Canada-China trade deal opens door to cheaper EVs, but raises fears for auto jobs

Under the initial deal, Ottawa will allow in up to 49,000 Chinese EVs at a tariff of 6.1 per cent, reduced from 100 per cent.

Electric vehicles on display at the Montreal International Auto Show held in Montreal, Canada from Jan 16 to 25, 2026.

This audio is generated by an AI tool.

MONTREAL: At the Montreal International Auto Show last week, electric vehicles made up roughly 40 per cent of the lineup.

While vehicles from Europe, the United States and South Korea filled the exhibition floor, Chinese-made cars were notably absent – despite China being the world’s top EV producer.

That is expected to change following a new trade agreement between Canada and China on Jan 16, which is set to bring cheaper EVs to Canadian consumers.

Under the initial deal, Ottawa will allow in up to 49,000 Chinese EVs at a tariff of 6.1 per cent, reduced from 100 per cent. This represents about 3 per cent of annual vehicle sales in Canada.

Canadian Prime Minister Mark Carney later said the quota will gradually increase, reaching about 70,000 vehicles in five years.

The move is expected to significantly lower prices for consumers, but unions and industry watchers warned it could further weaken Canada’s already limited EV manufacturing base.

DIVERSIFICATION AN ECONOMIC NECESSITY

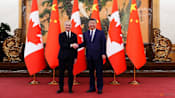

The policy shift follows a landmark meeting in January between Carney and Chinese President Xi Jinping.

Under the deal, Beijing agreed to lower tariffs on Canadian agricultural products, while Canada reduced duties on Chinese EVs.

The agreement also supports Canada’s goal of doubling non-US trade over the next decade amid increasingly strained ties with Washington.

In his keynote speech last Tuesday at the World Economic Forum held in Davos, Switzerland, Carney framed diversification as an economic necessity.

“We know the old order is not coming back. We shouldn’t mourn it. Nostalgia is not a strategy,” he said.

“But we believe, from the fracture we can build something bigger, better, stronger, more just. This is the task of the middle powers.”

For Canadian consumers, the deal could translate into substantial savings.

Chinese-made EVs can cost between US$10,000 and US$15,000 less than comparable Western models and have received positive reviews for quality and technology.

“China hasn’t just caught up – they’ve jumped far over the rest of the world and their cars are very good,” said Greig Mordue, an associate professor in the faculty of engineering at McMaster University.

OBSTACLES IN ENTERING MARKET

Still, Mordue said Chinese automakers will face hurdles entering the Canadian market.

“Selling and distributing vehicles requires an infrastructure and it requires regulatory approval to sell individual cars in the Canadian market,” he noted.

Companies such as Chinese EV giant BYD do not yet have that infrastructure in Canada.

By contrast, American manufacturer Tesla – which manufactures vehicles in China – already has a well-established footprint. Its Shanghai plant produces a Canada-specific Model Y for export, and the company operates 39 stores across Canada.

Canada’s EV manufacturing footprint is also limited.

For example, Stellantis builds the Dodge Charger Daytona EV in Canada's main auto manufacturing province, Ontario, but sales have been weak.

General Motors last year shelved plans to manufacture EVs at an Ontario plant that was once slated to become Canada’s first full-scale EV facility.

Labour groups have warned that the influx of cheaper Chinese EVs could further undermine Canadian auto jobs.

Unifor, which represents autoworkers, has warned the trade deal risks accelerating job losses in the sector. Ontario Premier Doug Ford has also called for a boycott of Chinese-made EVs.

Some analysts warned the move could complicate relations with the US as well, as Ottawa prepares to review its free trade agreement with Washington.

But Julian Karaguesian, a former special advisor at Canada’s Finance Ministry, said Canada has little to gain from trying to appease US President Donald Trump.

“The spear point of Trump’s trade policies is to get auto production back into the US. No American cars are going to be made outside of the US. They’re going to come home from Mexico. They’re going to come home from Canada,” said Karaguesian, now a visiting lecturer at McGill University.

“We’re losing auto production from this administration, so we might as well do what’s in our interests,” he added.

To ease labour concerns, Carney said the deal could attract joint ventures and Chinese investment to Canada.

But with Trump officials pledging to block Chinese EVs from entering the US, analysts said Canada may be a less attractive market for large-scale investment.

Even so, observers noted that China tends to take a long-term view – and that the Trump administration will not last forever.