US government ramps up subsidies for semiconductor sector, with new facilities planned

Supply chain disruptions during the COVID-19 pandemic and ongoing geopolitical tensions have fuelled US officials’ concerns about the domestic semiconductor industry.

The SemiCon West trade show held from Jul 9 to 11 in San Francisco, California, US.

This audio is generated by an AI tool.

SAN FRANCISCO: The United States has taken major steps to boost its semiconductor chip production, amid concerns about supply chain disruption and geopolitical tensions.

Government subsidies have created new opportunities as Washington seeks to re-establish a manufacturing sector that has shifted to Asia in recent decades.

Investments in the US semiconductor industry this year have grown to over US$300 billion – many times more than the usual US$15 billion worth of investments in a typical year, according to industry players.

Earlier this month, industry experts gathered at America’s largest semiconductor trade show – SemiCon West – in San Francisco, which focused on the development of the country’s semiconductor manufacturing supply chain.

WHAT TRIGGERED CONCERNS?

US officials became concerned after chip shortages during the COVID-19 pandemic impacted the availability of everything from automobiles to household appliances.

Then in 2022, the landmark CHIPS and Science Act was signed into law, setting aside US$52 billion to subsidise domestic semiconductor production.

Semiconductors, sometimes referred to as integrated circuits or microchips, power billions of electronic devices around the world like mobile phones, computers and vehicles.

Another major issue for Washington is that Taiwan produces most of the world’s advanced semiconductors.

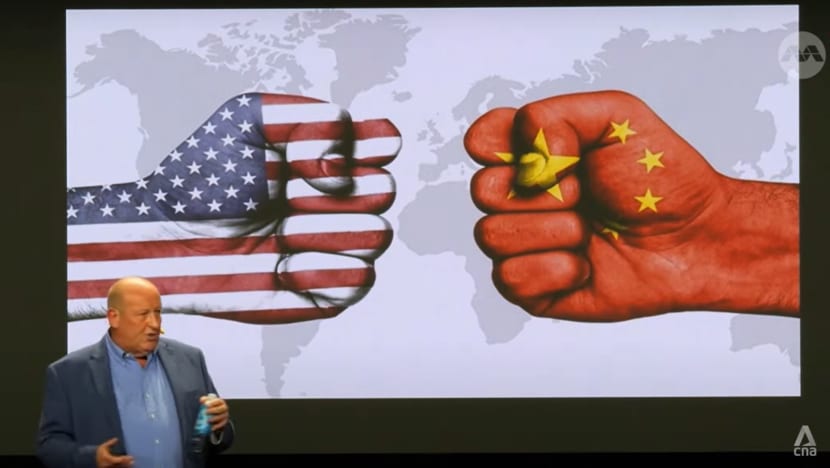

Amid simmering trade tensions between the US and China, which considers Taiwan its territory, a push has emerged to localise the supply chain of an industry seen as critical to US national security.

OTHER COUNTRIES HAVE BENEFITED

The geopolitical standoff between Beijing and Washington has already created opportunities for other countries.

Malaysia, for example, has long been an important supplier to the industry, having grown to become the sixth-largest exporter of semiconductors in the world. Its ecosystem has proven a magnet for companies seeking to de-risk.

CNA previously reported that more foreign semiconductor and electric vehicle companies have been relocating from China to Southeast Asia to bypass trade restrictions and strengthen their supply chains.

Irvin Francis, trade commissioner at the Consulate General of Malaysia in Los Angeles, said that Malaysian semiconductor firms have always been seen as “substitutes” to those in countries like China.

“As it stands, there is significantly high tax imposed (on) companies from China … we think companies from Malaysia can be the answer to fill in that gap,” he told CNA at SemiCon West.

SEVERAL NEW FACILITIES PLANNED ACROSS AMERICA

Already, the US government’s subsidies have led to over a dozen new planned semiconductor facilities across the US.

Some states like Arizona are set to reap the benefits. Semiconductor giants TSMC and Intel recently announced new facilities there, spurred by subsidies awarded to them under the CHIPS and Science Act.

The US government previously approved subsidies of up to US$6.6 billion for TSMC, the global leader in making artificial intelligence chips.

The Taiwanese giant manufactures chips for companies like Nvidia – which briefly became the world’s most valuable firm last month – and Microsoft.

Meanwhile, American chipmaker Intel was awarded up to US$8.5 billion.

"We feel confident that we're going to continue to bring great investment to the state of Arizona, great quality jobs to the state of Arizona, with the goal of increasing our economic vitality in the state,” said Fernando Garcia, executive vice president of international trade and investment at the state’s commerce authority.

If the chips manage to fall into place, however, one issue the US will have to address is finding enough people to work at these sites.

This had led to calls to reform the skilled work visa programmes that allow foreigners to work in the US.

According to a Semiconductor Industry Association study conducted last year, the country could be looking at a shortage of nearly 70,000 technicians by the end of the decade if things do not change.