At least S$8.5 million lost in December to phishing scams involving OCBC Bank

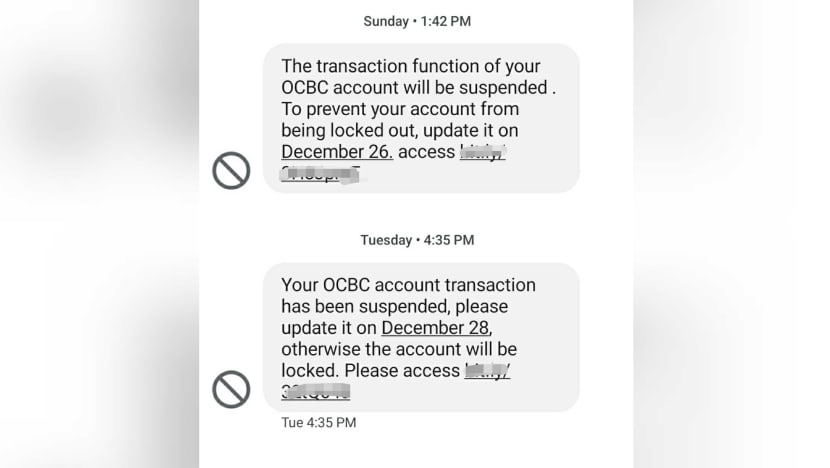

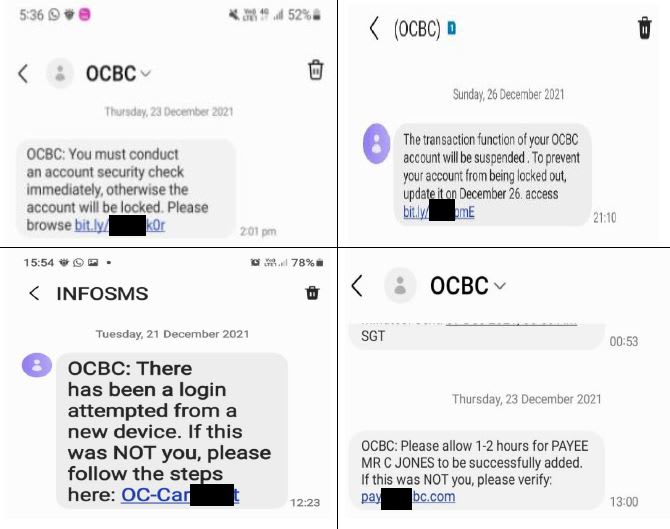

Screengrab of phishing scam messages impersonating OCBC, Dec 2021.

SINGAPORE: At least S$8.5 million were lost in phishing scams involving SMSes impersonating OCBC Bank in December, said the Singapore Police Force (SPF) on Thursday (Dec 30).

In a news release, the police said at least 469 victims have fallen prey to such scams since Dec 1, with most of the money lost in the past two weeks.

According to SPF, victims would receive unsolicited SMSes claiming that there were issues with their banking accounts, asking them to click on a link to resolve the issue.

Upon clicking, victims would be redirected to fake bank websites and asked to key in their iBanking account login details.

They would find out they had been scammed when they received notifications informing them of unauthorised transactions charged to their bank accounts.

It is "challenging and difficult" to recover the funds once they have been "fraudulently transferred out of the victim's bank account", said the police.

"OCBC Bank has warned its customers about the phishing SMSes using several different channels including its online banking platforms, social media page and media advisory," the police added.

Members of the public are advised not to click on "dubious" URL links provided in unsolicited text messages. OCBC will not send SMSes containing Bitly links, said SPF.

"Always verify the authenticity of the information with the official website or sources. Never disclose your personal or Internet banking details and one-time password to anyone.

"Report any fraudulent transactions to your bank immediately," it added.

OCBC WARNS OF "POTENTIAL SURGE" OF SCAMS

OCBC on Thursday warned customers about the scams "given the potential surge in attacks this New Year weekend".

Between Dec 8 and Dec 17, 26 customers reported a loss of about S$140,000 to phishing scams, said the bank in a media advisory sent to CNA.

"However, scammers’ phishing attacks have become particularly aggressive in recent weeks, especially during the Christmas weekend," it added.

From Dec 24 to Dec 26, there were 186 customers affected, with about US$2.7 million lost.

"Once the funds have left the customer’s account, the possibility of recovery is very low," said OCBC.

"They often reroute the monies through various accounts, making it difficult to track their movement and even harder to recover the cash."