How alternative lenders are helping to plug the SME funding gap

Amid the pandemic, many SMEs have faced cash flow issues due to the uncertain business environment. Money Mind looks at how Singapore’s fintech lenders are stepping up to plug the funding gap.

(Photo: iStock)

SINGAPORE: Alternative financing has been a lifeline for marketing and distribution firm JuntoSTARC during this pandemic.

The firm distributes branded earphones, speakers and power banks to major retailers and online platforms.

With more gadgets now in demand amid the rise of virtual workplaces, the need to fill up stocks has become critical.

All of this is happening in the context of a global semiconductor crunch, which has led to longer lead times and higher prices.

Businesses such as JuntoSTARC have, as a result, found themselves in need of additional funds to purchase goods earlier, or to maintain more stock.

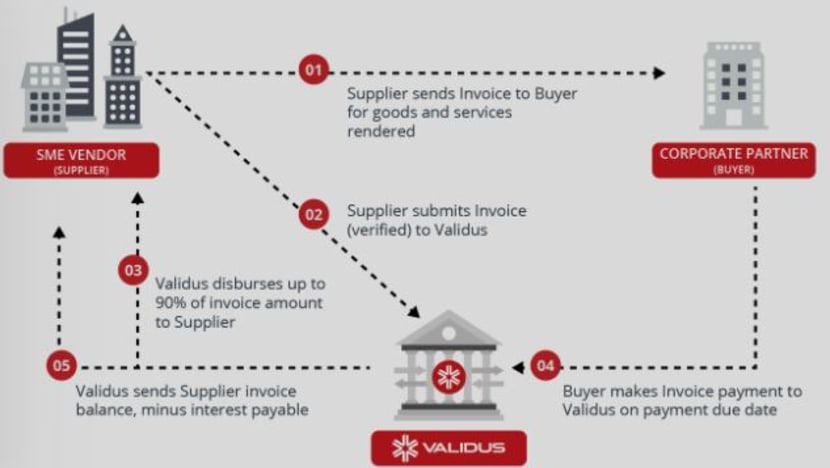

JuntoSTARC has been tapping on invoice financing from Validus Capital over the past two years.

The financing is collateral-free and allows the firm to get paid earlier and fund new shipments, which cost around US$100,000 to US$150,000 per month.

"They buy the invoice and finance it, and ... help us to free up cash from the retail side. It’s always better to have a bit more on-hand. To plan more rather than keep a very, very tight cash flow," said Mr Edmond Ting, managing director of JuntoSTARC.

JuntoSTARC is among the 30,000 SMEs that have used the financing offered by Validus.

The fintech lender operates in Singapore, Indonesia, Thailand and Vietnam.

Loan disbursements grew 30 times in the past year, helping cross the S$1 billion mark. The firm expects to cross the next billion mark in the next year.

“We've kept it very basic - the invoice requirement, as well as the confirmation from the buyer. When they need a term loan or a working capital solution, we literally just take credit bureau records of the director and six months of bank statements, and that's literally about it,” said Mr Vikas Nahata, co-founder and executive chairman of Validus Capital.

SMEs remain an underserved segment in the region.

According to International Finance Corporation, a member of the World Bank Group, there is a US$4.7 trillion funding gap for SMEs globally. About 45 per cent of that is in East Asia and the Pacific.

“In Singapore itself, it's close to US$20 billion a year in our opinion. Indonesia is much bigger at about US$160 billion to US$170 billion a year. More than 30 million SMEs across the region. Thailand is about US$30 billion to US$35 billion a year, and Vietnam will probably be close to about US$25 billion to US$30 billion as well. So overall I would say this would probably be around the range of US$270 billion to US$300 billion per year,” said Mr Nahata.

FAST APPROVAL

SMEs that lack bank collateral and credit track record typically turn to alternative sources.

Mr Kelvin Teo is co-founder and group CEO of Funding Societies, an SME digital financing platform.

He said that the speed of approval is one reason why SMEs approach their company.

“It’s really because of speed as well as all forms of shorter working capital solutions that we have – that’s why SMEs come to us. If you apply through our website, or through our mobile app with sufficient documents, we can actually give you a decision within hours, and transfer the money on the same day.”

Fintech lenders can disburse up to S$1 million dollars in funding, but the lending cost could be higher.

“There are certain niche areas where alternative financing could actually play a stronger part versus the banks. Some of these cases include supply chain financing, very short-term loans or what we call bullet loans, or factoring invoice receivables financing. The financing costs and interest will be about one to two times higher than most banks. For private lenders, it could go up three to five times higher than banks,” said Mr Benjamin Teo, business development manager at business advisory consultancy Linkflow Capital.

In Singapore, traditional banks are still the go-to for most business owners.

“According to our internal data in 2020, banks’ share of financing within our platform has actually surged, while alternative lenders’ share of financing dropped from 11 per cent of total credit disbursement in 2019 to only 1 per cent in 2020. So this likely (because) of the introduction of the (government’s) temporary bridging loan, where the interest rate was at an all-time low,” said Mr Teo.

Related:

Digital lenders are crowdfunded by retail, institutional and high-end investors. They keep default rates low by funding only growing firms rather those in distress.

For Validus, the next growth phase is an expansion into Malaysia and the launch of a neobank by January next year. A neobank is a kind of digital bank that does not have physical branches and conduct their services entirely online.

“Within that whole segment, we can handle your payments, we can handle your payroll. We can handle your accounting by tying up with an accounting cloud accounting software company, and we can offer you loans when you need it. So it's almost like becoming a digital CFO for these enterprises that are actually showing tremendous growth,” said Mr Nahata.

Funding Societies has also set its sights on Vietnam and the Philippines in the next six to 12 months. It currently operates in Singapore, Indonesia, Malaysia and Thailand.

The company says it has disbursed close to S$2.5 billion in loans to nearly 100,000 SMEs in the last five or six years. It is also optimistic about cross-border trade in Southeast Asia.

Post-pandemic, fintech lenders will likely play a bigger role as interest rate gaps narrow.

But it will be challenging as digital banks emerge and traditional banks ramp up their online presence.

As fintech lending continues to evolve, industry players say virtual credit cards and expense management solutions could be among new offerings.

Data analytics and artificial intelligence will be key in standing out.

“The crux of it is really risk management, and therefore, data plays a huge part," said Funding Societies' Mr Teo.

"Our advantage is really that we have been serving SMEs’ unsecured financing for the last five, six years across multiple cycles even through a financial crisis. And that has enabled us to train our credit model.”

According to business consultant Mr Teo, a squeeze in the space is expected.

“We foresee a consolidation of alternative finances, especially the P2B platforms. So there might be some market consolidation coming up. We will probably only be left with one or two stronger players eventually.”