The highs and lows of M1: From bright beginnings to delisting and proposed sale

Keppel said it would sell M1's telecom operations to fellow telco Simba for S$1.43 billion.

The M1 shop at Peranakan Place closed in January 2024. (Photo: Facebook/M1)

This audio is generated by an AI tool.

SINGAPORE: When M1 launched in 1997, the telco's popularity grew quickly – within a month, it had captured 10 per cent of the market share, or 35,000 subscribers.

The company, which started life as MobileOne – a consortium formed by Keppel, Singapore Press Holdings (SPH), Cable & Wireless and Hong Kong Telecom – was the second telco in Singapore.

Its market share ballooned to a third in the next five years, with about 1 million subscribers. It launched an initial public offering and listed on the Singapore Exchange (SGX) in 2002.

The company was valued at between S$1.2 billion and S$1.5 billion then, making it the biggest share offering since 1999.

But it has not always been smooth sailing for M1, as it struggled with increased competition.

On Monday (Aug 11), Keppel announced that it would sell M1's telecom operations to Simba Telecom for an enterprise value of S$1.43 billion (US$1.11 billion).

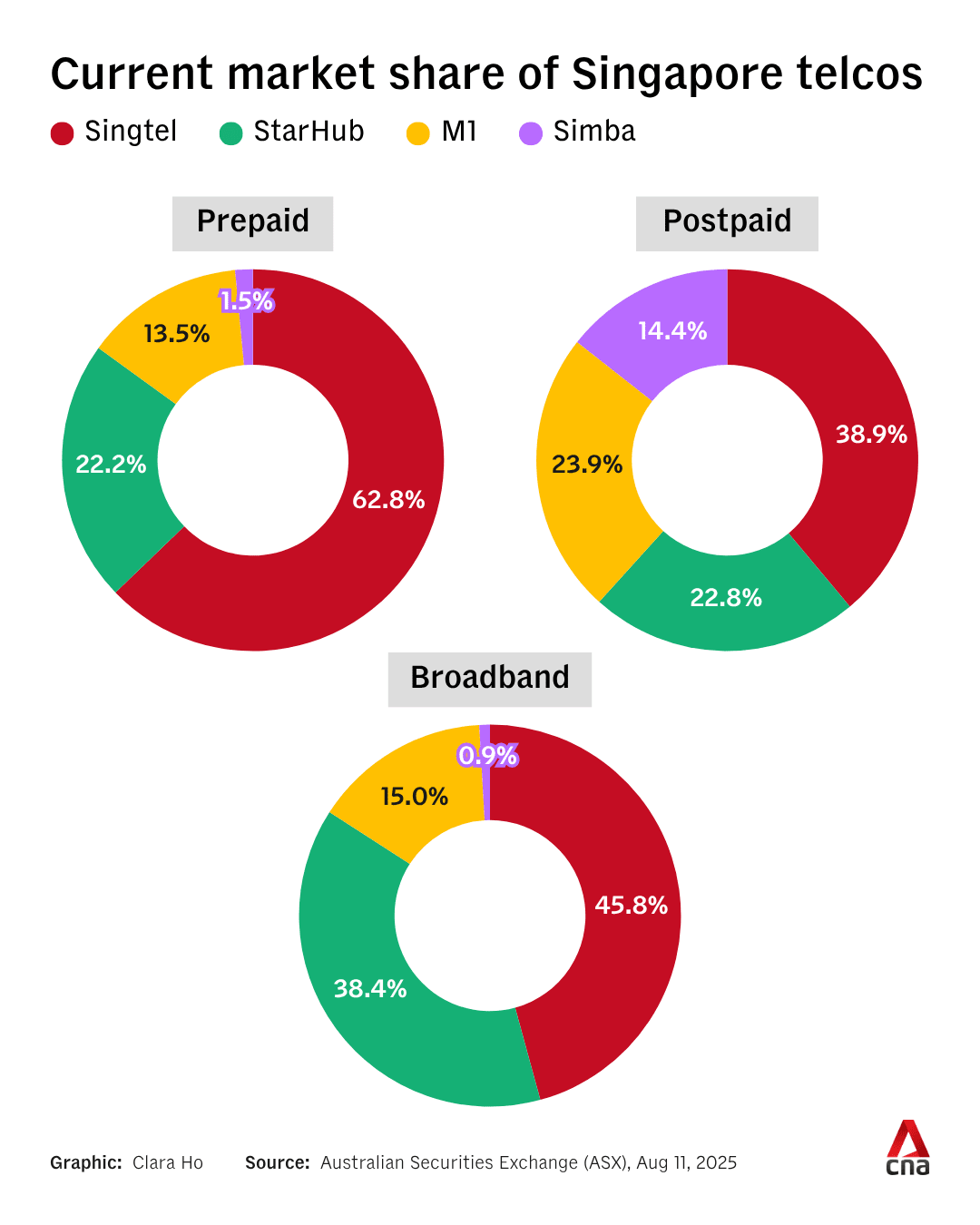

M1 currently has 13.5 per cent of Singapore’s prepaid mobile market, 23.9 per cent of the postpaid mobile market and 15 per cent of the broadband market, according to a regulatory filing on the Australian Securities Exchange by Simba’s owner Tuas.

The company made significant inroads in its first two decades of service.

In 2005, M1 launched consumer 3G services – the first operator in Singapore to do so. That same year, Malaysian telecommunications conglomerate Axiata bought a 12.1 per cent stake in the company for S$260.8 million.

Over the next few years, it became the first in Singapore to launch an islandwide wireless broadband service as well as Southeast Asia's first 4G network.

M1 shares hit a high of S$3.99 in March 2015, but competition was never far away.

StarHub entered the market in 2000 as Singapore's third telco. It was followed in 2016 by TPG Singapore, which would become Simba.

The country also opened up to mobile virtual network operators (MVNOs).

The competition took its toll, and a year later, M1 shares had almost halved in value. Reuters reported that M1's shareholders – SPH, Keppel and Axiata – had approached China Mobile to sell their majority stake.

More reports emerged that Chinese companies Shanxi Meijin Energy and China Broadband Capital were preparing to make separate bids for M1.

None of those deals materialised.

BUYOUT AND DELISTING

By September 2018, M1’s share price had dropped by almost 60 per cent since its high in 2015.

That same month, Keppel and SPH offered to buy shares they did not already own in M1. The companies said then the move was to “arrest the decline in M1 shareholder value through a combination of transformational efforts which are expected to take several years”.

The deal would allow M1 to cooperate further with other Keppel units and allow SPH to provide digital content through M1’s mobile platform, the companies said. At that point, the companies valued the telco at S$1.9 billion.

In December, Keppel and SPH announced their “firm intention” to make a voluntary general offer.

By January 2019, the two companies launched an offer to buy out majority shareholder Axiata and gain control of M1. That offer was accepted the following month and Axiata sold its 28.7 per cent stake.

It meant Keppel and SPH collectively owned 90.15 per cent of M1’s shares.

To be listed on the stock exchange, the total number of shares in a company that is issued to the public must be at least 10 per cent. With M1 no longer meeting this requirement, it was delisted from the SGX in April 2019.

In 2020, a joint venture between M1 and Starhub won the rights to build Singapore's two nationwide 5G networks. The other telco was Singtel.

SALE

In its announcement on Monday, Keppel said it would receive S$1 billion in cash proceeds for its stake in M1.

Keppel will retain the information and communications technology business, including data centres and subsea cables.

The company said it hopes to complete the proposed sale "over the next few months", adding that Simba had submitted the strongest bid among interested parties.

Simba is wholly owned by Australia-listed Tuas. In a separate statement, Tuas said it is looking to raise at least A$416 million (US$271 million) through a placement and share purchase plan.

The deal is subject to regulatory approval by Singapore's Infocomm Media Development Authority (IMDA). Its considerations include ensuring there is "no significant lessening" of competition.