Singaporean family desperate after egg scam wipes out S$150,000 in life savings

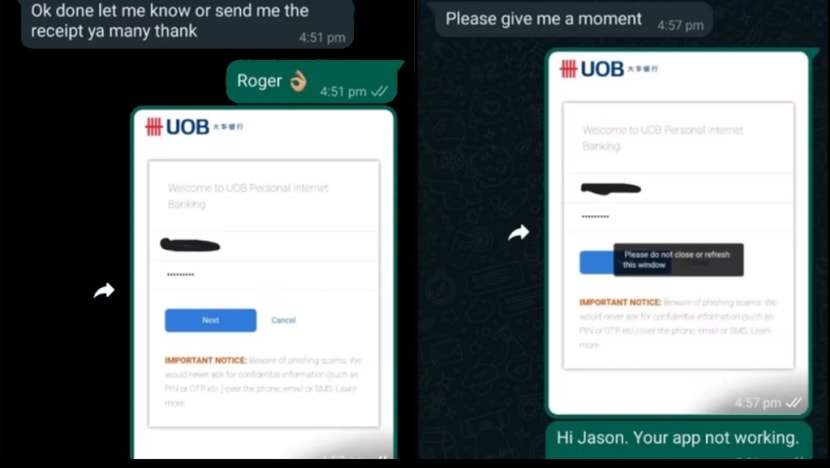

WhatsApp text conversations between Mr Singh and the egg "seller", with Mr Singh sending screenshots of a login page where he keyed in his bank details.

SINGAPORE — Near the end of every year, the Singh family sets up a Christmas tree dotted with presents for friends and relatives coming over to celebrate the festivities.

But for 2023, their Christmas tree stood in a corner of their flat, bereft of gifts.

Presents are the last thing on their minds, after the family of five tried to buy eggs online but fell victim to an e-commerce scam that wiped out more than S$150,000 (US$113,310) in life savings, spread across four bank accounts and a credit card.

That was the money that would have paid for the teenage children's university fees; their 81-year-old grandmother's medical expenses; their housing loan; and eventual retirement for Mr and Mrs Singh.

The family declined to be named in full, citing the need to protect themselves from further scams.

Their case is not unique. Malware scams, which involve victims downloading apps that infect their phones with malware, are on the rise in Singapore.

In the first half of 2023, there were more than 750 incidents of Android device users falling prey to such scams, amounting to at least S$10 million lost.

Banks have been rolling out dedicated security measures in response, but the evolving nature and technology behind the scams have proved challenging to tackle.

And the likes of Mr Singh, the 57-year-old head of the family, are paying the price.

"I couldn't believe it," the communications supervisor told CNA in an interview over the weekend, just two days shy of Christmas. "I'm very careful. And I tell my mum to be careful of scams happening everywhere.

"Can anyone imagine their life savings being completely wiped out in a single day?"

JUST WANTED TO BUY EGGS

The ordeal started on Nov 26, when Mr Singh's wife came across a Facebook advertisement selling organic eggs.

She decided to give it a try, and together with her husband clicked on an "order" button. The couple was directed to a WhatsApp chat with a "seller" who went by the name of Jason.

Jason assured them about the quality of the eggs and asked for a deposit to be placed via an app, with the remainder to be paid upon delivery. He then sent a link to download the app.

Mr Singh installed the app, used it to order 60 eggs, and was led to a payment page that looked strikingly similar to UOB's.

Mr Singh then keyed in the login details of his UOB account. The transaction failed.

He informed Jason of the problem and tried to cancel his order, but Jason insisted on proceeding with the delivery, which he claimed would be on the next day.

On Nov 27, Mr Singh received not eggs but a call from a UOB customer service officer, asking about a hefty credit card transaction which Mr Singh "vehemently denied".

He checked his bank accounts with both UOB and DBS and found, to his horror, that all of his funds had been depleted.

"When (I saw) zero, zero, zero I think I went into a state of shock. Like I became a zombie. I didn't know what to do," said Mr Singh.

"I immediately contacted my wife ... and said that we have been scammed," Mr Singh recalled. "We were trembling when we were at the police station and my wife broke down and she still breaks down."

The Singapore Police Force confirmed to CNA that a report was lodged and that investigations are ongoing.

The Singhs have also reached out to the banks involved.

His UOB account had logged a series of outgoing S$15,000 transactions, while nearly S$30,000 was siphoned from his DBS one.

Mr Singh said he did not receive any notifications, alerts or one-time passwords to permit the transactions - even though he usually received these for transactions involving much smaller amounts.

He has several questions, including why the scammers were able to access his credit card details - which he did not disclose - as well as other bank accounts.

"The banks should take responsibility, at least partial responsibility," Mr Singh added. "I'm not the one who went down and withdrew the money and gave it to the scammer ... I wasn't even aware this thing was happening."

He said he had trusted the banks to safeguard his money, and that they should have recognised and stopped the fraudulent transactions.

Responding to CNA's queries, both UOB and DBS said they were aware of Mr Singh's case and were in contact with him.

"Protecting our customers is a priority to UOB. With an increasing number of scam cases reported in Singapore, UOB has progressively introduced various security controls and measures to combat this scourge," a UOB spokesperson said.

"That said, our customers remain the singular most effective defence and we strongly urge them to exercise vigilance and caution in this ever-evolving threat landscape."

DBS said it assesses the circumstances of victims and offers goodwill payouts on a case-by-case basis.

"Beyond financial assistance, we also partner with counselling centres to offer counselling services to victims who may need emotional support," a spokesperson said.

She cited examples of measures DBS customers can take to secure their funds.

DigiVault, launched last month, lets customers lock up their money in an account from which funds cannot be digitally transferred out. Customers need to personally visit a branch - where their identity will be verified - before they can access funds. CNA

For more reports like this, visit cna.asia.