Enhanced QR payment scheme on trial with more scan-and-pay options for merchants and consumers

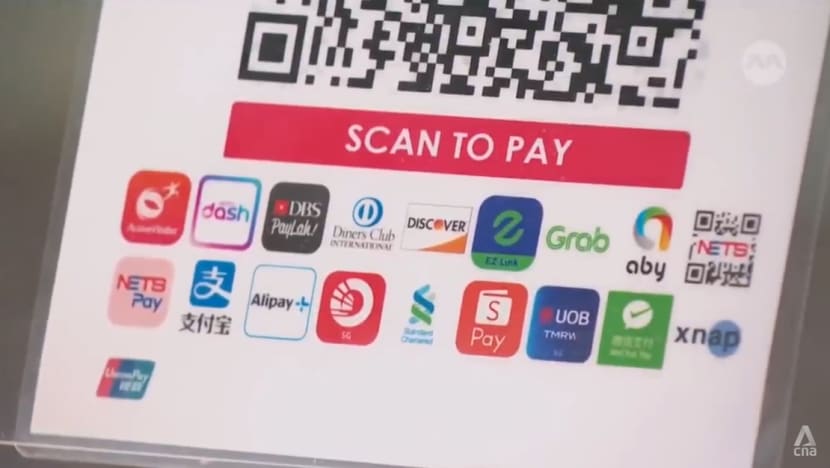

The Singapore Quick Response Code Scheme (SGQR+), an enhanced QR code payment system, will enable merchants to accept 23 payment methods by signing up with just one financial institution.

A customer makes a digital payment at a cashier.

This audio is generated by an AI tool.

SINGAPORE: Consumers in Singapore could soon have more digital payment options at stores by scanning a single QR code.

The Singapore Quick Response Code Scheme (SGQR+), an enhanced QR code payment system, will enable merchants to accept 23 payment methods by signing up with just one financial institution.

The upgraded scheme seeks to reduce the hassle of digital transactions for both merchants and shoppers.

The Monetary Authority of Singapore (MAS) kicked off the month-long SGQR+ trial on Wednesday (Nov 1) at more than 1,000 merchant acceptance points.

Participating stores are at districts 16 and 17, which comprises areas in Loyang, Bedok, Upper East Coast and Changi – including Jewel Changi Airport.

Merchants at the Singapore FinTech Festival (SFF), which will be held from Nov 15 to 17 at the Singapore Expo, will also be involved in the proof of concept.

MORE PAYMENT OPTIONS UNDER SGQR+

The central bank introduced the SGQR in 2018, which allows merchants to combine multiple payment QR codes into a single label.

However, consumers are limited by each merchant’s commercial relationship with different financial institutions that provide the various payment schemes.

One business taking part in the trial is fast food chain Arnold's Fried Chicken, whose customers only had about five payment options under the SGQR.

“There were instances when customers asked us if we have like FavePay or GrabPay, etc. But unfortunately, we didn’t have those payment options to extend to them,” said the eatery’s corporate service manager Mervyn Lee.

With the enhanced SGQR+, its patrons now have much more digital payment choices.

The MAS said in a press release: “SGQR+ will increase the number of payment methods that merchants can accept. Merchants will only need to sign up with a single financial institution to unlock a diverse range of local and cross-border payment schemes.”

The trial will involve 23 payment schemes, including local issuers Changi Pay, EZ-Link, GrabPay and NETS, as well as overseas issuers Google Pay and Visa. Alipay and WeChat from China, DuitNow from Malaysia and PromptPay from Thailand are also part of the test.

MAS said the availability of international payment options will allow tourists to transact conveniently using their native payment applications.

TWO PAYMENT PROVIDERS

Merchants participating in the trial can choose from two payment providers – Liquid Group and NETS.

The track led by Liquid Group, a local digital payment provider, operates a switch that processes payments between the financial institutions serving the merchants and those serving the consumers.

It will also allow consumers to scan and pay at participating merchants using their mobile applications that are linked to credit cards.

“It's a many-to-many framework, meaning connecting many users to many app merchants … the whole thing will be able to eventually create a more inclusive and scalable system in Singapore,” said Mr Jeremy Tan, CEO of Liquid Group.

The other option by electronic payment service provider NETS is an expansion of the payment system that some vendors already use under the government-subsidised Hawkers Go Digital programme.

“The real benefit is even today, when one wallet or one bank is not able to work for whatever reason, I can use another bank app or I can use another wallet that's on my phone to make that payment,” said Mr Lawrence Chan, group CEO of NETS.

“It gives opportunity for scale, where consumers have choice. Merchants can accommodate the consumers’ choice with this interoperability.”

The MAS hopes the continued improvement of the system can pave the way for Singapore to become a global leader in QR payments, and a potential QR payments hub.

“SGQR+ is a significant leap in interoperable QR payments,” said MAS chief fintech officer Sopnendu Mohanty.

“It will streamline payment acceptance for merchants and substantially increase the number of merchant acceptance points for both local and foreign consumers to use their preferred e-wallet or banking application.”

Results on whether the SGQR+ can be deployed on a larger scale is expected to be out in the first half of next year.