Half a million dollars lost to scammers spoofing bank hotlines on Google ads: Police

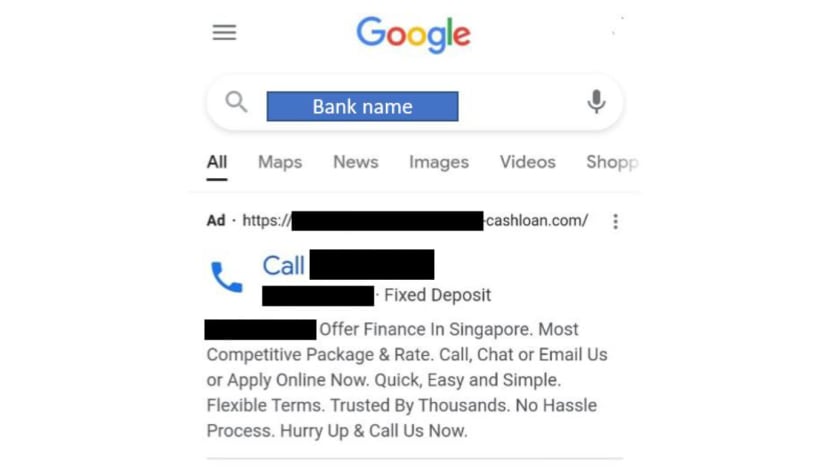

A screenshot of an advertisement posted by scammers on Google Search. (Image: Singapore Police Force)

SINGAPORE: A new scam that tricks victims into calling fake bank hotlines found in advertisements on Google searches has resulted in losses amounting to at least S$495,000, the police said on Wednesday (Jan 19).

At least 15 people have fallen prey to this new scam variant since December 2021, the police added.

Google is working closely with the Singapore police to identify these advertisements and take them down.

HOW THE SCAM WORKS

The ploy starts with scammers posting advertisements on Google Searches, which turn up when a user searches for bank contact numbers.

These ads, which provide fake phone numbers, appear as the first few search results.

Believing these fake numbers to be genuine, the victims would call these numbers and speak to a scammer impersonating as bank staff.

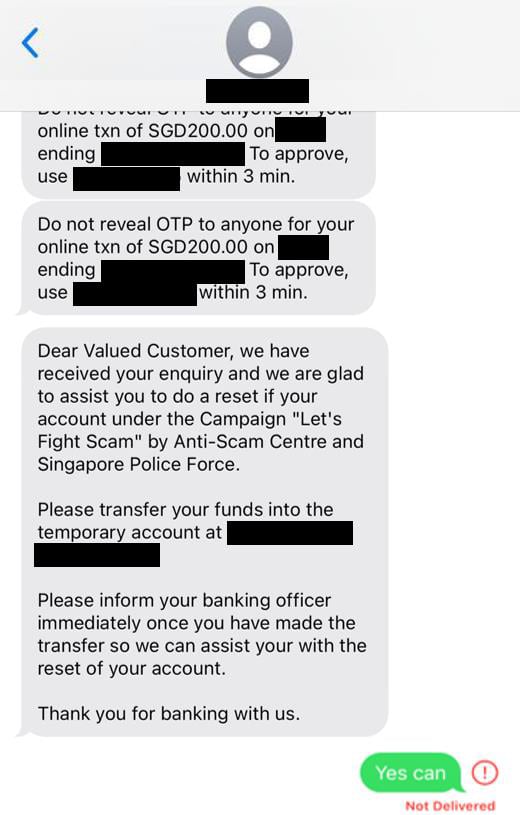

"After sharing the reasons for contacting the bank, victims would be informed that there were issues with their bank account, credit/debit cards or loan amount," said the police.

Following that, the scammer would instruct the victims to temporarily transfer the funds to bank accounts provided, under the pretext of resolving the bank account or credit/debit card issue or to make a payment for the outstanding loan.

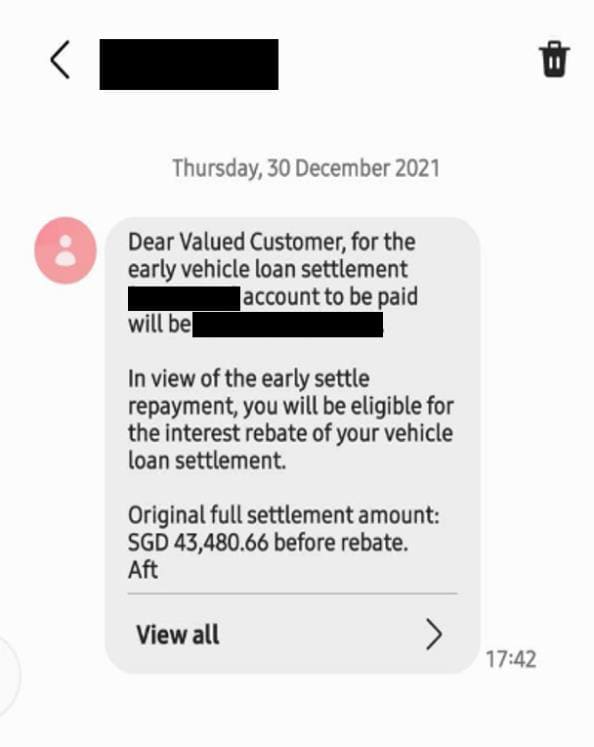

The police added: "In some cases, victims would receive an SMS with headers spoofing that of the bank to appear more authentic, claiming that the bank was facilitating a reset of the victims’ bank account as part of the 'Let’s Fight Scam' Campaign by the Anti-Scam Centre and Singapore Police Force, or would state that the victim needed to transfer money for early loan settlement."

Victims would realise that they had been scammed only after contacting the bank via the authentic hotline, or when the bank contacted victims to verify the reason for the large sum of money transferred.

In response to queries from CNA, a Google spokesperson said it is constantly working to ensure users’ advertisement experiences on its platforms are "safe".

"If we find advertisers who violate our policies or misrepresent themselves, we take quick action," the spokesperson said.

In 2021, Google launched advertiser identity verification in Singapore to provide more transparency and let users know who is advertising to them, and will continue scaling it to all advertisers across its platforms, the spokesperson added.

Under this policy, advertisers must verify their identities before running ads in Google Ads or Display & Video 360. Google is currently verifying advertisements in more than 100 regions and stating the advertiser name and location in its "About this ad" feature.

The police advised the members of the public to always verify the authenticity of the information with numbers listed on the official bank website or behind the cards issued by the banks.

People should never transfer funds into bank accounts belonging to an unknown person or disclose one's personal information, banking details and OTP to anyone, said the police. Any fraudulent transactions should be reported to the bank immediately.

Any information relating to such crimes can be reported to the police hotline at 1800-255-0000 or submitted online.

Members of the public can also visit www.scamalert.sg or call the anti-scam hotline at 1800-722-6688.