Emerging stronger from COVID-19 crisis the focus of Budget 2021

Deputy Prime Minister Heng Swee Keat delivers the Budget 2021 statement on Feb 16, 2021.

SINGAPORE: Deputy Prime Minister Heng Swee Keat on Tuesday (Feb 16) laid out Singapore’s path of recovery from the COVID-19 pandemic in a Budget that will again draw on the nation’s past reserves.

Mr Heng said that as Singapore’s economy reopens, the focus of Budget 2021 will shift “from containment to restructuring”, but there will be targeted support for the hardest-hit sectors as the global battle against COVID-19 is far from over.

While the arrival of vaccines has given the world some hope, it’s not a “silver bullet”, he said, as immunising a large proportion of people takes time, and more infectious variants of the virus have emerged.

As it happened: DPM Heng Swee Keat's Budget 2021 speech

The current uncertainty is accentuated by several structural trends and challenges, he warned.

“As a small, open economy, Singapore’s economic recovery is contingent on how the global situation plays out,” he said. “Not everything is within our control. We need to adapt nimbly to the wide range of possible outcomes.”

The Government has already spent nearly S$100 billion in five Budgets over the last financial year to help Singapore tide through the global coronavirus outbreak, racking up the largest Budget deficit since independence at S$64.9 billion or 13.9 per cent of GDP.

READ: Singapore economy could have contracted 12.4% if not for COVID-19 Budget measures: MAS estimates

Singapore’s GDP shrank by 5.4 per cent, but this is less than half of the estimated 12.4 per cent it could have fallen, the Ministry of Finance (MOF) said in a report last week.

Support measures also helped to prevent resident unemployment rate, which was at 4.1 per cent in 2020, from rising by a further 1.7 percentage points, according to MOF.

“I am confident that we, as Singaporeans, can once again summon our resolve to tackle the challenges and emerge stronger from this unprecedented crisis,” said Mr Heng, who is also the Co-ordinating Minister for Economic Policies and Finance Minister.

READ: What you need to know about Budget 2021

COVID-19 RESILIENCE PACKAGE

A total of S$11 billion has been set aside for a COVID-19 Resilience Package to safeguard public health and support the industries that will take time to recover, he said.

While the Singapore economy is projected to grow between 4 and 6 per cent his year, some sectors will remain under stress.

The Jobs Support Scheme (JSS) will be extended, but at a lower level, to help Tier 1 sectors such as aviation, aerospace and tourism. Some support will continue to be provided for Tier 2 industries, including retail, arts and culture, food services and built environment.

READ: Budget 2021: Jobs Support Scheme extended for worst-hit sectors as part of S$11 billion package

JSS, which subsidises the salaries of Singaporean workers, will be extended to September for Tier 1 firms, and until June for Tier 2 companies. It will cease after March this year for firms in industries that are recovering, and had already stopped in December for some sectors like ICT.

The sectors most affected by the pandemic will also receive targeted help, Mr Heng said. These include aviation, the land transport sector and arts and culture.

The COVID-19 Resilience Package will also fund public health and safe re-opening measures, as well as the COVID-19 Recovery Grant, which supports workers who lost their jobs or suffered significant pay cuts.

GLOBAL SHIFTS AND OPPORTUNITIES

Beyond dealing with immediate needs, Budget 2021 has to help Singapore emerge stronger from the COVID-19 pandemic, said Mr Heng.

He said that COVID-19 has, arguably, triggered global shifts on a scale greater than the 1929 Great Depression, and some “broad contours” can be seen.

“These three changes – the changing competitive landscape, rising inequalities, and the importance of sustainability – are all mega-shifts, that will continue to reshape the world,” said Mr Heng.

This year’s Budget is therefore focused on accelerating structural adaptation to help businesses and workers meet these changes, he added.

READ: Budget 2021: S$24 billion to transform businesses and workers over next three years

Over the next three years, S$24 billion will be used to help businesses innovate, catalyse capital to help firms transform and scale, and to create or redesign jobs for Singaporeans, he said.

One of the initiatives is to restore Changi Airport’s connectivity and invest in on-arrival COVID-19 testing and biosafety systems.

Platforms to help businesses digitalise and innovate will be launched and enhanced: A new Corporate Venture Launchpad will be piloted to provide co-funding for businesses to build new ventures.

READ: Budget 2021: Aviation sector to get S$870 million in aid this year

The Government will also co-fund and enable businesses that want to innovate, transform and scale up.

“Businesses have had to preserve cash flows during these uncertain times. Yet it is precisely during these extraordinary times, that those that are ready to seize new opportunities will emerge stronger,” said Mr Heng.

Among a number of schemes to fund such transformation is a Local Enterprises Funding Platform. The Government will set aside S$500 million to be co-invested with Temasek Holdings in the fund, which will be managed commercially. The Ministry of Trade and Industry is to provide more details later.

HELP FOR LOCAL WORKERS, BALANCING FOREIGN WORKER INFLOW

Mr Heng said that the employment landscape is also undergoing fundamental changes, which COVID-19 is accelerating.

"'Working from Home’ is just a short step to ‘Working from Anywhere’ … Singaporeans may find more opportunities as the best firms outsource globally, but will also face stiffer competition from talents who may not even step foot in Singapore,” he said.

But he said that Singaporeans should not be fearful as there are many strengths in Singapore that will enable it to create good jobs in the country.

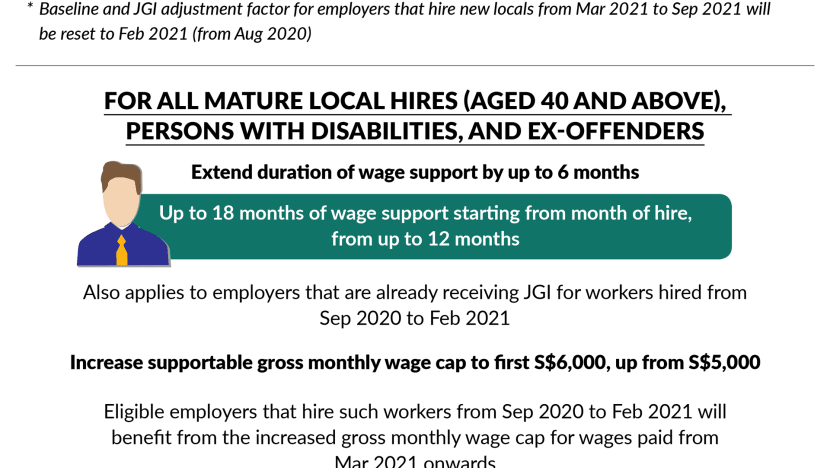

An additional S$5.4 billion will fund a second tranche of the SGUnited Jobs and Skills Package announced last year, most of which will go to the Jobs Growth Incentive. The scheme covers the first 12 months of a new hire’s salary for firms that create new jobs.

READ: Budget 2021: S$5.4 billion boost to SGUnited to support hiring of 200,000 locals

This next phase of the package will target to support the hiring of 200,000 Singaporeans this year, said Mr Heng.

Singapore also needs to focus on “enhancing the complementarity” of local and foreign manpower, he said.

“The way forward is neither to have few or no foreign workers, nor to have a big inflow. We have to accept what this little island can accommodate,” he said.

Schemes to retain and train Singaporean workers will be extended while Mr Heng announced a cut in the ratio of Manufacturing S Passes from Jan 1, 2022.

READ: Budget 2021: S Pass quota for manufacturing sector to be cut to 15% from 2023

The Deputy Prime Minister also said that the salaries of nurses and healthcare workers will be raised, and the Health Minister will announce details later.

ADDITIONAL GST, CDC VOUCHERS

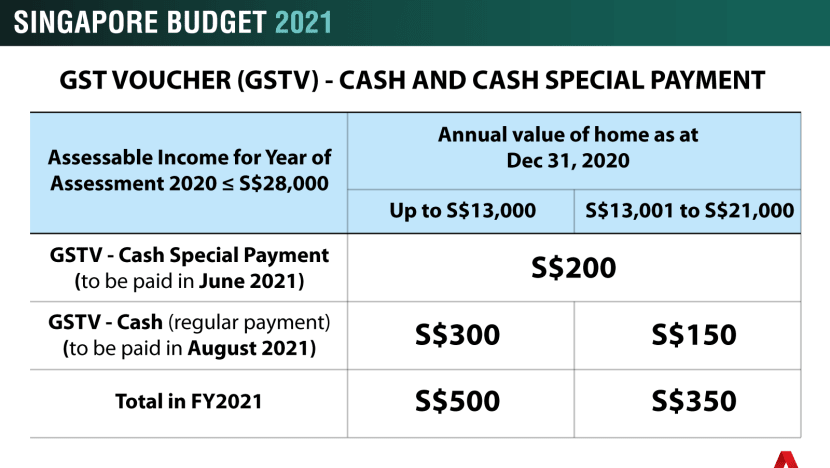

For families and individuals, a S$900 million Household Support Package will give continued support amid the current crisis, said Mr Heng.

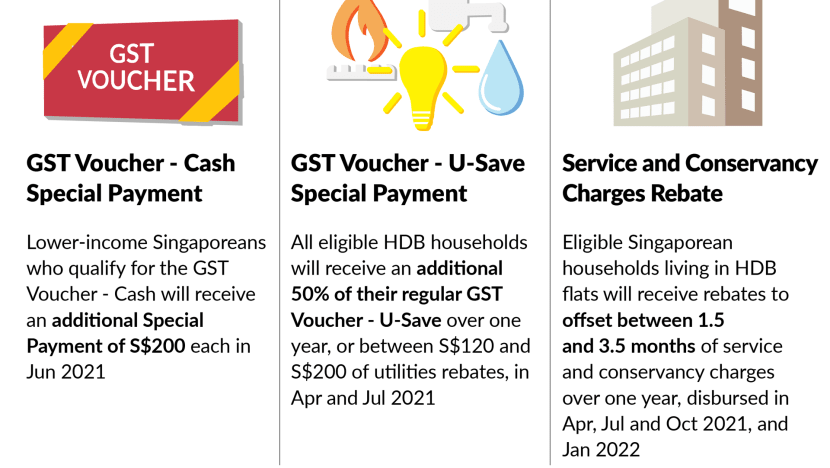

Lower- and middle-income Singaporeans will get an additional one-off GST Voucher special payment of S$200 in cash, on top of the regular GST Voucher for adult citizens with an annual income of S$28,000 or less.

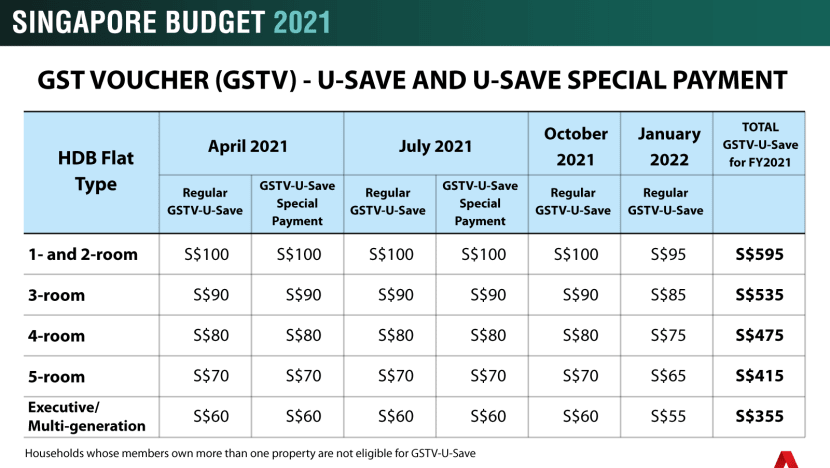

Housing Board households will get an additional 50 per cent U-Save rebate in utility bills, and rebates in Service and Conservancy Charges.

All Singaporean households will also get S$100 in Community Development Councils (CDC) vouchers to be spent at heartland shops and hawker centres.

READ: Budget 2021: S$900 million Household Support Package to help families with expenses

This is to “thank all Singaporeans for their sense of solidarity and to support our heartland businesses and hawkers”, said Mr Heng.

The Government will also continue to provide more support for the vulnerable in society, including lower-wage workers and people with disabilities, lower-income families and children with special needs, said Mr Heng.

Community Link, an initiative to help families with children living in rental housing, will be expanded nationwide to cover 14,000 families over the next two years.

A pilot Inclusive Support Programme will integrate early intervention and early childhood services in pre-schools so that children with special needs can learn alongside others.

Mr Heng also promised to continue to identify and target groups that may need further support, and study ways to help the self-employed improve their job security.

READ: Budget 2021: Support for low-wage workers, lower-income families, children with special needs and charities

BUILDING A SUSTAINABLE HOME

Calling climate change an “existential threat” for humanity, Mr Heng said that Singapore will continue its “whole-of-society” effort to meet this global challenge.

Minister for Sustainability and the Environment Grace Fu announced the Singapore Green Plan 2030 last week.

READ: Budget 2021: Government to issue green bonds to help enable sustainability efforts

On Tuesday, Mr Heng gave more details including a S$60 million fund to help the agri-food sector. Singapore has set the goal of meeting 30 per cent of its food production by 2030.

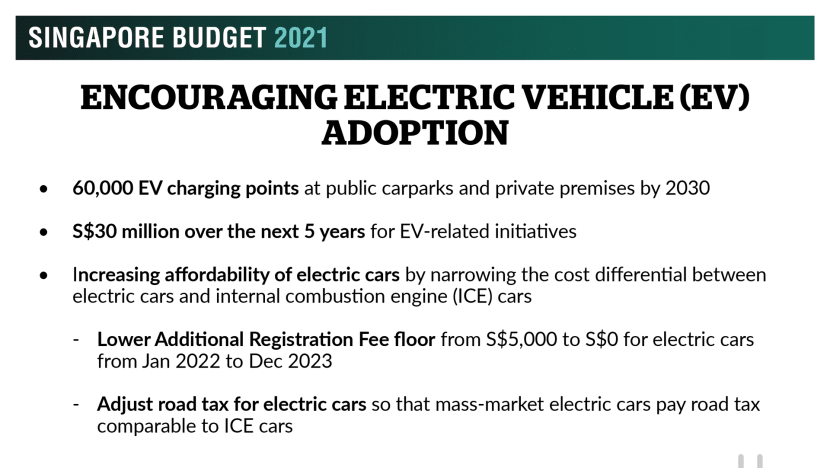

He also announced more initiatives to encourage electric car adoption such as expanding Singapore’s public charging infrastructure for electric vehicles. The Government will set aside S$30 million over five years for electric vehicle-related initiatives, he said.

READ: Budget 2021: More incentives to encourage early adoption of electric vehicles

In addition, petrol duty rates were raised by 15 cents per litre from Tuesday. The Government will provide road tax rebates to help those who rely on their vehicles to make a living, Mr Heng said.

Singapore will also review the trajectory of its carbon tax post-2023, and the results are to be announced in 2022. It is currently set at S$5 per tonne of greenhouse gas emissions, with plans to raise it to between S$10 and S$15 per tonne by 2030.

The Government will also issue green bonds on select public infrastructure projects and the public service will commit to more ambitious goals for sustainability under a GreenGov.sg initiative.

“Last but not least, I encourage all Singaporeans to play our part … building a green Singapore will require a whole-of-society effort,” he said.

READ: Budget 2021: Govt to review 'trajectory and level' of carbon tax; outcome at next year's Budget

RAISING GST NECESSARY BUT NOT YET

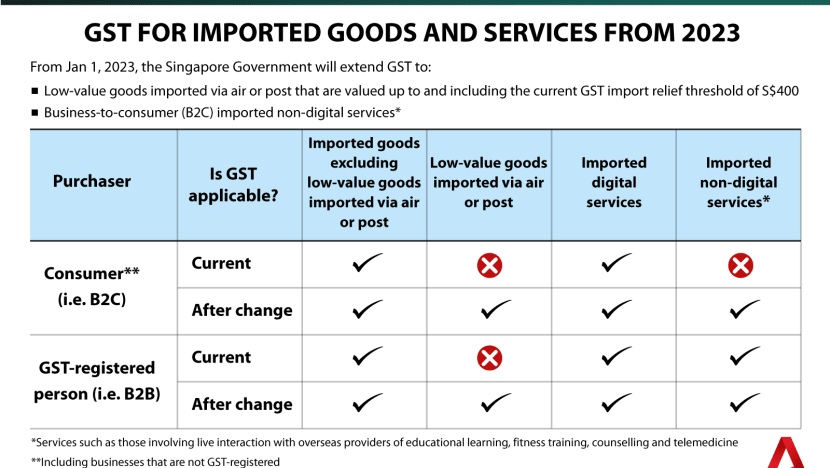

Mr Heng also announced that from January 2023, GST will extend to all imported goods, even low-value ones below S$400.

Currently, only goods above S$400 which are imported via air or post are subject to GST. Mr Heng said that other countries have started to tax such goods and this will level the playing field for local businesses.

READ: Budget 2021: GST hike to happen between 2022 and 2025

“We have to make the move sometime during 2022 to 2025, and sooner rather than later, subject to the economic outlook,” he said.

Mr Heng said that the Government will continue to meet recurrent spending needs with recurrent revenue, while saving its past reserves for crises such as COVID-19.

He updated that of the S$52 billion drawn from Singapore’s reserves, S$42.7 billion is expected to be used.

This leaves S$9.3 billion unused. However, S$11 billion is required for the COVID-19 Resilience Package which will be funded from the reserves.

The total expected draw on past reserves over FY2020 and FY2021 will be up to S$53.7 billion, a net increase of S$1.7 billion from what was expected. FY2021 will see an overall deficit of S$11 billion or 2.2 per cent of GDP.

Concluding his roughly two-hour Budget speech, Mr Heng urged Singaporeans to continue to think long-term and tackle future challenges such as climate change and future pandemics.

“Let us continue to focus on what lies ahead, and chart a clear direction forward … Let us strive to emerge stronger together, as a united and shining red dot, trusted by all,” he said.

Following the Budget announcement, Prime Minister Lee Hsien Loong said that while Singapore grapples with the COVID-19 pandemic, it must not neglect the future.

“Hence the Budget has many items that build our capabilities and competitiveness. When the sun shines again, we must be ready to seize the new opportunities,” he said in a Facebook post.

Mr Lee added that this “can do” spirit helped Singapore overcome the last financial crisis.

“With the resilience that our people have shown this time, I am confident that we can do it again,” he said.