S Pass quota cut not a surprise, but manufacturing firms say they struggle to hire locals

A worker at a manufacturing facility in Singapore. (Photo: TODAY)

SINGAPORE: The Government’s latest move to reduce the number of mid-skilled foreign workers that manufacturers can hire did not come as a surprise for industry players and observers.

But coping with the lower quota may not be easy, according to those in the industry, given ongoing difficulties in wooing locals and challenges of transforming amid a recession.

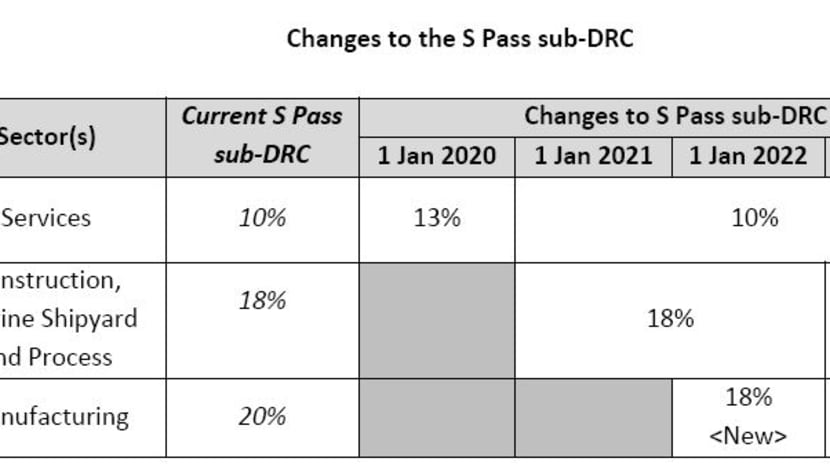

Deputy Prime Minister and Finance Minister Heng Swee Keat announced on Tuesday (Feb 16) that the S Pass sub-Dependency Ratio Ceiling (DRC) for manufacturing will be cut from 20 per cent to 18 per cent from Jan 1, 2022, and to 15 per cent from Jan 1, 2023.

The DRC is the maximum permitted ratio of foreign workers to the total workforce that a company is allowed to hire. This includes work permit and S Pass holders.

The latest move is specific to the latter, who are mid-level skilled foreigners earning at least S$2,500 a month. Manufacturers told CNA that S Pass workers typically fill specialised roles like technicians and machinists.

READ: Budget 2021: S Pass quota for manufacturing sector to be cut to 15% from 2023

Similar S Pass quota reductions are already under way in other industries such as construction, Mr Heng noted in his Budget speech, adding that this is part of the Government’s efforts to moderate Singapore’s reliance on foreign labour.

It also comes after the country announced a new 10-year vision for manufacturing, with a key strategy being to grow the sector’s Singaporean workforce.

READ: What you need to know about Budget 2021

HARDLY A SURPRISE

Observers said Tuesday’s announcement was hardly a surprise.

“This is in line with the broader policy thrust of reducing the reliance on foreign manpower, fostering a Singaporean core workforce and to encourage investment into technology,” said DBS senior economist Irvin Seah.

It also ties in with Singapore’s push towards digitalisation and the use of advanced technology like artificial intelligence in manufacturing processes, noted President of the Association of Small and Medium Enterprises (ASME) Kurt Wee.

While firms will have to make further adjustments in an already difficult business environment, being given advance notice is helpful, he added.

Mr Seah reckoned that the impact on manufacturers will be “marginal”, as the sector has invested significantly in automation over the years and remained resilient amid a pandemic-induced recession.

READ: Singapore aims to grow manufacturing sector by 50% over next 10 years

Echoing that, Maybank Kim Eng's economists said employment in the manufacturing sector was already falling due to rising productivity and technology adoption.

Employment declined by 17 per cent over the past seven years but manufacturing output jumped 26 per cent during the same period, they wrote in a report.

As such, tighter foreign manpower requirements in the higher-productivity manufacturing sector “may be less painful” than the services sectors, which are more labour-intensive and have lower productivity.

CHALLENGES REMAIN

But those in the industry were more cautious.

Mr Douglas Foo, president of the Singapore Manufacturing Federation (SMF), said: “While there is concern over the sub-DRC change that was announced in the Singapore Budget 2021, this has not come as a complete surprise, given the DRC cuts in other sectors previously.”

The industry understands the need “to build a strong Singaporean core”, but time is needed to adjust and re-plan business operations, he added.

“Cuts in DRC will invariably affect businesses one way or the other as labour is always a quintessential component in manufacturing,” Mr Foo told CNA.

“The SMF, on behalf of its members, therefore requests for a flexible, progressive and careful implementation of the reduction of the DRC.”

The SMF will continue to provide feedback to relevant authorities, while helping its members to rejig business models and implement digital solutions, he added.

READ: Singapore to grow manufacturing by attracting top firms, says Chan Chun Sing

One difficulty that confronts many manufacturers is getting locals to take up jobs in the industry.

Citing its study that polled 589 respondents, the SMF said companies are having a hard time filling certain roles, such as robotics software engineers, artificial intelligence or software developers, and machine programmers, with local talent.

Home-grown contract manufacturing firm Watson EP Industries noted difficulties in retaining local workers.

“Although we try to hire Singaporeans, either they don’t stay very long or we can’t attract very good local talents,” said group executive director Joyce Seow, who added that local SMEs are often seen as a “training ground to move on to bigger companies”.

“I don’t think I’m alone in facing that problem … so we rely on S pass holders who stay longer. And as they get more familiar with the company culture and processes, they can contribute more compared with others who come for two years and leave.”

At the moment, Watson EP Industries has three technicians on S Passes. Given this low proportion, the quota cut will not have much of an immediate impact but Ms Seow is concerned about the long term.

Given the push to adopt advanced technology, it will need more skilled technicians.

“But this is the group that we have difficulties in finding people who can stay,” she told CNA.

The industry, while still seeing growth, is also grappling with supply chain disruptions and a global shortage of electronic components.

“We knew (the quota cut) would come but we thought it’d be a few more years given the pandemic’s effect on the economy,” added Ms Seow.

READ: IN FOCUS: After COVID-19, where are the Singapore economy, workforce headed?

At TranZplus Engineering, it is already facing a manpower crunch.

“We have always been putting up advertisements but very few locals apply,” said chief executive Nelson Lim, who noted that the firm’s location in an industrial estate in western Singapore also made it unattractive among younger workers.

Moving forward, the company plans to double down on the digitalisation of its work flow processes, which first began two years ago. Other plans include deploying autonomous mobile robots to further reduce manpower needs.

With the reduction in quotas being done progressively, businesses will have time to plan, although impact in the form of higher costs is almost inevitable, said Mr Lim.

SUPPORT MEASURES

Businesses acknowledged that there are schemes they can turn to for help.

On top of the latest S$24 billion plan to help firms and workers adapt to a post-COVID-19 world, there are other sector-specific initiatives such as the new Southeast Asia Manufacturing Alliance (SMA).

READ: Budget 2021: S$24 billion to transform businesses and workers over next three years

Ms Seow pointed to the SMA, which was launched earlier this month, as a platform that will make overseas expansion “less painful”, especially with COVID-19 travel curbs still in place.

At Illumina, where S Pass holders account for less than 10 per cent of its workforce in Singapore, the latest quota cuts will not have a huge impact.

The American DNA-sequencing firm currently employs about 1,400 people in Singapore. Since starting operations in Singapore in 2008, its Woodlands facility is now the company's biggest manufacturing site globally.

It plans to ramp up its presence in Singapore, especially in research and development.

Mr Derric Lee, vice-president and general manager of Illumina Singapore said: “As we continue to grow and expand our footprint in Singapore, the Jobs Growth Incentive for hiring locals will certainly help Illumina to accelerate and grow our company, providing opportunities for Singaporeans who want to join our growing industry.”