Scams and fraud drive claims against financial institutions to record high, says industry mediator

The Financial Industry Disputes Resolution Centre handled 2,646 claims against financial institutions in the financial year that ended on Jun 30, 2025.

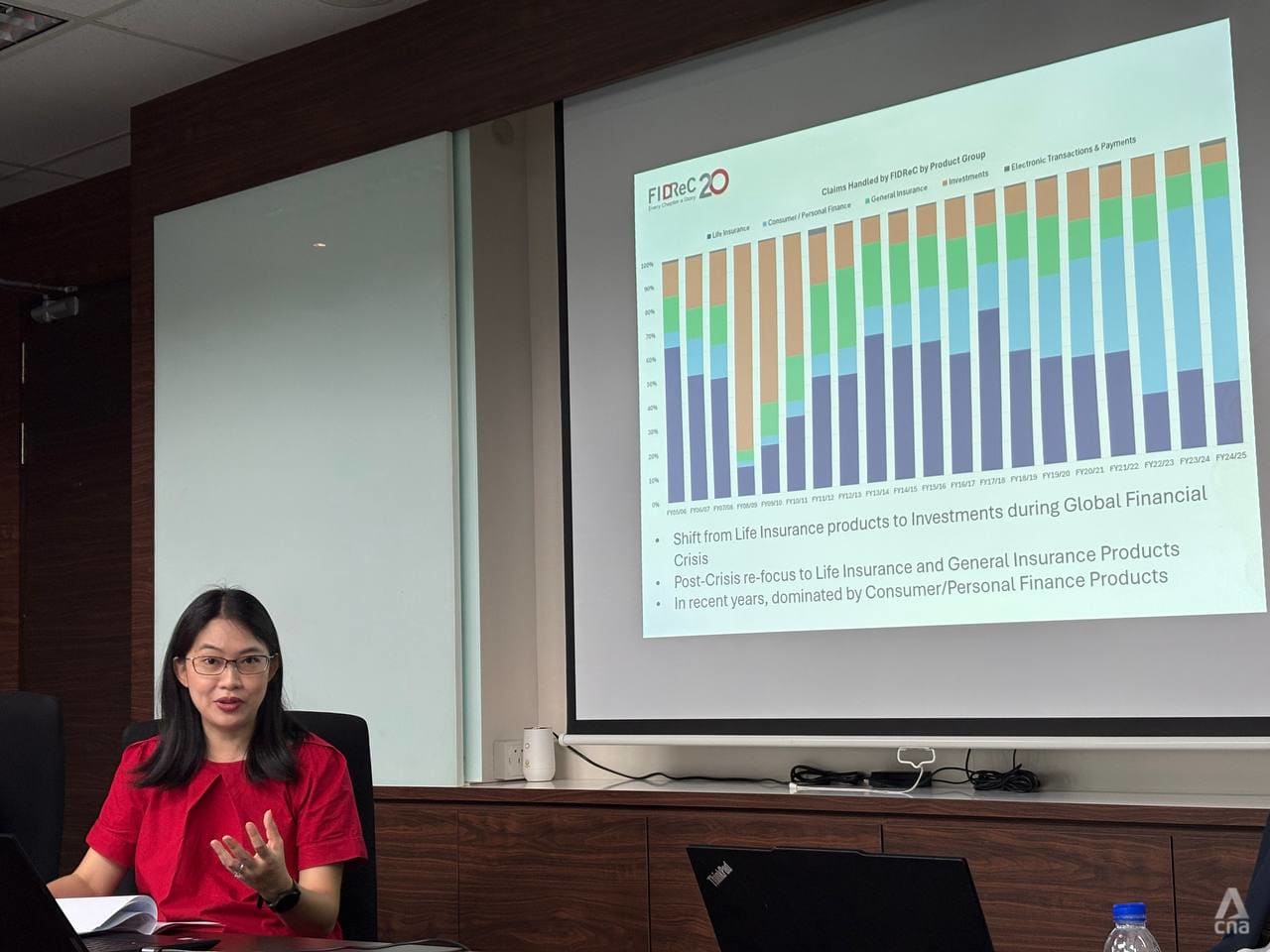

The Financial Industry Disputes Resolution Centre handles disputes for consumers, small businesses and charities. (Photo: CNA/Abigail Ng)

This audio is generated by an AI tool.

SINGAPORE: The number of claims made against financial institutions jumped almost 200 per cent from 2021 to 2025, mainly driven by fraud or scam-related claims, according to data from a dispute resolution centre.

The Financial Industry Disputes Resolution Centre (FIDReC) handled a record-high of 2,646 claims in the financial year 2024/2025, which ended on Jun 30.

There were more than 3,000 reports including cases resolved directly between the consumer and financial institution, and cases that were reported to FIDReC but out of its jurisdiction, said chief executive officer Eunice Chua at a press conference on Wednesday (Sep 24).

In the 2021/2022 financial year, the centre handled fewer than 1,000 cases.

Launched in 2005, FIDReC is a not-for-profit company that resolves financial disputes for consumers, small businesses and charities through mediation and adjudication.

It aims to be independent and impartial, and operates independently of the government, financial institutions and consumer bodies. Disputes are usually resolved without the involvement of external lawyers.

"This year's volume has reached a peak not seen since the global financial crisis of 2008," FIDReC said in a press release. In that financial year, the centre handled 2,257 claims.

After the situation stabilised, the average number of claims per financial year was 964 for about 10 years, until the recent rise due to fraud and scams.

"Unlike the brief spike in 2008 that normalised within two years, FIDReC expects the current all-time high to continue rising as digital banking and online transactions become more widespread," the centre said.

Insurance payouts and investments used to be a major source of disputes, but scams and frauds made up 49 per cent of claims from July 2024 to June 2025.

The total value of the claims in that period was S$103 million (US$80.4 million), a jump from S$57 million the year before. In the 2015/2016 financial year, the claim value was only S$13 million.

Transnational organised crime, instant transfers and notification fatigue are factors that have contributed to the increase, FIDReC said.

The most common cases seen by the centre involve compromised credentials and impersonation scams. Card-to-wallet linking is a growing area of concern, where victims may miss the initial alert and find out about fraudulent wallet purchases only later on, it added.

CHANCES OF SUCCESS

FIDReC said it has consistently completed at least 85 per cent of accepted complaints within six months.

Most are resolved at the mediation stage.

For the financial year ended Jun 30, 2024, 80 per cent of scam-related cases were resolved through mediation with settlement, while 11 per cent ended at mediation without settlement.

In cases that proceed to adjudication, the financial institutions are usually able to defend themselves successfully.

Just 2 per cent of scam cases were resolved through adjudication with an award in favour of the consumer, and 7 per cent went to adjudication and ended with no award to the consumer, for the financial year 2023/2024.

Ms Chua said the size of the settlement is usually between 10 per cent and 30 per cent of the amount lost.

"The successful cases tend to be true goodwill kind of situations where there's a very sympathetic circumstance," she said, giving examples of elderly consumers or customers who are suffering from illness.

"Our financial institutions do look at these truly sympathetic factors outside of responsibilities," said Ms Chua.

"Sometimes the bank will ... find that it's the customer's fault, but still I want to try to help you, or at least share in this loss that you're suffering by giving ... not a full amount, but some percentage," said Mr Kenneth Har, director of alternative dispute resolution at FIDReC.

A customer who reports their case promptly and cooperates with the bank or police investigations may also have a higher chance of success.

The challenges in seeking redress remain significant, said FIDReC, noting that clawback options are scarce once funds are transferred out, and consumers do have the responsibility of monitoring alerts and protecting their access credentials.

GOVERNMENT-LED FRAMEWORK "LIMITED"

Singapore's Shared Responsibility Framework also has limitations, as it only applies to phishing cases involving fake sites, while authorised transactions and card-to-wallet fraud is not covered, said FIDReC.

The guidelines spell out the duties of consumers, financial institutions and telecommunications companies in mitigating the risk of seemingly authorised transactions.

They also clarify the allocation of responsibility for losses arising from such transactions. The Monetary Authority of Singapore and Infocomm Media Development Authority announced that the framework would take effect in December 2024.

Ms Chua said many consumers are not able to pinpoint how their credentials were lost, stolen or compromised.

"They are not able to say that it was because they clicked on a phishing link, they're not aware that it was malware," she said.

Because the Shared Responsibility Framework's scope is limited to phishing, consumers who make reports but cannot identify the reason they were scammed will not benefit from the guidelines.

"In fact, we ... hardly see any cases referring to this Shared Responsibility Framework," she said.

Each complaint received tells a story of trust challenged, clarity sought and systems tested, said Ms Chua.

The underlying story is one of people navigating a changing financial landscape, she said.

"Beyond the statistics lies the true impact of FIDReC's work: helping real people resolve genuine issues, and in doing so, shaping a financial ecosystem that is fair, responsive and humane."