Social service groups face continued challenges in detecting, addressing rising financial abuse cases in Singapore

Examples of financial abuse cases include adult children forcing their parents to monetise assets for their benefit, and withdrawing money from their parents’ bank accounts without their knowledge.

SINGAPORE: Some social service agencies in Singapore have seen a jump of over 50 per cent in the number of financial abuse cases over the past three years.

Such incidents are getting tougher to detect and even harder to recover from, as the definition of financial abuse differs from case to case, they told CNA.

Financial abuse generally refers to cases where one party withholds and controls the financial resources and cash flow in the household.

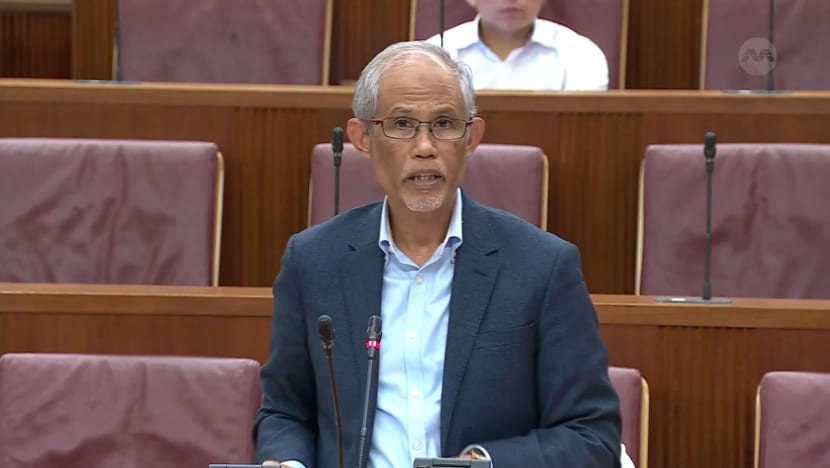

“Financial abuse is an emerging issue, and MSF (Ministry of Social and Family Development) is concerned with its potential negative effects on victim-survivors and the wider community,” Minister for Social and Family Development Masagos Zulkifli said in a written parliamentary reply last month.

He explained that the perpetrator is often an immediate family member of the victim-survivor.

Examples of cases include adult children forcing their parents to monetise assets for their benefit, and withdrawing money from their parents’ bank accounts without their knowledge, said Mr Masagos.

“Some cases also allegedly involved the use of violence, which caused physical harm or distress to the victim-survivor,” he added.

HARD TO IDENTIFY

A former victim of financial abuse, who only wanted to be known as Bayu, told CNA that her ex-husband did not let her get a job and would only give her an allowance to support their children.

Her personal funds and the family’s finances were all controlled by him, she added.

It was only seven months into the marriage that she reassessed her situation and confronted him. He then told her she could buy things for herself, but had to seek his permission.

However, any attempt to buy something was usually met with threats, and this went on for more than a decade, said the 41-year-old.

"At the beginning, I only wanted one thing – to seek a divorce. But to seek a divorce, there’s like so many things that I have to do,” said Bayu.

“At that moment, I had no money, I had zero money, I had zero cash, I had no investment, nothing. So from that moment, I felt that whatever I wanted to do (or) to achieve the things that I wanted to do, I couldn’t, because he would not allow me to stay in the house if I insisted that I wanted to get a divorce.”

Her situation was made even tougher as she had to care for her two children.

The couple, who got married in 2005, applied for divorce in 2016 and proceedings were later finalised in 2019.

Such cases of financial abuse are getting more common, said Ms Lorraine Lim, deputy CEO of the Singapore Council of Women’s Organisations.

“It often starts off very subtly, like most forms of domestic violence, whether it's physical or emotional,” said Ms Lim.

“It's (also) hard to identify, because financial abuse sometimes may not come with any physical abuse, so they may not see that they are being abused."

DIFFERENT EXPERIENCES OF ABUSE

Adding to the complexity is the fact that people of different age groups could also experience financial abuse differently.

Seniors, for instance, could face a situation where their adult children withdraw money from their parents' bank accounts without their knowledge nor approval.

"We have seen a group where it is the children who get the HDB (Housing Board flat) of the elderly by saying, ‘Look HDB is very expensive now, can you sell your flat and move in with me?’,” Care Corner Singapore’s principal social worker Kristine Lam told CNA.

“And for convenience to take more loan, the new HDB does not have the name of the elderly, and after the elderly move in, the children may do things that make it difficult for the elderly to continue to stay with them.”

This would cause the elderly person to lose their flat, and end up not having a place to stay at all, said Ms Lam.

Over the past five years, MSF’s Adult Protective Service has investigated five to 18 cases per year involving alleged financial abuse, Mr Masagos had said in his Feb 6 written parliamentary reply to a question from Sengkang GRC MP Jamus Lim.

“There are industry guidelines for frontline professionals, such as banking staff, to help them detect signs of financial abuse when transacting with customers,” he said.

Victim-survivors or their families may in certain circumstances be able to sue the perpetrator to recover the lost assets, and the perpetrator may also be liable for criminal offences depending on the case, said Mr Masagos.

“Social workers may also detect cases of financial abuse when assisting clients facing family violence,” he added.

He urged those facing domestic violence, including financial abuse, to seek assistance from a Family Service Centre or call the National Anti-Violence and Sexual Harassment Helpline.

Social service agencies told CNA more needs to be done to beef up financial education for victim-survivors.

Ms Lim said: "They really need to learn from scratch how to balance the budget, and how to make the household expenditure in a way that is acceptable and spend within their means. So that is a skill that really benefits them."