Global chip industry has gone from shortage to slump, but things will improve: Micron chief

Mr Sanjay Mehrotra’s comments come as the industry moves to cushion the impact of the global chip slump by slashing capital spending and output, amid fears that it is close to a bottom.

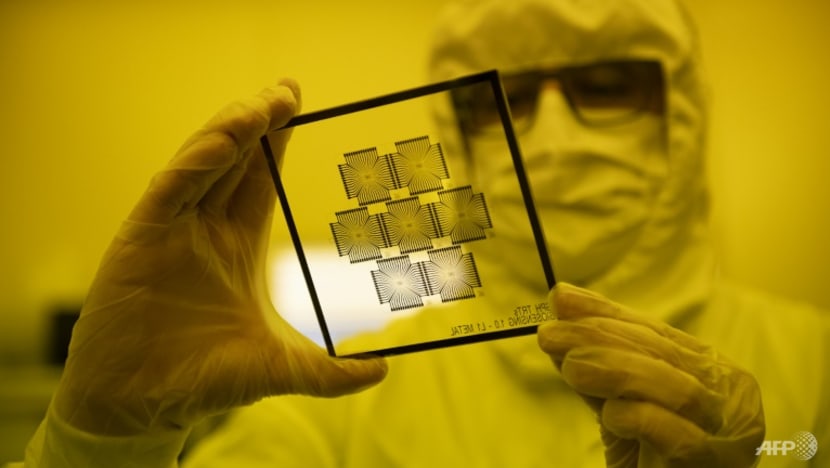

The tech industry has suffered from a shortage of components for chipmaking, blamed on a boom in global demand for electronic products and pandemic snarled supply chains. (Photo: AFP/File/Josep Lago)

SINGAPORE: The global chip industry is going through a downturn, but what remains important is that the demand for memory and storage continues to rise in the longer term, according to the head of a global tech giant.

The industry has been impacted by factors like lockdowns in China, the Russian invasion of Ukraine, and global high inflation, noted Mr Sanjay Mehrotra, chief executive of Micron on Tuesday (Nov 22).

“The main driver of the downturn in the memory industry right now is that our customers are adjusting inventories toward a more normalised level, and this is reducing the demand,” he told CNA’s Asia First.

The resulting imbalance between demand and supply is affecting the pricing environment in the industry, he added.

It typically takes about six months for customer inventories to get normalised, he said, adding that macroeconomic factors will also affect the pace at which it happens.

This is a U-turn in the situation over the last three years of the COVID-19 pandemic, when customers built “high levels of inventory” in response to the recent semiconductor supply chain shortage.

Mr Mehrotra’s comments come as the industry moves to cushion the impact of the global chip slump by slashing capital spending and output, amid fears that it is close to a bottom.

Micron, which was the first major chip maker to sound the alarm about falling demand for PCs and smartphones, will reduce chip production by about 20 per cent and has also put a hiring freeze in place. In the same vein, Taiwanese chipmaker TSMC has cut its annual investment budget for this year by at least 10 per cent, while South Korea's SK Hynix, whose clients include Apple, slashed investment for next year by half.

RECENT GLOBAL CHIP SHORTAGE

The situation is a vast contrast from just a year ago, when the demand for chips surged amid tight supply, causing an abrupt shortage.

Among the factors that fuelled the increase at the time was a shift to working from home during the pandemic, as the workforce bought laptops, webcams and monitors. Carmakers who cut back drastically early in the pandemic added to the demand after an unexpected quick rebound in car sales left them scrambling for chips.

Related:

This was coupled with the supply crunch caused by Chinese smartphone maker Huawei Technologies rushing to build its inventory to survive US sanctions.

The global shortage brought car production to a standstill and delayed consumer electronics product launches. Broadband providers also faced months-long delays for Internet routers.

The industry started seeing signs of easing in in the middle of this year and now faces low demand amid a high supply.

LONG-TERM OUTLOOK

The ongoing imbalance between demand and supply is only in the near-term, said Mr Mehrotra.

“From a long-term perspective, the key enablers for the trends today are AI, connectivity, smart cities, smart homes, and of course, autonomous - all of these require more and more data insights, so long-term trends are intact,” he said.

He noted that the industry goes through cycles of demand.

“What's important is that the demand for memory and storage continues to increase across cycles,” he said, adding that Micron is “well-positioned” to emerge stronger on the other side of the downturn.

Micron’s Singapore office, which has about 10,000 employees, is the centre of the firm’s manufacturing for NAND Flash, a type of storage technology found in devices like memory cards, USB flash drives and smartphones, Mr Mehrotra noted.

Singapore continues to be a strong contributor to the opportunities ahead for his firm, he added.

“As the inventories at our customers and … suppliers get restored toward the normal levels, then the industry trajectory of demand growth as well as healthier profitability will resume,” he said.