All OCBC banking services restored after morning outage

"We would like to assure our customers that no customer data has been compromised and that their monies remain safe," said OCBC.

A screengrab of OCBC's website.

SINGAPORE: OCBC banking services have been fully restored after a morning outage on Monday (Aug 28) due to a "technical problem".

The affected services include its internet and mobile banking platforms, PayNow, ATMs, cards and Velocity, the bank's digital business banking platform.

An OCBC spokesperson said that banking channels were hit by a technical problem at 8.33am, affecting consumer and business banking customers.

In an update at about 12.20pm, the bank said all banking services had been restored.

"Our customers can perform banking transactions at our branches, ATMs, internet and mobile banking platforms, and Velocity. Cards services have also been restored," the spokesperson said, adding that the bank is investigating the cause of the "technical problem".

"We would like to assure our customers that no customer data has been compromised and that their monies remain safe."

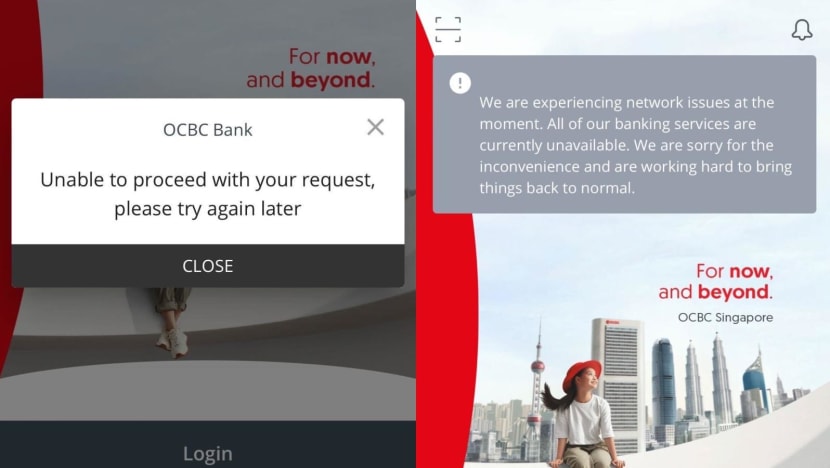

An announcement on OCBC's website earlier on Monday stated that all banking services were affected.

"We are experiencing network issues at the moment. All of our banking services are down," said OCBC.

According to updates from the bank on Facebook, card and branch services were restored at about 10.30am, while ATM services were back up at about 10.40am.

In response to CNA's queries, OCBC said at about 10.50am that customers could still visit its six branches that were currently open.

"The other branches will be opened at 11am. We are on standby to deploy additional resources at branches and extend branch banking hours to support our customers," said the spokesperson.

Commenting on OCBC's Facebook post, some customers noted that their credit card payments were declined and that they were unable to withdraw cash.

One customer said that her payment for an online doctor consultation could not go through.

Another said: "Have breakfast with a client, used credit card and then ATM card to pay bills, all declined."

Several also said that it was embarrassing for them when their credit card transactions were declined.

The Monetary Authority of Singapore (MAS) said it is following up with OCBC on the root cause of the incident and will take supervisory actions as needed.

In May, DBS online banking and payment services were disrupted for the second time in less than two months, with preliminary investigations linking the cause to human error.

In the wake of the two service disruptions, MAS imposed an additional capital requirement on Singapore's largest lender.

The bank will now need to apply a multiplier of 1.8 times to its risk-weighted assets for operational risk, bringing its total additional regulatory capital to approximately S$1.6 billion (US$1.2 billion).

This is up from the multiplier of 1.5 times - translating to S$930 million - imposed by MAS in February 2022 after DBS was also hit by a major, two-day disruption in November 2021.