Hiring at Citigroup Singapore to pick up, says global firm’s head of wealth

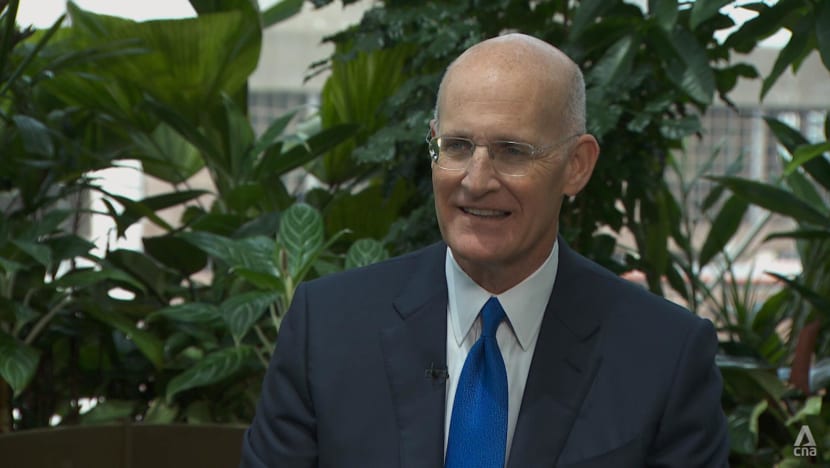

In a wide-ranging interview with CNA’s Elizabeth Neo, Mr Andy Sieg shared the importance of Asia to his firm’s growth.

Citi's office in Singapore. (Photo: Citi).

This audio is generated by an AI tool.

SINGAPORE: Hiring at global lender Citigroup's Singapore office is likely to expand on the back of an increase in productivity, said the bank's head of wealth Andy Sieg.

This is a turnaround from the situation earlier this year, when employees here went through rounds of layoffs as a result of the lender's major restructuring of its business.

Year-on-year productivity for the average customer-facing employee serving clients under wealth management programmes Citigold and Citigold Private Client in Singapore is up almost 80 per cent, Mr Sieg noted.

“That causes me to be very optimistic and very energised to invest in the market and add more resources,” he told CNA on Thursday (Sep 19).

“So, you'll see hiring pick up and I think it'll take place in a way that will really leverage that productivity.”

Hiring DBS’ Yeo Wenxian, who will begin her role as Citi’s head of wealth for South Asia on Nov 1, is a “signal that we're out in the market, looking for strong talent”, Mr Sieg said.

“We can invest in growth with great confidence, because we're seeing a level of productivity across our team, which is the productivity that you need to inspire investment,” he said.

Pointing to the hiring of Ms Wen, he said Citi Singapore has been a “magnet” for extraordinary talent.

“She represents what we hope and expect to see a lot more of – which is locally grown talent … playing roles that are visible here,” he said.

“EPICENTRE” OF GLOBAL WEALTH CREATION

Mr Sieg’s positive outlook on Citi’s wealth business in Singapore is driven by its pace of growth.

The city-state is the “epicentre” of global wealth creation alongside Hong Kong, said Mr Sieg, who is in the country for F1 client events and internal business meetings.

Wealth management is one of the key pillars of Citi CEO Jane Fraser's massive transformation plan that was announced last year.

Mr Sieg noted that Singapore’s central role partly comes from its status as a locus of family offices, which he called a “major contributor” to the firm’s business.

He noted that while many family offices – typically set up to facilitate the process of intergenerational wealth transfer – may originate from regions like the Middle East, they have decided to put their roots down in Singapore.

“Singapore has always been the crossroads of global trade. Now it's a crossroads of financial markets in a new and important way,” he said.

ROLE OF FAMILY OFFICES

Mr Sieg said that family offices play a key part of the over 20 per cent year-on-year revenue growth in Citi’s global business.

Citi manages 1,800 family offices worldwide, with an average net worth of more than US$2 billion.

The role that family offices are playing today is very different, compared with the past, Mr Sieg said. Family offices previously helped clients manage their wealth after accumulation, then divide it over subsequent generations.

Today, however, family offices encapsulate the ambition of families, he said.

“What excites me on behalf of family offices is to see how many people building businesses around the world and looking for financing today are likely to turn to a family office to be their partner, as frequently as they might turn to a private equity firm,” he said.

“They love the fact that a family office will have a long-time horizon, like many entrepreneurs do.”

Citi has added team members who can serve the needs of family offices, he added.

“They're looking for intellectual capital because they'd love to know what other family offices are doing,” he said.

SERVING CLIENTS IN CHINA AND INDIA

Mr Sieg said Asia is “leading the way forward” for Citi’s wealth business, adding that it is “firing on all cylinders”.

“Not only are wealth levels high, but there's so much dynamism (and) so much new wealth being created.”

On how Citi plans to tap on savings that are trapped in China after selling its consumer wealth portfolio in the country to HSBC last year, Mr Sieg said his firm’s focus on Chinese clients “has been redoubled”.

Citi continues to serve its clients in China from places like Singapore and Hong Kong, noting that growth has picked up – a “strong endorsement” of the firm’s moves, he added.

“Our strategy and our focus on clients in China hasn't changed. It's just the way in which we're serving that market (that) has changed. We're now serving it offshore exclusively,” he said.

“Bringing more focus to our strategy has actually accelerated the growth of the business quite a bit, because we're not spreading our management focus among multiple approaches to the market.”

When asked if Citi will re-enter the Indian market, which it also similarly serves offshore after exiting the country last year, Mr Sieg said while there is no change to its strategy, it will boost the manpower of the team serving Indian clients.

“When we look at Citi strategy today versus in the past, we are much more focused. We are trying to be much deeper with the clients that we serve,” he said.

While the change in structure has meant the lender has had to walk away from some areas, the firm is reaping the benefits from better focus on clients, he said.

“We've made those shifts, and we see the payoff of the shifts in terms of the momentum of the business,” he said.