Commentary: Singapore offices breathe post-pandemic life

Although hybrid working is set to be the post-pandemic norm, demand for office space is still expected to outpace supply, as employees return to the workplace and businesses prepare for growth, says JLL Singapore’s Tay Huey Ying.

People taking in the view of the city skyline along Marina Bay in Singapore. (Photo: AFP/ROSLAN RAHMAN)

SINGAPORE: Fears about the demise of offices following the successful work-from-home experiment during the pandemic have proven to be unfounded.

After more than two years, Singapore’s central business district (CBD) has returned to some pre-pandemic semblance. Since the cap on employees in the workplace was fully lifted in April, one only needs to look at the downtown lunch crowds to quash any doubts about their return to the office.

Demand for office space has turned around sharply: The net absorption of office space expanded to a 17-quarter high in the second quarter of 2022, driving vacancy rate down to 6.8 per cent by end-June from the pandemic-high of 9.6 per cent in the third quarter of 2021.

OFFICE DOWNSIZING TREND IS SLOWING

It might sound surprising at first since hybrid working is expected to be the new norm. But of course, working a few days from home still means the rest of the week in the office for many.

The trend of downsizing has slowed down. Some occupiers are understood to have abandoned or are re-evaluating plans to downsize, seeing or expecting the squeeze for space as more employees return.

Other occupiers have bucked the trend and expanded, to cope with or prepare for business growth arising from the rebound in economic activities. Online trading and investment specialist Saxo Markets’ new CapitaSpring premises are reportedly 15 per cent larger than its previous office. Investment firm Blackstone is also understood to be doubling its space to 36,000 sq ft when it relocates within Marina Bay Financial Centre.

Lured by our business-friendly operating environment, Singapore continued to welcome new arrivals. In March, Sony Music officially opened its new regional headquarters at Duo Tower.

DEMAND FOR FLEXIBLE SPACE, GREEN DEVELOPMENTS

Demand for flexible space has rebounded. It was reported that enquiries for JustCo’s workplace solutions rose by more than 40 per cent in the first quarter of 2022 compared to the previous quarter, with a spike right after the easing of some restrictions in March.

JustCo has plans to open a new centre at International Plaza in early 2023. Another flexible-space provider WeWork also opened its biggest centre in the region in phases from July this year.

Underpinned by the emphasis on employees’ health and wellbeing as well as sustainable workplaces, occupier demand has gravitated towards the newer and greener developments.

CapitaSpring achieved a 93 per cent leasing commitment rate by the time it received Temporary Occupation Permit at end-2021 during the pandemic, while pre-commitment rates of Guoco Midtown and IOI Central Boulevard Towers scheduled for completion in 2022 and 2023, respectively, are climbing steadily.

OFFICE RENTS NEARLY BACK TO PRE-PANDEMIC PEAK

The pandemic has accelerated economic obsolescence of offices and provided the impetus to redevelop ageing assets. The latest to join the likes of AXA Tower, Fuji Xerox Towers, Keppel Towers and Shaw Tower in undergoing redevelopment is Clifford Centre in Raffles Place.

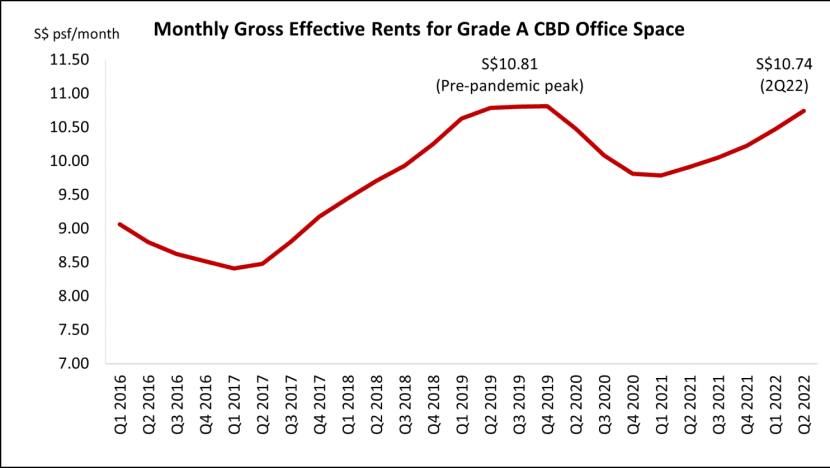

As a result, even with new completions, the growth in CBD office inventory has fallen behind that of demand. This has provided the stage for rents to climb.For Grade A office spaces in the CBD, the average monthly gross effective rents have been rising at an accelerated pace every quarter since bottoming out in early 2021. By the second quarter of 2022, they had recovered to reach S$10.74 per sq ft, just slightly below their pre-pandemic peak of S$10.81 per sq ft in the fourth quarter of 2019.

DEMAND STILL EXPECTED TO OUTPACE SUPPLY

With the looming economic slowdown arising from geopolitical tensions and interest rate hikes to stem soaring inflation, occupiers may turn cautious in the short term. But demand is still expected to outpace supply in the medium term and will likely see a resurgence when current headwinds recede.

Singapore’s reputation as a global hub and praises for the effective management of the COVID-19 pandemic will attract businesses looking for a stable place to operate and a safe place in which their employees can live.

On the other hand, CBD office stock is set for sluggish growth in the medium-term given the Government’s focus on releasing land in the Jurong Lake District to drive its development to becoming the largest commercial node outside the CBD. The withdrawal of ageing office assets for redevelopment will also stunt the growth of CBD office inventory. All this points to CBD rent continuing its upward trend.

This affirms the integral role of physical offices in many companies’ post-pandemic workplace strategies. Even if hybrid work is here to stay, it seems so are physical workplaces.

Tay Huey Ying is the Head of Research and Consultancy, JLL Singapore.