Job vacancies in Singapore hit ‘record high’ in June amid border restrictions, labour crunch

File photo of Singapore's skyline. (Photo: Mubin Saadat)

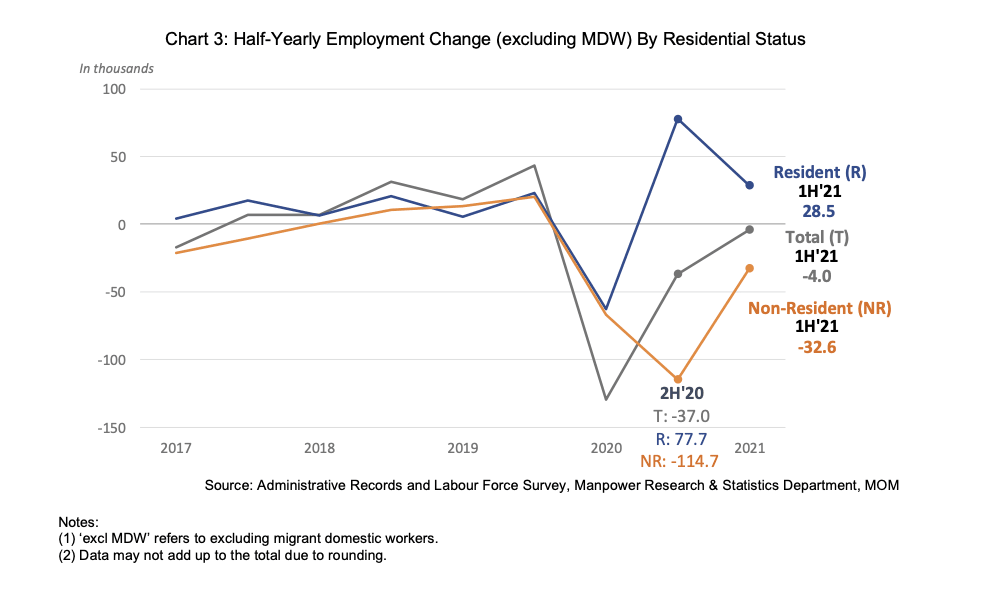

SINGAPORE: Singapore’s resident unemployment continued to ease in the first half of the year, with the number of job vacancies rising to a “record high” in June amid COVID-19 border restrictions and manpower shortages, official data showed on Wednesday (Sep 15).

While resident employment increased across many sectors, recovery was uneven, according to the Labour Market Report released by the Ministry of Manpower (MOM).

Resident employment increased across growth sectors such as information and communications, health and social services, professional services, public administration and education and financial and insurance services.

However, employment declined in sectors “adversely affected” by Phase 2 (Heightened Alert) restrictions in the second quarter of the year. These include food and beverage services and retail trade, as well as tourism-related arts, entertainment and recreation and accommodation.

Non-resident employment declined across all sectors and pass types due to tightened travel restrictions.Overall, total employment declined, taking into account a sharper decline in non-resident employment and the slower growth of resident employment.

VACANCIES

Seasonally adjusted job vacancies rose to an all-time high of 92,100 in June due to the ongoing border restrictions affecting the availability of manpower in the construction and manufacturing sectors and the sustained demand across the growth sectors.

The ratio of job vacancies to unemployed persons increased to above one for the first time since March 2019, with 163 openings for every 100 unemployed persons in June.

UNEMPLOYMENT AND LONG-TERM UNEMPLOYMENT RATES REMAIN ELEVATED

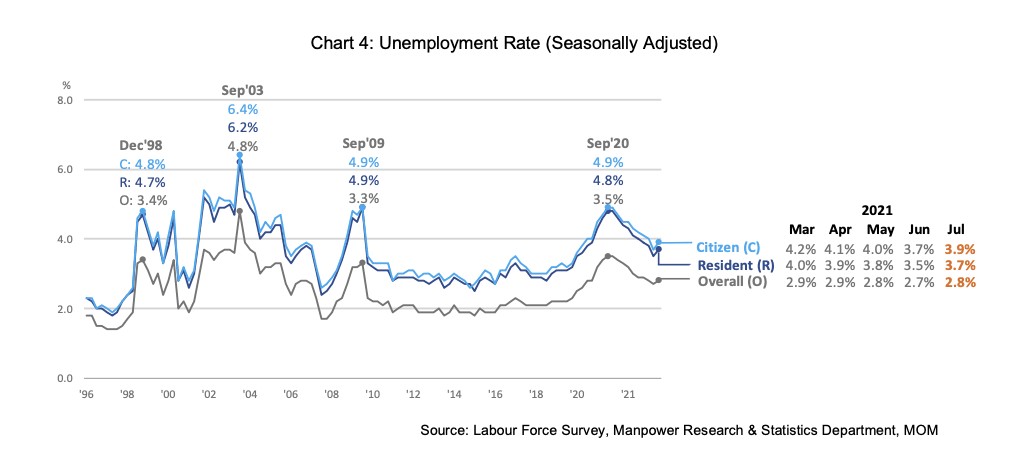

The unemployment and long-term unemployment rates “remain elevated”, said MOM.

This is despite the downtrend in seasonally adjusted unemployment rates in June, with the rate at 3.5 per cent for residents and 3.7 per cent for citizens.

The seasonally adjusted resident long-term unemployment rate also dipped to 0.9 per cent in June, from the high of 1.1 per cent in December 2020 and March 2021.

In a briefing on Wednesday, MOM permanent secretary Aubeck Kam also addressed previously reported data for July, saying the "slight" increase in unemployment rate that month reflected a dip in demand for manpower by the food and beverage and retail sectors, which were "most affected" by the Phase 2 (Heightened Alert) measures.

"Notwithstanding that, overall, we have made considerable improvement since September 2020, when unemployment rates peaked."

He added that most age and education groups registered a decline in their resident unemployment rate in June, as compared to March. However, the unemployment rate rose for residents in their 40s as well as those with degree qualifications.

"We remain concerned for our mature workers and they continue to be the focus of many of our jobs interventions," said Mr Kam.

When asked for the reason behind the rise in the unemployment rate for residents in their 40s, MOM’s director of manpower research and statistics Ang Boon Heng noted that rates for this age group had fallen from 4.1 per cent in December last year to 3.2 per cent in March, before rising to 3.7 per cent in June.

"We have to monitor this and see whether it forms a trend, or if it's just those little fluctuations that we see on a quarter-to-quarter basis," he said.

MOM's director for manpower planning and policy division Kenny Tan added that this a "structural issue" that MOM has been aware of for a "long time", and was a reason why the ministry launched the SkillsFuture Mid-Career Support Package for mature workers.

RETRENCHMENTS

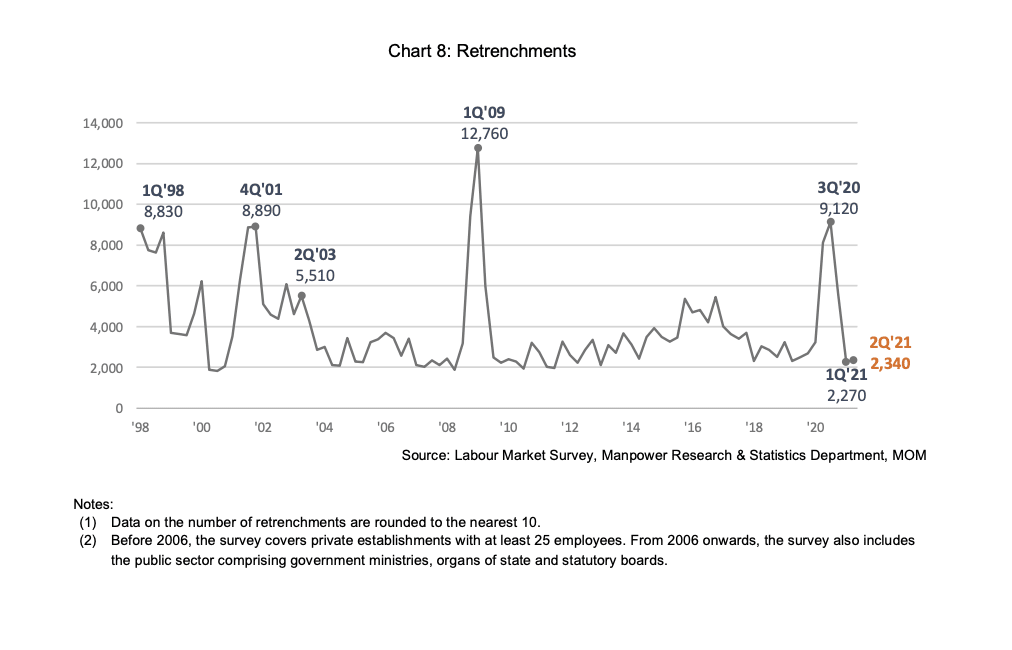

In the first half of the year, there were 4,620 retrenchments, or 2.3 retrenchments for every 1,000 employees.

“These were comparable to the half-yearly levels seen in 2018/2019,” said MOM.

By quarter, retrenchments were slightly higher in the second quarter with 2,340 layoffs, compared with 2,270 retrenchments in the first quarter. This is amid the Phase 2 (Heightened Alert) measures.

However, they remain within the pre-pandemic quarterly range, said Mr Kam, "so we do not see anything that suggests any cause for concern".

More employees, particularly those in the food and beverage services, were placed on short work-week or temporary layoff in the second quarter - 5,580 compared to 4,020 in the first quarter.

“While the number remained elevated compared to pre-pandemic times, the prevalence of such temporary work arrangements helped to keep retrenchments relatively low in 1H 2021,” said MOM.

The six-month re-entry rate among retrenched residents dipped slightly in the second quarter, following improvements in the fourth quarter of 2020 and the first quarter of this year. It fell from 66 per cent to 64 per cent.

However, not all groups saw a decline in re-entry rates. It rose for people below the age of 50, as well as those retrenched from clerical sales and service work and for people those who had degree qualifications, said Mr Kam.

OUTLOOK

As vaccination rates continue to rise, domestic and border restrictions should be eased progressively, said MOM.

“This should raise employment levels and progressively reduce unemployment rates.

“However, we should expect the labour market recovery to be uneven across sectors as uncertainties in the external economic environment remain.”

Tourism- and aviation-related sectors are projected to have a “slow recovery” as “travel restrictions globally are likely to be lifted cautiously and global travel demand may also remain sluggish amidst the spread of more contagious strains of the virus”, said MOM.

Activity in these sectors is expected to remain “significantly below” pre-pandemic levels even by the end of the year.

Meanwhile, consumer-facing sectors such as food and beverage services and retail trade should start to recover, as domestic restrictions ease over the year.

However, they are not expected to return to pre-pandemic levels due to the “subdued” tourism outlook.

“By contrast, the growth prospects for outward-oriented sectors remain strong given the rebound in global demand. These include the manufacturing, wholesale trade, information and communications and financial and insurance services sectors.”