OCBC begins making ‘goodwill payouts’ to scam victims, says response fell short of expectations

People walk past OCBC Bank during lunch break at the Raffles Place financial business district in Singapore on Sep 14, 2021. (Photo: AFP/Roslan Rahman)

SINGAPORE: OCBC said on Monday (Jan 17) that it has begun making “goodwill payouts” to customers who had fallen prey to recent phishing scams involving the bank.

"The payouts to this group of customers are made on goodwill basis after thorough verification, taking into account the circumstances of each case," the bank said in a media release.

"Customers started receiving the goodwill payouts from Jan 8, 2022, and to date, more than 30 customers have received them."

OCBC did not specify the size of the payouts or whether affected customers would receive full compensation for the amount they lost. CNA has contacted the bank for more information.

According to the police, at least 469 people had fallen victim to the SMS phishing scams involving OCBC in December. The victims reportedly lost at least S$8.5 million in total.

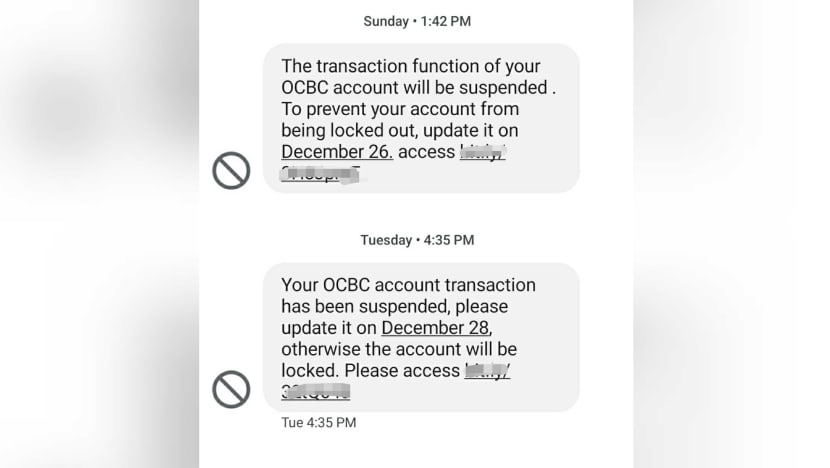

Victims would receive unsolicited SMSes claiming that there were issues with their banking accounts, asking them to click on a link to resolve the issue.

They would then be redirected to a fake website that mirrored OCBC's and asked to key in their ibanking account login details. Victims discovered that they had been scammed when they received notifications informing them of unauthorised transactions charged to their bank accounts.

Calling it a "particularly aggressive and highly coordinated" scam, OCBC said its investigation confirmed that victims had provided their online banking log-in credentials to the phishing websites. Thereafter, the scammers were "very fast" in fraudulently transferring the monies out of the customers' bank accounts.

The lender acknowledged that its customer service and response had fallen short of customers’ expectations, especially at a time of stress and anxiety.

It added that it has since set up a dedicated support team for the victims and has reached out to those affected to address their concerns.

“We strongly condemn this scam as it preyed on consumers’ fear and was a highly-coordinated one. We fully understand the concerns and anxiety of our affected customers," said OCBC’s group chief executive officer Helen Wong.

"We have begun making goodwill payouts since Jan 8, 2022. I sincerely ask our customers to allow us the time to conduct a thorough review and validation before we inform them of the payouts."

As investigations are complex and extensive involving multiple checks and parties, the bank said it needed more time to get back to affected customers to address their concerns.

"We seek our customers’ patience and understanding as investigations are complex, and we apologise that our response fell short of our customers’ expectations during their time of distress," Ms Wong said.

Affected customers will be contacted as soon as the review and validation of their case are complete, the bank added.

In a separate statement, the Monetary Authority of Singapore (MAS) said it "expects all affected customers to be treated fairly".

It added that it takes "a serious view" of the recent phishing scams involving the bank and has been following up with OCBC on it and broader issues relating to the incident.

"OCBC will conduct a thorough probe to identify the deficiencies in their processes and implement the necessary remedial measures. MAS will consider appropriate supervisory actions following this review," MAS' deputy managing director for financial supervision Ho Hern Shin said in the statement.

Turning to concerns about the bank’s systems, Ms Wong from OCBC stressed that OCBC's banking systems and digital banking platforms are "safe and secure".

Digital banking remains a convenient way to do banking but scammers are also increasing in sophistication, she said.

"Therefore, I urge everyone to stay alert and do your banking only at the bank’s official websites and on the official mobile apps. Together with the Association of Banks in Singapore and the Monetary Authority of Singapore, the industry will review to further strengthen the anti-fraud detection and prevention measures," added the group CEO.