CNA Explains: What a higher CPF monthly salary ceiling means for your retirement nest egg

How much more will you get in your CPF account after the monthly salary ceiling is raised? Will it be enough for your retirement?

Elderly men seen resting outside Raffles Place MRT on Jan 14, 2022. (File photo: CNA/Calvin Oh)

SINGAPORE: You may have heard by now that the Central Provident Fund (CPF) monthly salary ceiling will be going up, as part of announcements in Budget 2023 to address the retirement adequacy of Singaporeans.

Currently at S$6,000, the ceiling – which sets out the maximum amount of “ordinary wages” on which employee and employer CPF contributions are calculated – will be raised to S$8,000 in stages by 2026.

An example of an ordinary wage would be a person’s monthly salary.

The first increase to S$6,300 will kick in on Sep 1 this year, before the next hike to S$6,800 in 2024. It will be raised again to S$7,400 in 2025 before reaching S$8,000 in 2026.

This means that those earning above the ceiling will be getting a smaller take-home pay, as they set aside more for their CPF.

But such workers will also be getting more money in CPF contributions from their employers, which translates into a bump-up in their overall remuneration package.

All these extra CPF savings will help with the servicing of mortgages and add to a bigger retirement nest egg, experts told CNA.

But how big of an increase will this be, and will it be enough? CNA finds out.

WHAT IS CPF AND HOW DOES IT HELP WITH RETIREMENT?

Currently, employees up to 55 years old contribute 20 per cent of their monthly wages – or up to the monthly ceiling – to their CPF, while employers contribute 17 per cent.

These contribution rates drop progressively beyond 55 years old, although the Government has been gradually raising them over the past two years to help senior workers save more for retirement.

The next increase will take place in January 2024, as announced last Tuesday (Feb 14) in the latest Budget.

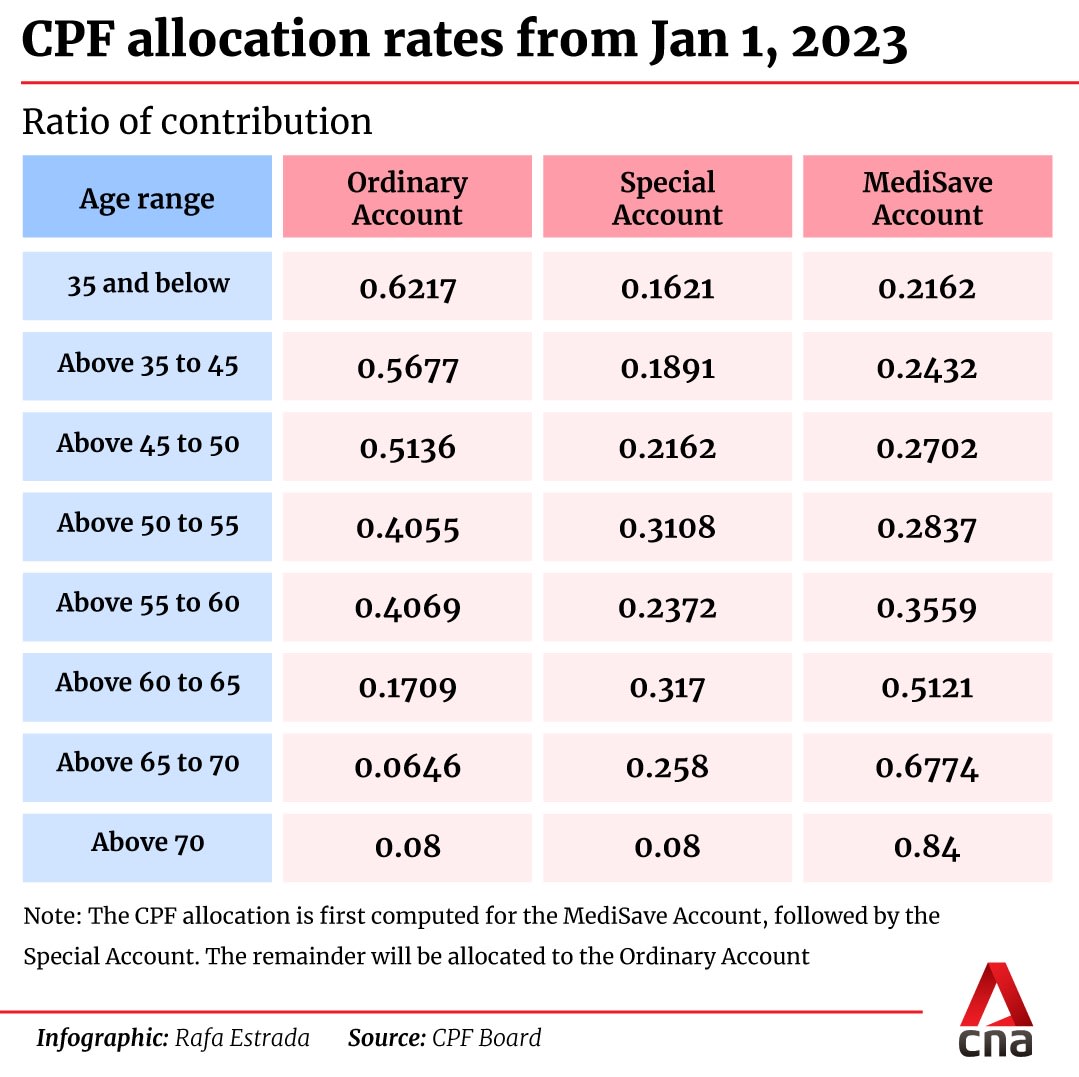

With each month’s CPF contributions, individuals accumulate savings in three accounts – the Ordinary Account, Special Account and MediSave Account.

The allocation rates differ as one gets older, with more going to the Special and MediSave accounts.

The interest rates for each account differ as well – it is currently 2.5 per cent per annum for the Ordinary Account and 4 per cent a year for the Special and MediSave accounts.

When you turn 55, funds in the Special Account, followed by the Ordinary Account, will be transferred to a newly created Retirement Account that offers yearly interest of 4 per cent.

There are three targets for the retirement sum, with each unlocking different tiers of guaranteed payouts 10 years later. The smallest is the Basic Retirement Sum, followed by the Full Retirement Sum and Enhanced Retirement Sum.

These targets – adjusted annually to account for inflation and other factors – aim to be “guideposts” to help Singaporeans gauge how much they need as monthly payouts when they retire, said the CPF Board.

For example, the Basic Retirement Sum for those turning 55 this year is S$99,400. That will translate into monthly payouts of about S$870 if payouts start at 65 years old.

The payouts go up to about S$1,620 each month if you are able to set aside the Full Retirement Sum of S$198,800.

Meeting the highest tier – the Enhanced Retirement Sum of S$298,200 – will yield monthly payouts of about S$2,370.

Simply put, the more you have stashed away in your CPF, the more you will receive in future to tide you through retirement.

HOW MUCH MORE WILL YOU GET IN YOUR CPF?

How much more a person will see in their CPF account due to the upcoming changes in the monthly salary ceiling will depend on many factors, such as income and age.

For example, a person with a monthly income of S$6,200 will have smaller CPF contributions compared with someone earning S$8,000 a month, as the ceiling moves up.

A younger person will also have time on their side to let the effect of compounding – faster growth in investments over time, as interest is earned on increasingly larger balances – work its “magic”, said PhillipCapital’s financial services manager Elijah Lee.

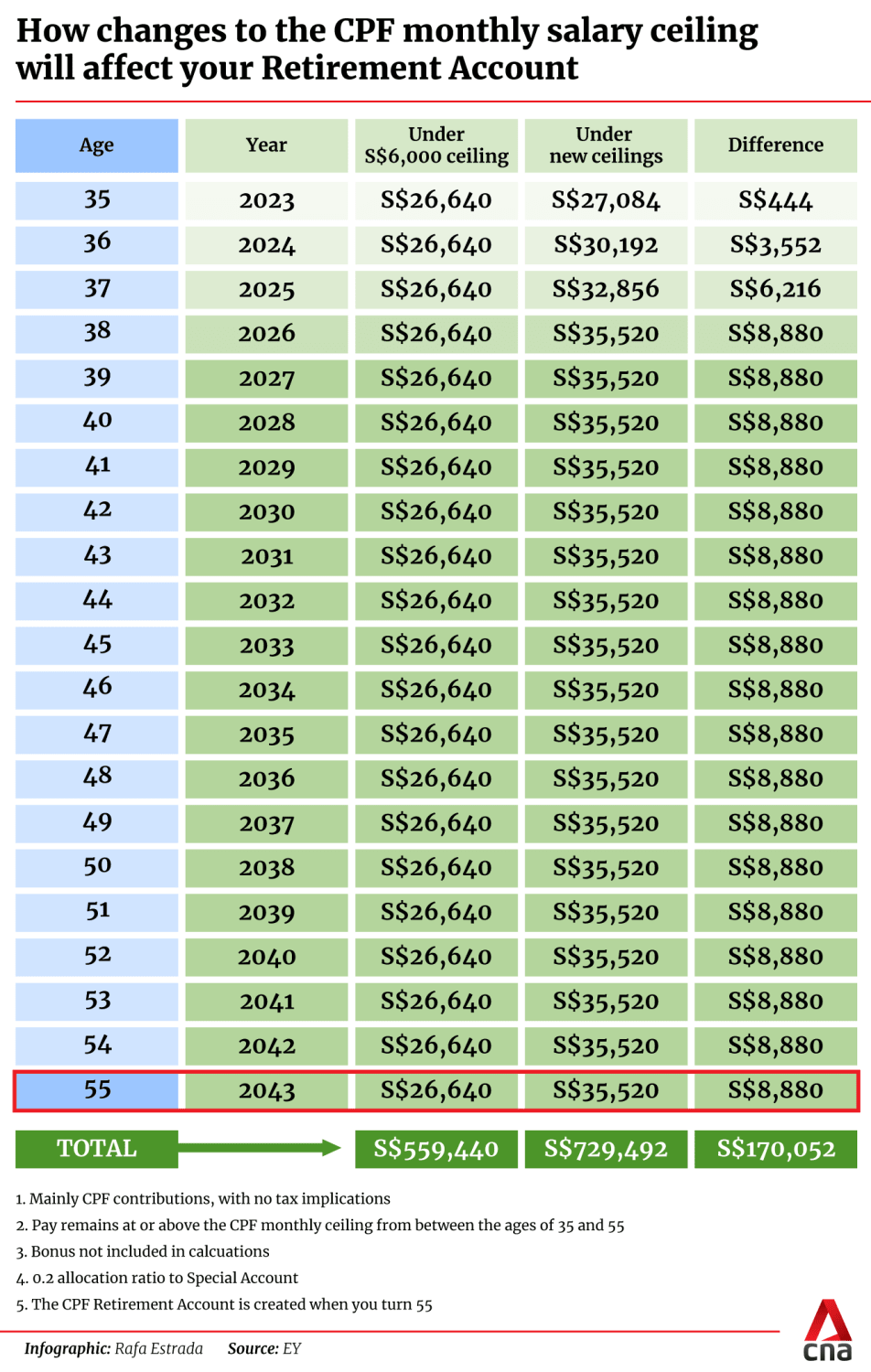

Let’s assume an individual who is 35 years old this year and earns at least S$8,000 a month with no additional bonuses – that is an annual salary of S$96,000.

This individual will start seeing an increase in CPF contributions in September – about S$444 more – when the first step-up in the monthly income ceiling kicks in.

The additional CPF contributions a year will grow to S$3,552 in 2024, S$6,216 in 2025 and S$8,880 in 2026, as the ceiling goes up.

According to calculations done by advisory firm EY, by the time a person turns 55 in 2043, these extra contributions will add up to about S$170,000, excluding accrued interest.

These calculations exclude any CPF contributions made prior to 2023. They also assume that the income ceiling for monthly CPF contributions remains at S$8,000 until 2043, although this is unlikely to be the case given periodic reviews to factor in rising income levels and cost of living, EY noted.

Nevertheless, the additional CPF contributions mark a 30 per cent increase from what would have been contributed during the same period if the ceiling remained at S$6,000, said Mr Panneer Selvam, ASEAN integrated mobile talent leader at EY People Advisory Services.

EY also pointed out that about S$78,000, or about 46 per cent, of the additional contributions came from the employer – a sum that the individual “would not have received” without the change.

“This increase in the ceiling allows for real wage growth to translate into increased retirement funds,” said Mr Selvam.

Who is affected by the new CPF monthly salary ceilings?

The latest announcement will not affect workers who earn salaries below the monthly ceiling.

High-income earners receiving large bonuses will also not be affected, with the CPF annual salary ceiling remaining at S$102,000, said MoneyOwl’s solutions lead Daphne Lye.

The annual ceiling sets out the maximum amount of annual income that is subject to CPF contributions. The yearly income takes into account additional wages such as a performance bonus.

The latest move in the monthly salary ceiling is targeted at helping the middle-income accumulate more savings in their CPF on a regular basis, said Ms Lye.

PhillipCapital’s financial services manager Elijah Lee agreed, noting that the announcement marks a shift in focus from savings based on ad-hoc bonuses to regular salaries. This will help to provide more certainty when it comes to retirement planning.

But amid the rising cost of living and longer life expectancy, further changes may be afoot.

The Government has said that the annual ceiling will be “reviewed periodically” to ensure it continues to cover the broad majority of CPF members.

Experts think this is only likely to happen further down the road, as policymakers weigh the impact on workers and businesses.

Already, business associations and observers are saying that the higher monthly salary ceiling will add to the woes of companies already grappling with rising costs.

While the phased increase can help soothe the impact, some smaller firms will still feel an additional “financial burden”, they added.

WHAT DOES THIS EXTRA AMOUNT MEAN FOR YOUR RETIREMENT?

Generally, with the boost in CPF savings, experts expect more people to be able to achieve the Basic Retirement Sum by the time they turn 55, or even set aside more to qualify for the Full and Enhanced Retirement Sums.

Back to the 35-year-old example, having additional funds of about S$170,000 will help this person to “meet or exceed” the Basic Retirement Sum by the time he or she turns 55 in 2043, Mr Selvam said.

The Basic Retirement Sums beyond 2027 have not been announced. Assuming that it continues to go up by 3.5 per cent a year, EY calculations show that it will likely be an estimated S$198,000 by 2043.

While significantly more than the Basic Retirement Sum of S$99,400 in 2023, the additional CPF funds, assuming they were left untouched, will mean that this person only needs another S$30,000 to achieve the Basic Retirement Sum.

Echoing a similar sentiment, DBS Bank’s head of financial planning literacy Lorna Tan said: “With the compounding effect, the increase in CPF salary ceiling would enable the middle-income to achieve their Full or even Enhanced Retirement Sums.”

While it is good news that more people will be able to accumulate larger amounts in their CPF and in turn receive bigger payouts for their retirement, it is also worth noting that the estimated monthly payouts have not been increasing at the same pace as the retirement sums.

Mr Lee noted that while the retirement sums have gone up by 3.5 per cent annually on average, the payouts have grown by about 3.25 per cent a year, likely due to longer life expectancy.

“With people living longer, the payouts can’t keep up with the increase of 3.5 per cent if we want to stretch the savings for longer,” he explained.

“This means that the latest measure, with compounding effect, should help Singaporeans to keep pace with inflation in the long run but on our own, we still have to do more to prepare for retirement.”

This is especially so if individuals prefer a more cosy lifestyle in retirement, such as going on frequent vacations.

Ms Tan said: “Our desired retirement lifestyle differs from person to person. As such, the increase in CPF monthly salary ceiling will impact each member’s retirement adequacy differently.

“For most people, it is insufficient to depend solely on CPF payouts, which are meant to fund our basic expenses.”

Experts also suggested topping up CPF accounts, especially for those who are not affected by the planned changes to the monthly salary ceiling. These include those earning monthly salaries below the ceiling.

MoneyOwl’s solutions lead Daphne Lye recommended top-ups be done to the Special Account to take advantage of the high and “risk-free” interest rate. Top-ups should be done earlier in the year to earn more interest, added Ms Tan.

Building up other streams of retirement income beyond CPF will also be key, said experts.

They suggested investing in the likes of unit trusts, as well as dividend-paying stocks and real estate investment trusts (REITs), which can help to be a source of passive income during retirement.

That said, not all dividend stocks and REITs are the same, said Mr Lee. Investors still have to be mindful of sectors and individual company fundamentals, given how firms can suspend dividend payments during challenging times, he added.