At least S$1.6 million lost to scams targeting Singapore bank customers in past 12 months: Police

Since January 2019, the police have received at least 60 reports of various versions of bank scams.

SINGAPORE — Victims have lost at least S$1.6 million over the past year to scammers targeting bank customers, the police said on Tuesday (Jan 14).

Since January last year, the police have received at least 60 reports of different versions of such bank scams.

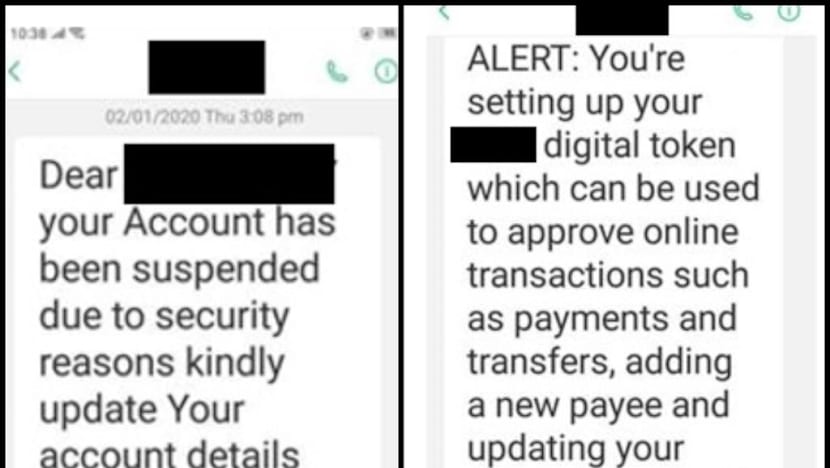

In one variant of the scam, the victims would be misled into thinking that their bank account or ATM card has been blocked, cancelled or deactivated.

Eventually, if the victims follow through with the scam, the scammer would ask for their personal particulars, internet banking details and one-time password (OTP). The victims would later realise that unauthorised transactions were made from their bank account.

In another variant, the victim would receive a call from the scammer on the messaging application Viber. The scammer, pretending to be an employee at a bank, would claim that the victim’s bank account has been locked or suspended.

The scammer would then offer to help the victim to resolve the matter. In some cases, the scammers would ask the victim to contact a specific number on WhatsApp for the purpose of verifying their identity.

In a third variant of the scam, the victim would receive a call from an automated voice message, purportedly from a bank, informing him that his bank account has been locked or would soon be cancelled.

The victim would then be prompted to press a number before the call would be transferred to someone claiming to be a bank agent.

In other cases, the victim would receive an SMS message, claiming to be from the bank, informing him that his ATM card has been blocked or deactivated.

The scammer would then direct the victim to call a specific number to re-activate the ATM card.

The police advised members of the public to beware of unsolicited messages or calls from people impersonating bank employees.

“Scammers may use caller ID spoofing technology to mask their actual phone number to display the bank’s number and logo as the profile picture on mobile applications such as Viber and WhatsApp,” the police added.

Members of the public should not disclose their internet banking details, such as their username or their personal identification number (PIN) to anyone through phone, email or SMS, because banks and government agencies will not ask anyone to disclose these details to them, the police said.

They also warned that individuals should not respond to digital token authentication requests via phone calls if they did not initiate any banking transaction.

“If you receive a suspicious call purportedly from your bank, hang up and call the hotline published on the bank’s website to verify the authenticity of the request. Do not call the number provided by the caller,” the police said.

Those who want to provide information on such scam calls may contact the police helpline at 1800-255-0000 or submit a report online at www.police.gov.sg/iwitness.

To seek scam-related advice, call the anti-scam helpline at 1800-722-6688 or visit www.scamalert.sg.