Equity futures sink, gold rises after Trump imposes tariffs

Traders work on the floor at the New York Stock Exchange in New York, Apr 2, 2025. (AP Photo/Seth Wenig)

Equity futures fell on Wednesday (Apr 2) after the US market close while safe-haven gold and bond prices rose as investors worried about US President Donald Trump's announcement of 10 per cent tariffs on all imports, with much higher rates for some trading partners.

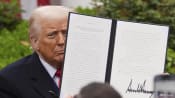

S&P 500 E-minis stock futures initially rose after Wall Street indexes closed the regular session higher, but then lost ground as Trump went into detail about his tariff plans in a White House Rose Garden event.

S&P 500 futures fell 1.6 per cent as Trump spoke while Nasdaq futures fell 2.4 per cent.

Trump, who has referred to Wednesday as "Liberation Day", outlined a range of levies for different countries including 34 per cent tariffs on imports from China, 20 per cent tariffs on imports from the European Union and 24 per cent on imports from Japan.

He also announced 25 per cent autos tariffs covering cars, light trucks, engines and other auto parts.

Before the announcement, the Dow Jones Industrial Average had closed up 235.36 points, or up 0.56 per cent, to 42,225.32, while the S&P 500 rose 37.90 points, or 0.67 per cent, to 5,670.97. The Nasdaq Composite had ended the session up 151.16 points, or 0.87 per cent, at 17,601.05.

MSCI's gauge of stocks across the globe rose 3.96 points, or 0.48 per cent, to 836.11.

But some investors noted that the market's reaction going forward would depend on responses from US trading partners.

"We've just got one side of the story, which is what we're doing. And the other side of the story is how other countries respond to what we're doing," said Walter Todd, chief investment officer at Greenwood Capital in Greenwood, South Carolina.

Todd said that would be "a big component to how the market ultimately digests what is being said right now".

Gold prices pushed closer to record highs, boosted by safe-haven inflows after the announcements.

Spot gold rose 0.64 per cent to US$3,130.38 an ounce. US gold futures rose 1.3 per cent to US$3,159.30 an ounce.

In fixed income, US Treasury yields fell, with two-year yields dropping to their lowest level in three weeks after Trump announced the tariffs.

The yield on benchmark US 10-year notes fell 1.6 basis points to 4.14 per cent, from 4.156 per cent late on Tuesday. The 30-year bond yield fell 0.5 basis points to 4.5098 per cent from 4.515 per cent late on Tuesday.

The 2-year note yield, which typically moves in step with interest rate expectations for the Federal Reserve, fell 0.5 basis points to 3.858 per cent, from 3.863 per cent late on Tuesday.

In currencies, the dollar lost ground.

After the announcements, the euro was up 0.38 per cent at US$1.0834 while sterling strengthened 0.54 per cent to US$1.2989.

Against the Japanese yen, the dollar weakened 0.17 per cent to 149.36.

In energy markets, oil prices, which had settled the regular session higher, lost ground after the tariff news stoked concerns that a global trade war may dampen demand for crude.

US crude fell 0.27 per cent to US$71.00 a barrel after settling up 0.72 per cent, while Brent fell to US$74.07 per barrel, down 0.59 per cent after settling at US$74.95 per barrel.

"When the press conference first started the president said tariffs would start with a 10 per cent baseline across the board. That was better than expected, which was why we saw futures rallying," said Chris Zaccarelli, chief investment officer at Northlight Asset Management in Charlotte, North Carolina.

"But once he got to specifics and started giving examples which were significantly higher than 10 per cent, that's when futures turned around and went negative," Zaccarelli added.

"In the short run tariffs are going to increase costs and reduce corporate profits. If we have a reshaping of the economy, I'm sure markets will have a different judgment, but the short-term knee-jerk reaction is to the initial price hikes."

Investor focus on Wednesday had been firmly on the scheduled announcement of reciprocal levies.