Singapore’s pharmaceutical sector faces uncertainty after new US 100% tariffs

Industry players say they are monitoring the situation, and at least one company told CNA that it is concerned about knock-on effects.

An employee checks readings at a laboratory in a pharmaceutical manufacturing factory in Singapore on Apr 17, 2017. (File photo: Reuters/Edgar Su)

This audio is generated by an AI tool.

SINGAPORE: The impact of the United States’ new pharmaceutical tariffs on Singapore remains uncertain, experts and companies told CNA.

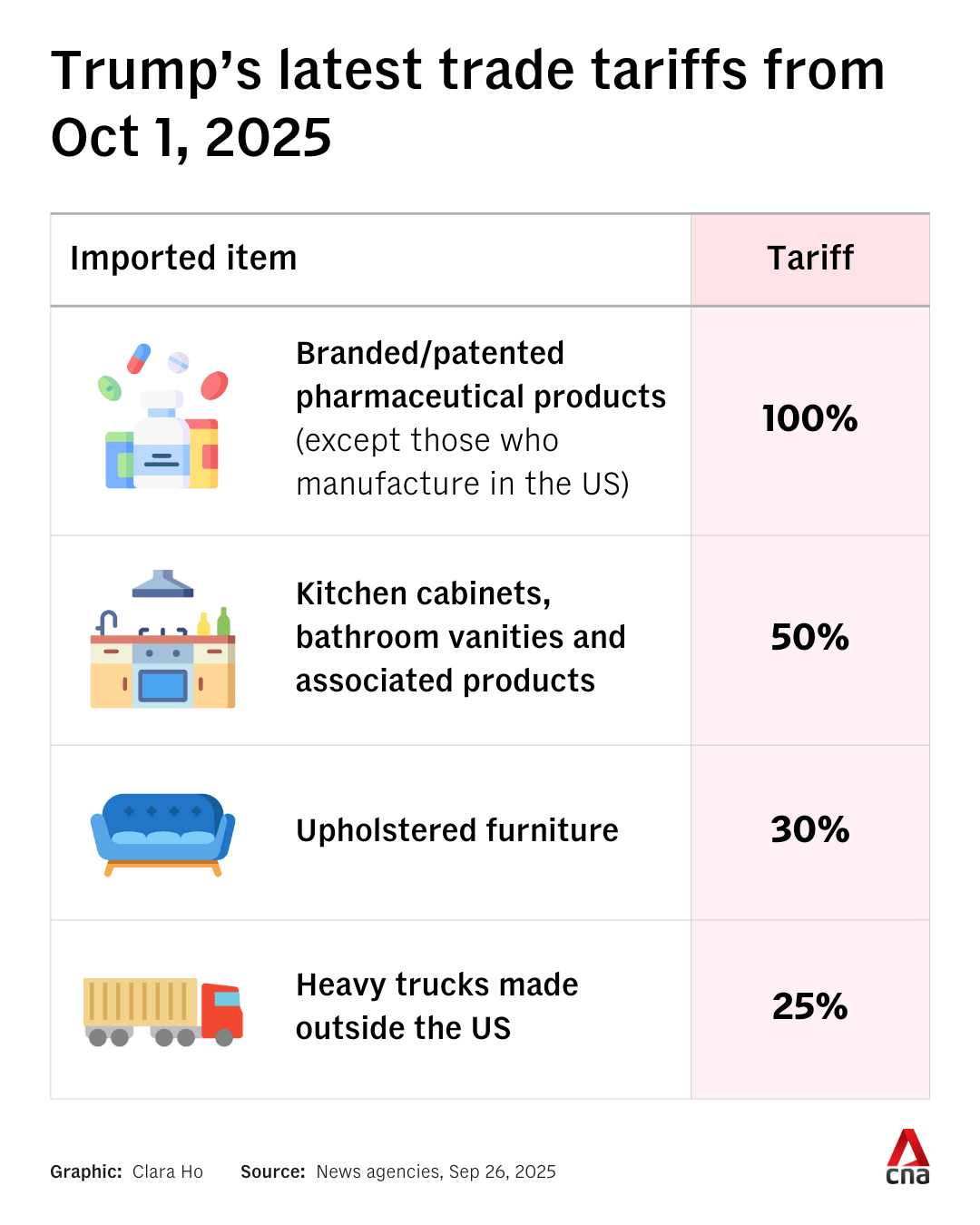

US President Donald Trump announced on Thursday (Sep 25) that a new 100 per cent tariff on any “branded or patented” pharmaceutical products will take effect from Oct 1 - unless a company is building a manufacturing plant in the US.

Industry players in Singapore said that they are monitoring the situation, and at least one company told CNA that it is concerned about knock-on effects.

Medical research organisation Hilleman Laboratories said it does not expect a direct impact on its Singapore operations, but flagged the possibility of ripple effects.

“While we don’t expect immediate direct effects, the interconnected nature of global supply chains means we remain vigilant about possible knock-on impacts,” it said.

There is a risk that higher costs due to tariffs could affect affordability and access challenges, particularly for vulnerable populations, it added.

When asked about the challenges in navigating the changes to tariff policies, Hilleman Laboratories said: “The main challenge is uncertainty.

“Shifts in trade policy can affect timelines, sourcing, and partnerships. Our role is to anticipate these changes while staying firmly on track with our scientific and public health commitments.”

Biotechnology company BioNTech told CNA it was “monitoring the situation closely”, although it noted it has manufacturing sites in the US.

“Together with our partner Pfizer we have manufacturing sites in the US and Europe for our COVID-19 vaccine,” BioNTech said. Pfizer is responsible for the commercialisation of BioNTech’s COVID-19 vaccine in the US.

Pharmaceutical giant GSK told CNA it is "engaging constructively" with the US administration.

IMPACT ON SINGAPORE

US tariffs on pharmaceutical imports threaten a key part of Singapore’s exports - pharmaceuticals make up about 13 per cent of the country’s exports to the US.

Last year, Singapore was the fourth-biggest exporter of pharmaceutical goods to the US, according to data from the Observatory of Economic Complexity.

Experts said the impact of the tariffs on Singapore is still unclear, depending on the specifics of the policy, which have yet to be announced.

Associate Professor Wee Hwee Lin from the National University of Singapore (NUS) said the impact on Singapore’s pharmaceutical industry may be limited.

“It is difficult to assess at the moment, but I anticipate that there will be minimal effect as the manufacturing facilities in Singapore mostly produce active pharmaceutical ingredients and not the final product,” she said.

She added that she was “not surprised” by the US announcement as there had been “earlier signals” by Mr Trump.

Dr Deborah Elms, head of trade policy at philanthropic organisation Hinrich Foundation, warned that even within one company, different products may or may not be subject to the tariff.

“I think it's a little unclear … because you'll need to look at not just which products are imported from abroad that are branded, not generics, but also (whether) those firms are producing products domestically,” she said.

“Even if it's not the same product, it's a little unclear. So if I make product ‘A’ domestically, but not product ‘B’, can I just declare my full line of pharmaceuticals is therefore exempt from this tariff?”

Dr Elms also noted that even if companies started construction in the US to declare themselves exempt from the tariffs, it would not actually solve the problem.

“At any point, Trump in the future could say, actually your facility isn't producing drugs yet, or it isn't producing enough drugs, and therefore … you are now required to pay these tariffs at 100 per cent, potentially more,” she said.

“And so the uncertainty for the sector, and in fact, for all products being sent to the US continues.”

For Singapore, Dr Elms said the tariffs could be a problem as the country is increasingly looking to pharmaceutical manufacturing as a key export, and the US is an important market.

Deputy Prime Minister Gan Kim Yong on Saturday said the tariffs may not have an immediate impact on exports for pharmaceutical companies in Singapore, given that most already have plans to invest in the US.

He added that most of the country’s pharmaceutical exports to the US are primarily patented and branded products.

Branded or patented pharmaceutical products refer to drugs sold under brand names that are protected by patents. When the patent expires, generic versions of the drug may then be sold by other companies.

Dr Elms noted that no tariffs had been implemented on generic products because of the thin margins of these drugs.

A 100 per cent duty on generic drugs would be “unviable” and result in no sales to the US, putting many patients there at risk, she said.

The Singapore Association of Pharmaceutical Industries said it is closely monitoring developments.

"While details are still emerging, we remain committed to working with the Ministry of Health and other stakeholders to help ensure continued access to innovative medicines and vaccines for patients in Singapore," it told CNA.

WILL DRUG PRICES INCREASE?

How drug prices move will depend on changes, if any, to the US tax regime, said Assoc Prof Wee.

“Pharmaceutical companies move their manufacturing facilities to countries such as Ireland because of the attractive corporate tax structure,” she said.

“Prices may go up if they are forced to relocate the manufacturing facilities back to the US, unless there are changes to the corporate tax structure in the US.”

Dr Elms similarly noted that companies may need to isolate production of certain products in some locations due to quality requirements of pharmaceutical manufacturing facilities.

“This potentially upends a lot of that and requires firms to make less than optimal decisions about where they're going to manufacture products,” she said.