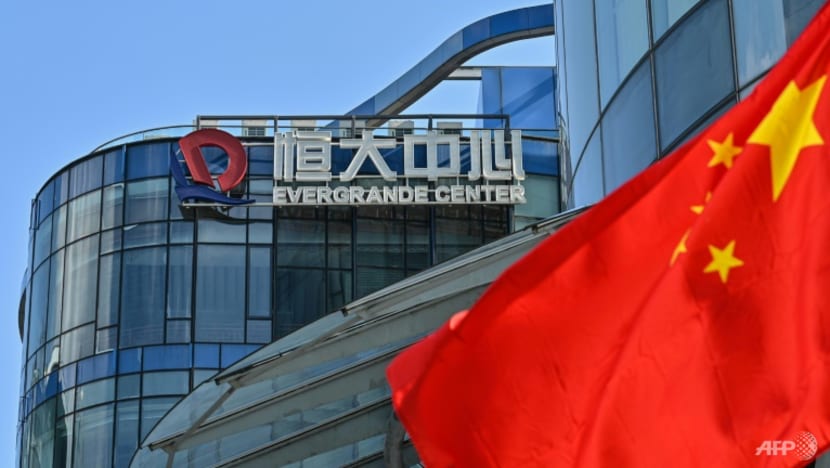

Commentary: Is there a housing bubble in China's real estate sector?

Managing China's real estate market involves a precarious balancing act. Getting it wrong could be costly, says a Chinese economist.

BEIJING: Despite strong global economic headwinds, not least from the COVID-19 pandemic, China managed to achieve 8.1 per cent GDP growth last year, its highest rate in a decade. With that, China met the International Monetary Fund’s expectations and far surpassed its own government’s 6 per cent target.

But China’s economic performance is not quite as strong as it may seem, and not only because year-on-year growth figures were flattered by the pandemic-induced trough in 2020 when the growth rate slowed sharply to just 2.3 per cent.

China’s growth momentum was much weaker in the second half of the year (4 per cent growth, year on year) than in the first half (12.7 per cent), owing largely to the government’s efforts to rein in the real estate sector.

SKYROCKETING HOUSING PRICES

China has good reason to be vigilant. Housing prices have roughly tripled over the past 20 years, with the ratio of home prices to annual income now averaging 43.15 in Shenzhen, 42.47 in Beijing, and 33.36 in Shanghai, compared to 13.37 in London and 8.76 in New York City.

This partly reflects the misallocation of resources: China has built too many skyscrapers, luxury hotels, and high-end apartments and not nearly enough affordable housing. Speculation is also a concern.

In order to stabilise housing prices, force real estate developers to deleverage and reduce commercial banks’ exposure to the sector, the government introduced three major policy measures, which began to take effect in 2021.

The first was the imposition of “three red lines” for developers. In August 2020, China’s government declared that a few large developers could not have a liability-to-asset ratio of more than 70 per cent, a net gearing ratio of more than 100 per cent or a cash-to-short-term-debt ratio of more than 100 per cent.

Last year, these red lines were applied to the entire real estate sector. If crossed, regulators will impose tighter debt limits on developers.

China also introduced new caps on banks’ lending exposure to the real estate sector. For the big state-owned commercial banks, property lending cannot exceed 40 per cent of the total, and mortgage lending is capped at 32.5 per cent. Limits for smaller banks are determined by regulators based on size.

Lastly, China overhauled how local governments sell rights to land. It is hoped that a limited number of centralised auctions will help to force down prices.

These measures go a long way toward explaining why the cumulative growth rate of real estate finance plunged from 54.2 per cent in January 2021 to 4.2 per cent in December.

Over the same period, the cumulative growth rate of total house sales dropped from 133.4 per cent to 4.8 per cent in terms of square meters, and from 104.9 per cent to 1.9 per cent in terms of value.

As a result, the cumulative growth rate of investment in real-estate development in China fell from 38.3 per cent to 4.4 per cent – a sharp decline, even taking the base effect into account.

Not surprisingly, because of the large share of real estate investment, total investment growth also plummeted in 2021, from 35 per cent in January to 4.9 per cent in December. This does not bode well for China’s economic growth.

INVESTMENTS IN THE HOUSING MARKET

Although investment’s contribution to GDP growth has decreased significantly since 2010, it remains important. Investment demand played a key role in fuelling the economic recovery early last year.

In fact, according to a 2020 World Bank report, the share of housing-related activities in both fixed-asset investment and GDP in China today far exceeds the levels in the United States at the peak of its housing boom in 2006.

That is why, when GDP growth declined in the third quarter of 2021, China’s government tweaked its policies to curb excessive borrowing by property developers.

China’s government has emphasised that policies to address financial vulnerabilities and structural problems should not impede economic growth.

But, when it comes to the real estate sector, that will not be an easy balance to strike – and, given the economy’s reliance on real estate, getting it wrong could have serious repercussions.

China’s government should have adopted a more expansionary fiscal and monetary policy last year to boost overall growth. It should have made more efforts to boost growth in infrastructure investment as well, to offset the negative impact of the slowdown of real estate investment on economic growth.

In fact, infrastructure investment grew by a measly 0.4 per cent last year, compared to 0.9 per cent in 2020.

The good news is that China’s government recently announced that stabilising growth is its top priority. China has ample room for implementing expansionary fiscal and monetary policy.

Markets are confident that China will be able to achieve a growth rate of 5.5 per cent in 2022. With that, one hopes that the country’s lacklustre GDP growth, which has continued for more than a decade, will finally end.

Yu Yongding is a former President of the China Society of World Economics and Director of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences. He also served on the Monetary Policy Committee of the People’s Bank of China from 2004 to 2006. PROJECT SYNDICATE.