CNA Explains: What a higher CPF monthly salary ceiling means for you

How much of your salary will you take home now that the CPF monthly salary ceiling has risen? How will the change affect the total monthly CPF contribution?

People walking in Raffles Place in Singapore. (Photo: AFP/Roslan Rahman)

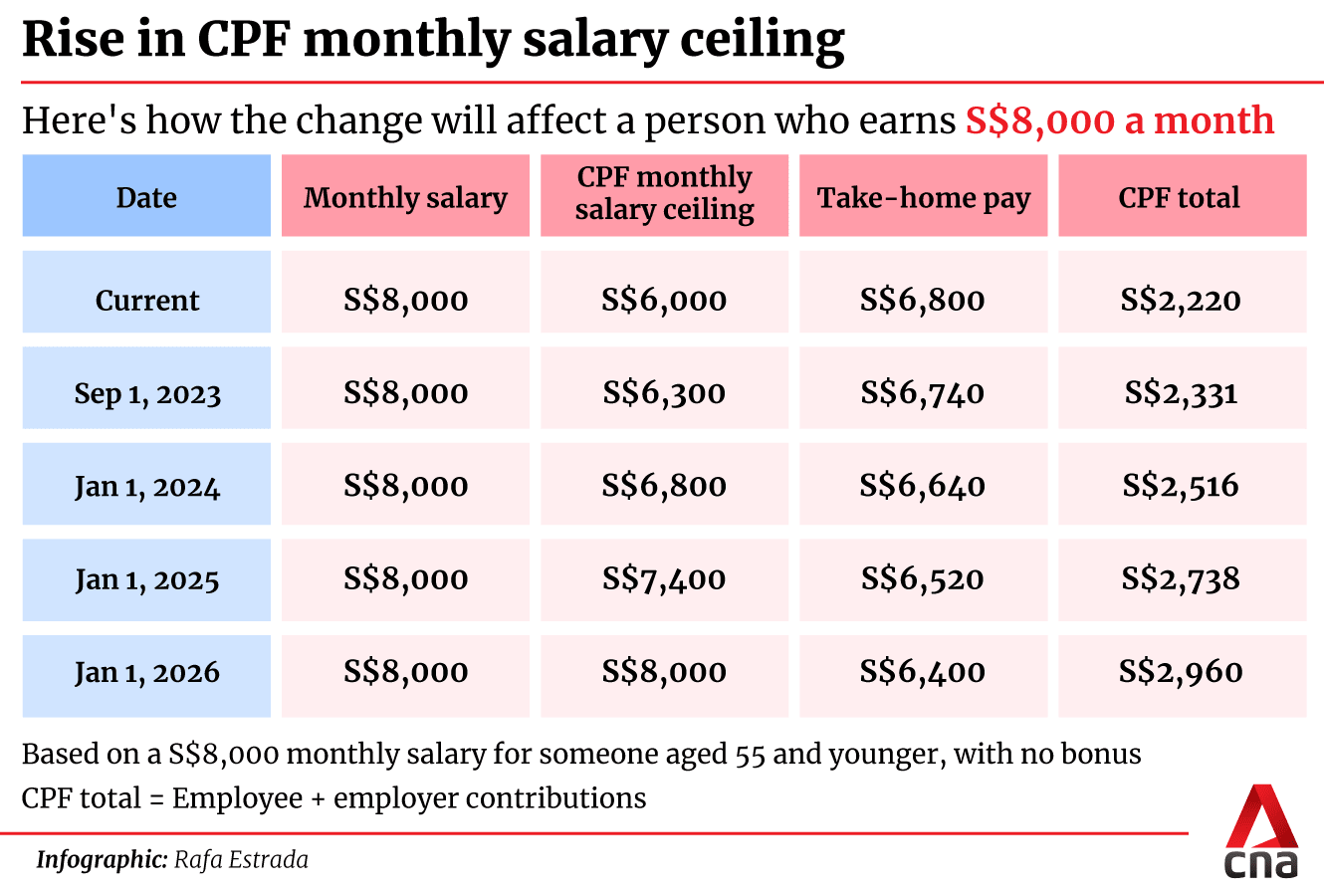

SINGAPORE: Singaporeans and most permanent residents may see a smaller take-home pay from September, with the Central Provident Fund (CPF) monthly salary ceiling rising by S$300 (US$222) to S$6,300.

It will then be increased to S$6,800 from January 2024, S$7,400 from January 2025 and S$8,000 from January 2026. The move was announced by Finance Minister Lawrence Wong in his Budget speech in February.

What will the changes mean for you? How will it affect your total CPF contribution?

WHAT IS THE CPF MONTHLY SALARY CEILING?

The CPF monthly salary ceiling sets the maximum amount of CPF contributions payable for "ordinary wages". An example of an ordinary wage would be a monthly salary.

In short, this means employees and employers alike currently need to make CPF contributions for the first S$6,300 of monthly salaries.

How CPF contributions are calculated is based on the monthly salary or ceiling, whichever is lower. Employees aged 55 or below have to make a 20 per cent contribution, while employers make a 17 per cent contribution.

For example, at the new CPF monthly ceiling of S$6,300, a worker aged 55 or below who earns S$6,300 per month contributes 20 per cent of that amount to their CPF – S$1,260.

If the individual's monthly salary exceeds the current CPF monthly ceiling, their contribution will still be S$1,260 per month. CPF contributions are not required on the remaining amount of their salary.

WHY THE CHANGE?

In his speech, Mr Wong said the move was to “keep pace with rising salaries” and would help middle-income Singaporeans save more for their retirement.

The last time the ceiling was adjusted was in 2016 when it was moved upwards from S$5,000 to S$6,000.

HOW WILL IT AFFECT MY TAKE-HOME PAY AND TOTAL CPF CONTRIBUTION?

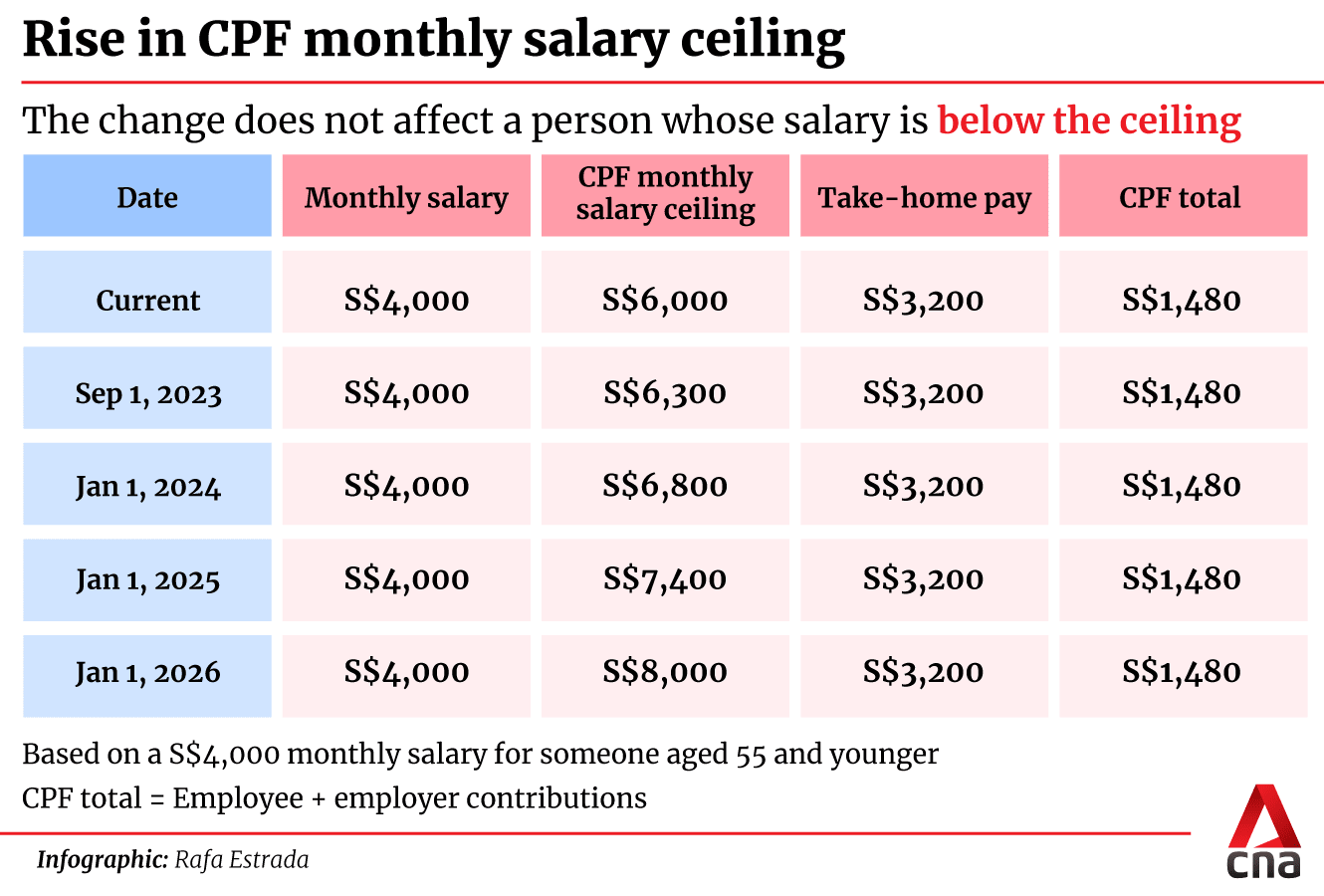

This depends on how much you are currently earning. The change does not affect people earning monthly salaries below the ceiling.

Before the change, if a person earns S$6,100 per month, their CPF contribution was S$1,200 – 20 per cent of the previous S$6,000 monthly ceiling. CPF contributions are not required for the remaining S$100, so their take-home pay was S$4,900.

The employer's contribution is 17 per cent of the previous S$6,000 ceiling, which comes up to S$1,020. The total contribution to CPF was S$2,220.

With the increased monthly ceiling of S$6,300, the same person with the same salary will contribute 20 per cent of their monthly wage to CPF – S$1,220 – since their monthly wage is now below the ceiling. This means that their take-home pay is now S$4,880.

The employer's contribution also goes up to 17 per cent of S$6,100, which comes up to S$1,037. This means the total contribution to CPF rises to S$2,257.

To summarise, the raising of the CPF monthly salary ceiling lowers the take-home pay of workers earning more than S$6,000 a month, but increases the total contribution from employers and employees to CPF accounts.

In addition to the CPF monthly salary ceiling, there is a CPF annual salary ceiling of S$102,000. This annual ceiling sets the maximum amount of CPF contributions payable for all wages received in a year – both ordinary wages and additional wages.

An example of an additional wage is the annual performance bonus.

The annual ceiling is currently set at 17 times of the previous S$6,000 monthly salary ceiling to account for five-month bonuses.

There will be no change to the CPF annual salary ceiling at this juncture, said the Ministry of Finance. This annual ceiling will be reviewed periodically to ensure it continues to cover the broad majority of CPF members, it added.

To ensure that employees earning the same annual salary receive the same CPF contributions, regardless of their salary structure, the CPF monthly salary ceiling will eventually be set at one-twelfth of the annual salary ceiling at a steady state.

WHAT DOES IT MEAN FOR EMPLOYERS?

Employees aged 55 and below currently contribute 20 per cent of their monthly wages to CPF, subject to the CPF ceiling, while employers of such workers contribute 17 per cent.

With the latest move, employers' monthly contributions will rise if their employee earns above the ceiling.

For example, at the previous monthly ceiling of S$6,000, an employer would have to make a CPF contribution of S$1,020 – 17 per cent of the ceiling – for a worker who earns S$8,000 a month.

From January 2026, when the monthly ceiling is S$8,000, the employer's contribution for such a worker will rise to S$1,360.

The change in the CPF monthly salary ceiling will only affect employer contributions for employees who earn above the ceiling.

As such, employees aged 55 and below who earn above the ceiling will get more overall because of the increased employer CPF contributions. While they take home less, they will now have more in their CPF accounts for various purposes, including for retirement or to pay for housing loans.

HOW WILL THIS HELP WITH RETIREMENT NEEDS?

Deloitte Singapore’s tax partner Yap Hsien Yew described the raising of the CPF monthly salary ceiling as “one of the most significant measures” regarding retirement planning in this year’s Budget, given how it will enable Singaporeans to accumulate larger amounts in their CPF accounts over time.

More people may be able to achieve the basic retirement sum “much sooner”, or even set aside more to qualify for the full and enhanced retirement sums that provide higher monthly payouts, he added.

Younger workers will have the benefit of time to enjoy the compounding effects on larger CPF account balances, said Mr Christopher Gee, senior research fellow and head of the governance and economy department at the Institute of Policy Studies.

But the change will be painful for some. For example, those in the sandwiched generation, who have to care for their children and elderly parents, will likely “feel most acutely” the impact of smaller take-home pay, Mr Gee added.

Taken together with other CPF-related announcements such as the increase in the monthly payout for seniors on the Retirement Sum Scheme, Budget 2023 will provide “much-needed financial security” for both the lower- and middle-income groups and give Singaporeans a greater peace of mind when planning their finances, said Mr Yap.

“(The measures) will help them to accumulate more savings and provide them with a more reliable income during their retirement years. This will help to ensure that these earners have a comfortable and financially secure retirement,” he said.