CNA Explains: The rise and fall of Temasek-backed fashion start-up Zilingo

The Singapore-based company is preparing to go into liquidation, putting an end to its struggles that have rocked the tech industry in Southeast Asia.

Bose and co-founder Dhruv Kapoor started Zilingo with the goal of building a technology platform to help tiny merchants sell to consumers across Southeast Asia. (Photo: Bloomberg/Ore Huiying)

SINGAPORE: It was once hailed as the darling of Southeast Asia’s tech scene and even came close to becoming a unicorn four years ago but now, the days are numbered for beleaguered fashion start-up Zilingo.

On Monday (Jan 23), the Economic Times reported that the Singapore-based company had sold its tech assets to Swiss e-commerce management software provider Buyogo AG, along with its Sri Lanka-based acquired entity nCinga Innovations.

The sale was reportedly completed in the first week of January, marking the beginning of the liquidation process at the Singapore-based startup.

The process will put an end to Zilingo's months-long struggle for survival, which has sent shockwaves through the tech industry in Southeast Asia and India.

Here’s what we know about Zilingo.

FROM NEAR-UNICORN TO FAILURE

The company was founded in 2015 by Ms Ankiti Bose and her business partner Dhruv Kapoor, helping to aggregate small fashion retailers in Singapore, Bangkok and Jakarta onto a single platform.

From there, Zilingo expanded into the business-to-business space by providing supply chain capabilities to fashion merchants.

By September 2017, the company was reportedly shipping to eight countries with seller hubs in Hong Kong, Korea, Vietnam, Cambodia, Indonesia and Thailand, adding 5,000 new merchants to its platform.

During its fourth round of funding in 2019, Zilingo raised US$226 million from some of the region’s most prominent investors, including Temasek Holdings and Sequoia Capital India, the regional arm of the Silicon Valley firm that backed Apple and Google.

It lifted the company's valuation to US$970 million - just shy of the US$1 billion mark that categorises start-ups as unicorns.

Later that year, Zilingo announced that it would spend US$100 million to expand into the US, establishing offices in New York and Los Angeles.

However, cracks soon began to appear, with the board increasingly concerned about the company's financial performance and profligate spending.

According to a Bloomberg report, the US$226 million Zilingo had raised from investors in early 2019 was gone in less than two years.

The firm also did not file annual financial statements, which is a basic requirement for all businesses of its size in Singapore, for two years - 2020 and 2021 - and the COVID-19 pandemic also buffeted Zilingo's revenue.

In April last year, Ms Bose was suspended as the company’s CEO following an investigation into the start-up's accounts after complaints about alleged financial irregularities were raised. A month later, she was fired.

Meanwhile, the company continued to downsize. According to Bloomberg, Zilingo's last headcount stood at fewer than 100 staff in India, Indonesia, Sri Lanka and Bangladesh.

WHO ARE ZILINGO’S INVESTORS?

In 2015, Zilingo raised around US$1.9 million from Sequoia Capital as well as three angel investors during its seed round, according to business data provider Crunchbase.

Following the initial investment, the company underwent four rounds of series funding between 2016 and 2019.

During an interview with Bloomberg TV in 2021, Ms Bose said that the company was considering an initial public offering (IPO) to raise capital but this never came to fruition.

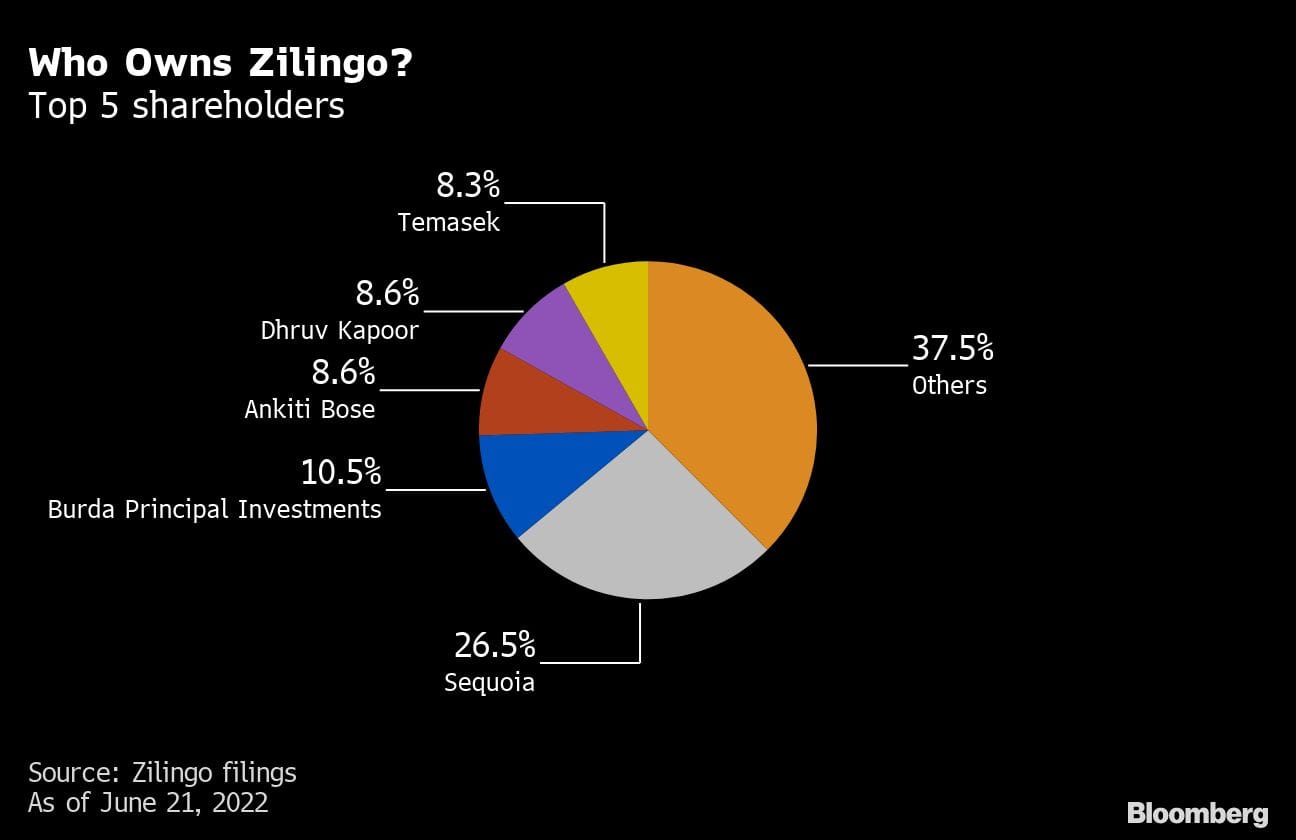

A total of 23 investors including Temasek Holdings, Sequoia Capital India and Sofina are listed on Zilingo’s page on Crunchbase.

As of June 21 last year, the company’s top five shareholders were: Sequioa (26.5 per cent), Burda Principal Investments (10.5 per cent), Ms Bose (8.6 per cent), Mr Kapoor (8.6 per cent) and Temasek (8.3 per cent), according to Zilingo filings.

In response to CNA's queries about Zilingo's imminent liquidation, Temasek said it declined to comment.