which has yet to be publicly disclosed, is tied to the announcement on Wednesday (June 26) by the DOJ that it is to recover an additional US$100 million in resolving two civil forfeiture cases.

The assets involved include artworks by Andy Warhol and Claude Monet, and financial deposits and properties in Singapore and other international locations.

Lawyers said that the agreement, signed by the parties on Jun 3 and 4, also involves other confidential commitments to the US government, which will pursue settlement negotiations with other counterparties, including administrations in other international jurisdictions, to reach a global resolution to the debacle that led to the jailing of former premier Najib Razak.

Najib and Low were the architects of the scandal-ridden state-owned sovereign fund 1MDB.

“As we have discussed, this Settlement Letter Agreement takes into account your preference for the United States to handle negotiations with Malaysia, Singapore, Switzerland, France and other foreign countries which have restraining orders in place as to most of the assets described below and in the Actions, and sets forth the procedure for the liquidation and transfer of net liquidated proceeds to Malaysia, as well as our mutual interest in resolving any potential litigation over the assets referenced below in Table 1,” the document states.

The list of the assets was redacted in the copy reviewed by CNA.

SETTLEMENT AGREEMENT LETTER DIFFERS FROM DOJ’S STATEMENT

The latest settlement agreement is the second asset forfeiture deal between the DOJ and Low following a separate US$700 million deal in October 2019.

Shockwaves from the 1MDB affair continue to percolate in Malaysia, and Low remains one of its most wanted criminal suspects.

For starters, the detailed provisions set out in the Settlement Agreement Letter are markedly different from the statement issued by DOJ on Wednesday, in which it stated that it had resolved two civil forfeiture cases against assets that were acquired with funds allegedly embezzled from 1MDB.

These cases stem from what US prosecutors have maintained was part of a conspiracy that took numerous shapes between 2009 and 2015 and involved the misappropriation of more than US$4.5 billion in stolen funds from 1MDB.

The DOJ noted that Low bought the Warhol and Monet artworks for around US$35 million, and pegged the valuation of the surrendered financial deposits and real estate properties at around US$67 million.

The DOJ also noted that Low separately faces charges in the Eastern District of New York for allegedly conspiring to launder billions of dollars embezzled from 1MDB and for conspiring to violate the Foreign Corrupt Practices Act by allegedly paying bribes to various Malaysian and Emirati officials.

In the District of Columbia, he faces charges for allegedly conspiring to make and conceal foreign and conduit campaign contributions during the US presidential election in 2012.

The DOJ added that the latest settlement “agreement does not release any entity or individual from filed or potential criminal charges".

Low, who remains on the run and is widely believed to be in China, could not be reached for comment.

Mr Rathmell, Low’s lawyer, also did not respond to queries by email for comment. CNA has also contacted the DOJ and the US Embassy in Kuala Lumpur.

POSSIBLE CLOSURE TO DOJ’S CAMPAIGN?

Lawyers tracking the 1MDB affair noted that Low’s legal troubles with the DOJ are the last vestige of a campaign by the DOJ on widespread misappropriation, money laundering and corruption.

It began in 2015 and focused on the issue of 1MDB bonds amounting to US$6 billion that was raised in three tranches coordinated by investment bank Goldman Sachs.

Goldman Sachs, which earned nearly US$600 million in fees from the two bond issues in 2012 and 2013, paid US$2.9 billion in penalties and fees to the DOJ in a settlement over its involvement in a 1MDB bribery scheme.

Tim Leissner, Goldman Sachs’ former Southeast Asia head who played a central role in the bond issues, pleaded guilty to conspiracy charges of money laundering and violating foreign bribery laws in 2018, before he was slapped with a lifetime ban by the Monetary Authority of Singapore to operate in the island state’s financial sector.

His junior colleague Roger Ng was sentenced to 10 years in jail over money laundering charges in March 2023 and was returned to Malaysia in October last year to assist the Malaysian government in its ongoing investigations into the 1MDB affair.

Lawyers and financial executives close to the situation noted that Low’s lawyers began negotiations sometime in February this year for a one-time settlement.

“The plan was to acknowledge assets that the US knew about, bring to the surface assets that were previously not captured under a fresh deal,” noted one senior Hong Kong-based financial executive familiar with the negotiation and close to the Low family.

The DOJ warmed up to the deal in early May this year, the executive added.