Hyflux trial: DBS representative says Hyflux did not disclose its entry into power business

Mr Lum Moe Tchun, who was senior vice-president at DBS at the time, testified on the first day of the resumption of the trial against former Hyflux chief executive officer Olivia Lum Ooi Lin and other Hyflux ex-leaders.

Mr Lum Moe Tchun and Ms Olivia Lum Ooi Lin at the State Courts on Jan 13, 2026. (Photos: CNA/Justin Tan, Jeremy Long)

This audio is generated by an AI tool.

SINGAPORE: A representative for DBS on Tuesday (Jan 13) testified that Hyflux did not disclose to him or his team members that the water treatment firm was entering the power business.

Mr Lum Moe Tchun, now managing director in investment banking at DBS, shared this on the first day of the resumption of the long-running trial against former Hyflux chief executive officer Olivia Lum Ooi Lin, 65, and other Hyflux ex-leaders.

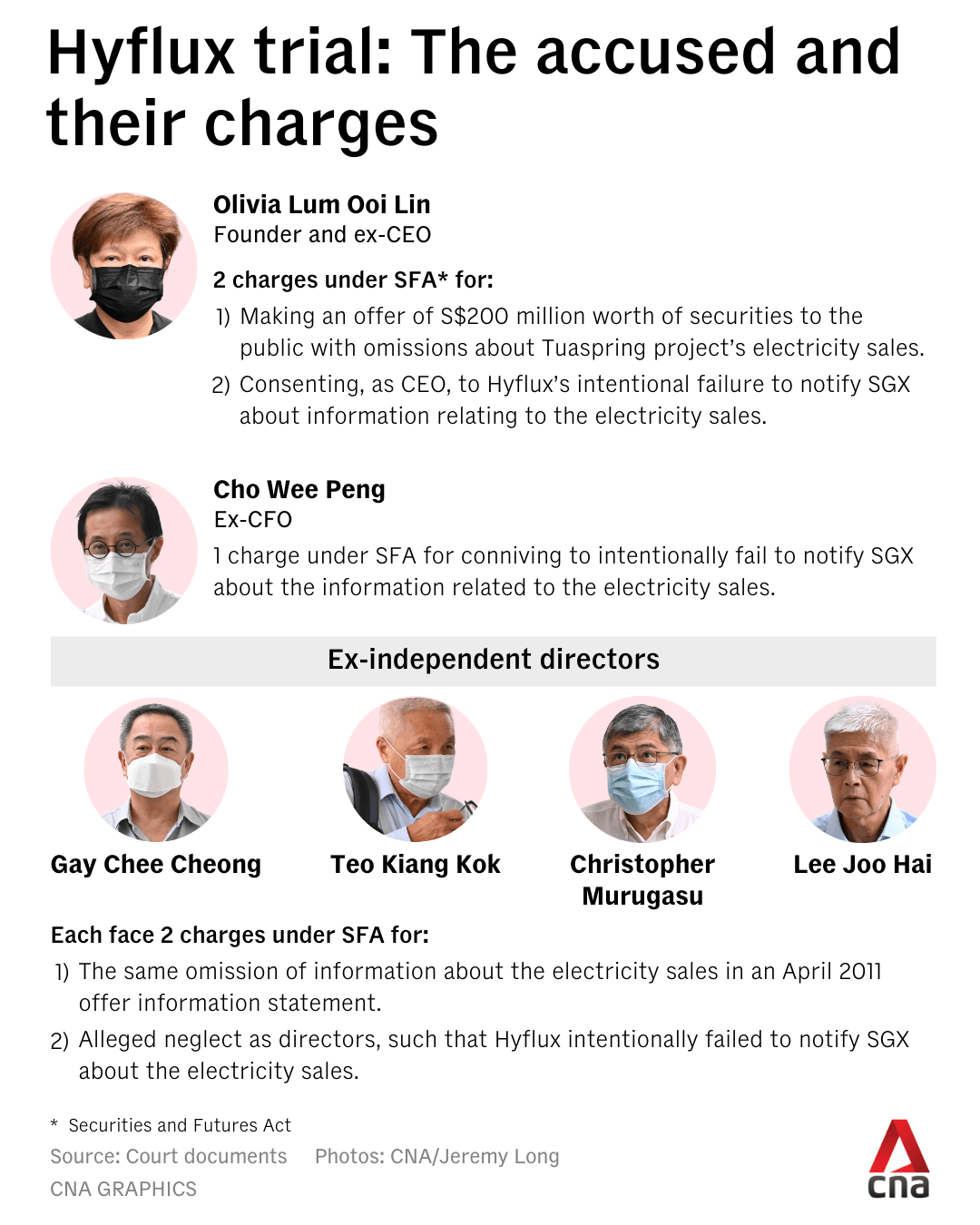

Along with then-chief financial officer Cho Wee Peng and four former independent directors of Hyflux, Olivia Lum is on trial for allegedly omitting details about electricity sales in its Tuaspring project.

Hyflux had pitched the project to the market as its second and largest seawater desalination plant in Tuas, but allegedly omitted that it would fund the sale of water at a very low price to national water agency PUB with its new business of selling electricity from a power plant it would build.

The unsuccessful foray into Singapore's power market contributed to the company's collapse and affected about 34,000 investors who held perpetual securities and preference shares, and were owed a total of S$900 million, according to the prosecution.

Hyflux's management decided to issue preference shares to raise funds and engaged DBS as the lead manager and bookrunner for the issuance of these shares.

The company lodged the April 2011 offer information statement with the Monetary Authority of Singapore for the issuance of up to S$200 million in 6 per cent cumulative non-convertible, non-voting, perpetual Class A preference shares.

These shares were oversubscribed, and the offer amount was increased, with Hyflux ultimately raising S$400 million from the issuance.

MR LUM'S TESTIMONY

Mr Lum told the court on Tuesday that he was senior vice-president at DBS at the time - between 2010 and 2012 - and that he led the campaign for DBS in the raising of preference shares for Hyflux.

He agreed with the prosecution that this was probably the first such issuance of preference shares by a listed company that was not a bank.

Mr Lum explained that the offer information statement, which is central to some of the charges in the trial, contains important information for investors to consider in taking up the preference shares.

He said the document was "a company document" drafted by Hyflux's legal counsel, with input from DBS and its own legal counsel.

He added that both sides ran through a series of questions to ensure that there was no further disclosure required for the offer information statement, and that it was accurate and contained no misleading information.

Asked how DBS ensured or checked that a company has made full disclosure, Mr Lum said: "Well, we can only work with information that's available to us, which is - as I mentioned - the announcements, the press releases, information that's made public by the company."

He said DBS would review this against the offer information statement for consistency, along with more recent developments or updates.

"If the offer information statement is not correct, or there's some statement that's not correct, then we would not want to continue with the offering," said Mr Lum.

Deputy Public Prosecutor Kevin Yong pointed Mr Lum to a line in the eventual offer information statement, where it said that the net proceeds from the issue of shares will be used to fund the group's water and infrastructure projects, and for general working capital in the estimated proportions of 80 per cent and 20 per cent, respectively.

Mr Lum said he took the "infrastructure projects" to mean projects related to water projects. Explaining, he said he had seen information on Hyflux's water projects in available documentation. He added that no one in the company had explained to him what these projects referred to.

Asked if Hyflux had told him that it meant power projects when it referred to "infrastructure projects", Mr Lum said: "I don't recall they mentioned that, no."

Mr Yong then showed him a news release from March 2011 on the Tuaspring project, and said there was nothing in there about the power business or the risks of entering into a power business, and asked if he knew why.

Mr Lum said he did not know.

Asked if Hyflux had told him that it was entering the power business, Mr Lum said: "I do not recall specific discussions, but no, I was not aware as far as I recall."

Mr Yong then asked him what he understood of a line in the news release that said excess power would be sold to the grid.

"My understanding is that the power plant's main purpose was to supply power to the desalination plant and any excess would be then sold to the grid," answered Mr Lum.

He added that Hyflux did not disclose to him, or his team, that it was entering the power business.

Mr Yong then asked what Mr Lum would have done if he had known.

"Well, typically again we do not advise the company on disclosure, but we would have brought it up for discussion, probably asked for more information on this, and we would have discussed this with a legal advisor," he said.

He added that there "could have been some consideration" to change or add to the disclosure depending on the outcome.

"At any point in time, did Hyflux seek DBS' advice on disclosure about the power plant?" asked Mr Yong.

"No, they did not," responded Mr Lum.

The trial continues with Mr Lum expected to be cross-examined for the next few days. He is one of the last few prosecution witnesses expected to take the stand.

This tranche of the trial is slated to run for several weeks in January and into early February.

If convicted of consenting to Hyflux's intentional failure to disclose the electricity sale information to the securities exchange, Olivia Lum could be jailed for up to seven years, fined up to S$250,000, or both.

For making an offer of securities to the public with omissions about the electricity sales, she could be jailed for up to two years, fined up to S$150,000, or both.