Police freeze 121 local bank accounts linked to OCBC scam; about S$2 million recovered

SINGAPORE: Singapore police have frozen 121 local bank accounts as of Feb 13 (Sunday) amid ongoing investigations into a recent SMS phishing scam targeting OCBC bank customers, while recovering about S$2 million of victims’ money.

In addition, about S$2.2 million has been traced to 89 overseas bank accounts, said Minister of State for Home Affairs Desmond Tan on Tuesday.

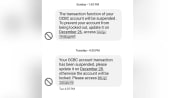

Mr Tan was giving a ministerial statement on Singapore’s anti-scam strategy after nearly 800 OCBC customers lost a combined S$13.7 million to scammers impersonating the bank via SMS phishing.

Responding to questions from Members of Parliament, he noted that the police have found at least 107 local and 171 overseas IP addresses linked to the unauthorised access of victims’ Internet banking accounts.

Many of the scam websites used in the phishing scam were hosted by companies based overseas, he added.

Police are investigating the local IP addresses linked to the scam and the owners of the local money mule accounts.

They are also working with Interpol and foreign law enforcement agencies to investigate the beneficiaries of the funds transferred overseas, as well as the hosts of these scam websites, said Mr Tan.

SCAMS ON THE RISE

The SMS phishing scam involving OCBC came amid a rise in the number of scams reported in Singapore.

Last year, 23,931 scam cases were reported, including 5,020 phishing scams.

These figures mark a four-fold increase from 2017 – when there were 5,147 cases of scams reported, with 16 being phishing scams, said Mr Tan, who also chairs the Inter-Ministry Committee on Scams.

Specifically on phishing scams involving SMSes impersonating banks, there were no such cases reported in 2017.

They started emerging in 2018 with 91 cases, followed by 57 cases in 2019 and 149 cases in 2020. This surged further to 1,021 last year.

Responding to another parliamentary question, Mr Tan noted that card fraud cases reported by major credit card issuers in Singapore formed less than 0.1 per cent of total credit card transactions last year.

The Monetary Authority of Singapore (MAS) and the Singapore Police Force (SPF) do not track the percentage of funds recovered for these unauthorised credit card transactions, he added.

NEW ANTI-SCAM COMMAND AND USING TECH

To better combat scams, the police will form an Anti-Scam Command this year to consolidate expertise in scams across all SPF land units, thereby improving its coordination of anti-scam enforcement and investigations.

The new command, said Mr Tan, will also oversee the newly formed Scam Strike Teams in the seven police land divisions.

At the moment, the police already have an Anti-Scam Centre (ASC) which was set up in 2019 as a specialised unit focused on anti-scam interventions and enforcement.

Last year, the ASC conducted 26 islandwide anti-scam operations and arrested about 7,500 money mules and scammers.

The unit has also frozen about 24,000 bank accounts suspected of being involved in scam activities since 2019, while recovering nearly S$160 million in scam proceeds.

Mr Tan pointed out that the recovery of money lost to scams is “very difficult”.

“Where we have been able to, it involved close partnerships with financial institutions, particularly by having a DBS staff co-located with SPF at the ASC to provide swifter and real-time coordination and intervention.”

As such, the ASC and MAS are working with more banks to co-locate their staff at the ASC so as to enhance the centre’s capabilities to freeze accounts and trace the flow of funds, he told the House.

The ASC also taps on technology, for instance, in automating manual work processes so that police resources can be focused on critical investigations and enforcement work.

RAMPING UP PUBLIC EDUCATION

But enforcement by itself is not sufficient, said Mr Tan, adding that the “best defence” against scammers is “a discerning public”.

The Government has been working on this, such as by rolling out an anti-scam public education campaign “Spot the Signs. Stop the Crimes”.

“As part of this campaign, we have disseminated materials advising the public on scam prevention tips, such as never to share one-time-passwords or your OTPs, with unverified parties and to be aware of requests for gift cards or online credits,” he said.

Authorities have also rolled out prevention initiatives targeted at specific segments of the population.

While scam victims are of a wide range of ages, Mr Tan noted that different profiles of victim fall prey to different types of scams.

For instance, young adults between 20 and 39 years old have formed the largest group of victims when it comes to phishing scams, job scams, e-commerce scams, investment scams, loan scams, China official impersonation scams and fake gambling platform scams.

For social media impersonation scams, Internet love scams and fake-friend call scams, adults between 40 and 59 years old were the most vulnerable.

In his speech, Mr Tan also urged more people to download the ScamShield app developed by the National Crime Prevention Council and the Government Technology Agency.

The app identifies and filters out scam messages using artificial intelligence, sending them to the phone’s junk folder. It also blocks scam calls from phone numbers used in other scam cases or reported by ScamShield users.

Since its launch in November 2020, the app, which is currently only available for iOS devices, has been downloaded about 257,000 times, Mr Tan said.

About 3.7 million SMSes and calls have been picked up as potential scams by the in-app algorithm and reports from users. Nearly 15,500 phone numbers have also been blocked.

Specifically on the OCBC scam, ScamShield picked up and filtered about 2,000 scam messages.

“Unfortunately, a lot more scam messages managed to reach the SMS inboxes of ScamShield users mainly because they appeared in the same thread as legitimate messages,” said Mr Tan.

To address this gap, Communications and Information Minister Josephine Teo said in her ministerial statement that authorities are considering requiring all users of alphanumeric IDs to be registered in a pilot SMS sender ID protection registry, among others.

Authorities are also working towards developing and releasing the Android version of ScamShield in the “next few months”, Mr Tan said.

Editor's note: Following an update by MHA, this article has been updated to correct the number of SMSes and calls that have been picked up as potential scams by the in-app algorithm and reports from users.