Are Singapore consumers ready for a sustainable future?

Despite widespread awareness of its importance, the majority of consumers are passive contributors to the sustainability cause, reveals Singlife’s Sustainable Future Index.

The Sustainable Future Index seeks to empower consumers and businesses to make informed choices that support environmental and holistic well-being. Photos and infographics: Singlife

This audio is generated by an AI tool.

Sustainability isn’t just about going green – it’s also about taking care of your health and financial well-being.

As a homegrown financial services provider, Singlife wants to chart a better way to sustainability, with a focus on improving the health and well-being of Singapore and its people. That’s why it developed the Sustainable Future Index (SFI), a pioneering measure of the readiness of consumers in Singapore for a sustainable future. Such readiness is determined not only by one’s actions, but also by one’s attitudes and beliefs about sustainability.

Through a survey of 1,000 Singaporeans and permanent residents across diverse demographic groups, the SFI explores what motivates consumers to adopt sustainable practices, the obstacles they face and their preferred sustainability habits. The goal? To identify gaps and empower both consumers and businesses to make better decisions that champion environmental and holistic wellness.

The launch of the SFI is especially meaningful as Singapore marks SG60 this year. Building a brighter future together means that Singapore continues to thrive sustainably for future generations to live, work and play in harmony.

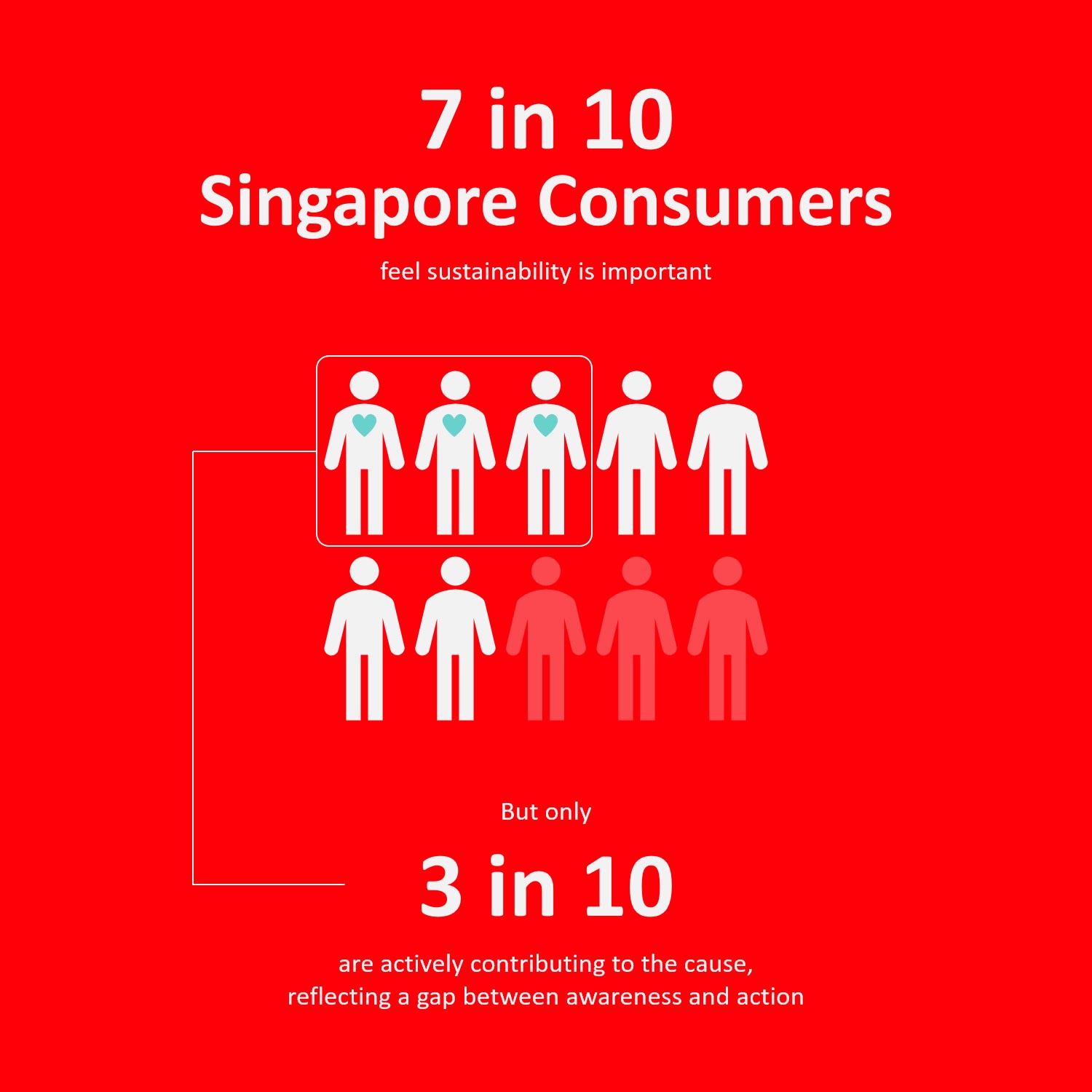

THE GAP BETWEEN AWARENESS AND ACTION

The SFI revealed a significant gap: While seven in 10 respondents recognise sustainability as vital for the planet’s future, only three in 10 are actively taking action, with most citing recycling and reducing single-use plastics as their primary actions. These steps, though important, fall short of the expansive actions needed to drive meaningful change.

To address global challenges, systemic change is required across industries, including in financial services. Singlife is stepping up with innovative solutions in sustainability that impact the daily lives of consumers, empowering them to turn attitudes into actions.

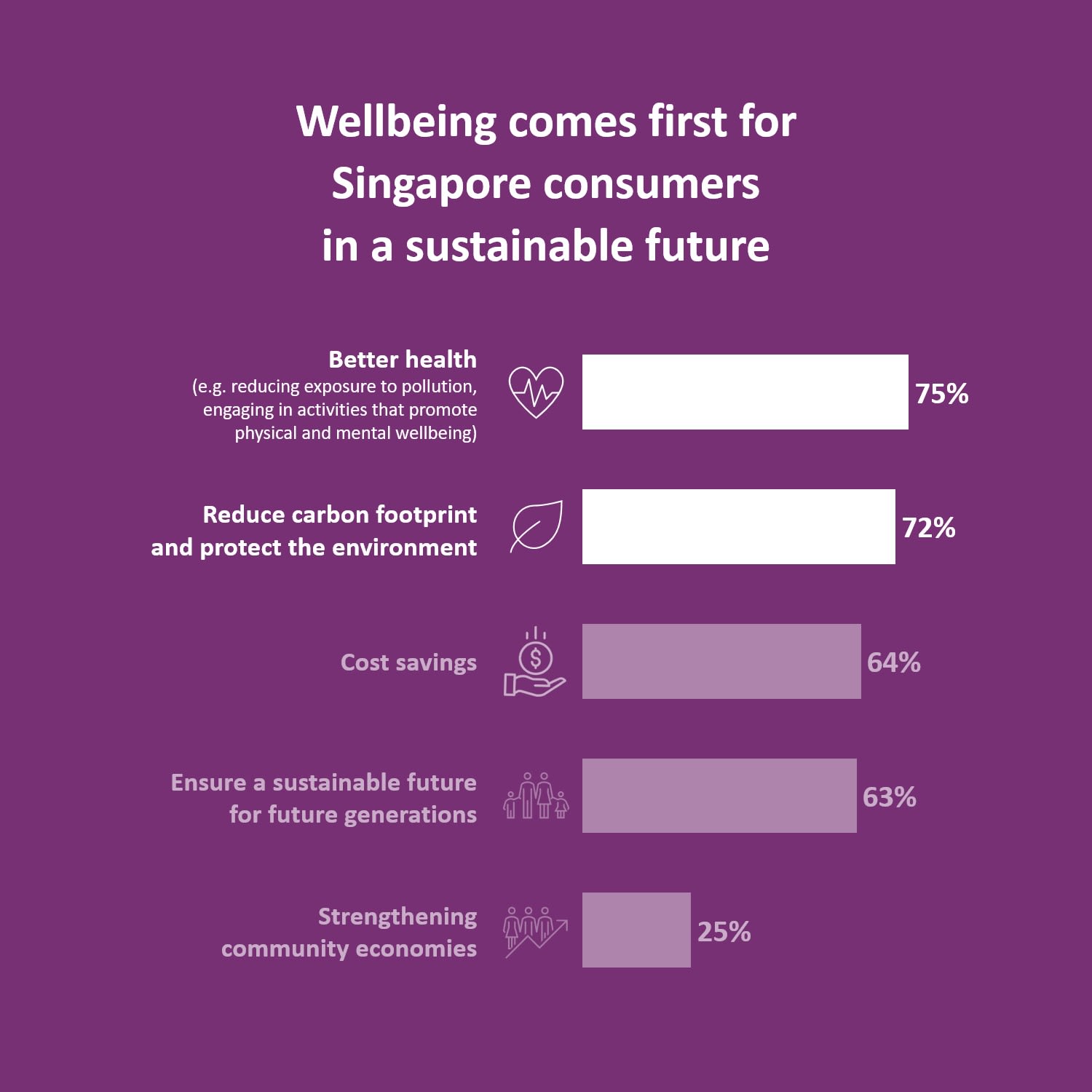

HOW TO PROTECT YOUR HEALTH AND THE ENVIRONMENT

Over 70 per cent of respondents identified improved health, such as living with cleaner air, and environmental protection as key motivators for embracing sustainable practices. However, the growing challenges posed by climate change and its impact on human health and daily life are becoming increasingly difficult to address.

In 2023, Singapore experienced one of its hottest days on record, with temperatures soaring to 37 degrees Celsius. In 2024, 122 additional days of extreme heat were recorded. The surge in dangerous heat levels poses significant risks to public health, particularly from heat-related illnesses like heatstroke. Recognising this growing threat, Singlife introduced heatstroke insurance in September 2023, offering coverage for death and hospitalisation caused by the condition. To date, more than 19,000 heatstroke policies have been issued.

On the environmental front, transport remains a major contributor to emissions. Transitioning to electric vehicles (EVs) is a critical step towards reducing Singapore’s carbon footprint. The Land Transport Authority estimated that electrifying all light vehicles could cut national emissions by 4 per cent, equivalent to 1.5 million to 2 million tonnes annually. In support of this green shift, Singlife became one of the first insurers to introduce EV insurance in 2023. The plan includes a 10 per cent Go Green discount and specialised benefits, such as coverage for accidents and assistance with insufficient battery power, to encourage EV adoption.

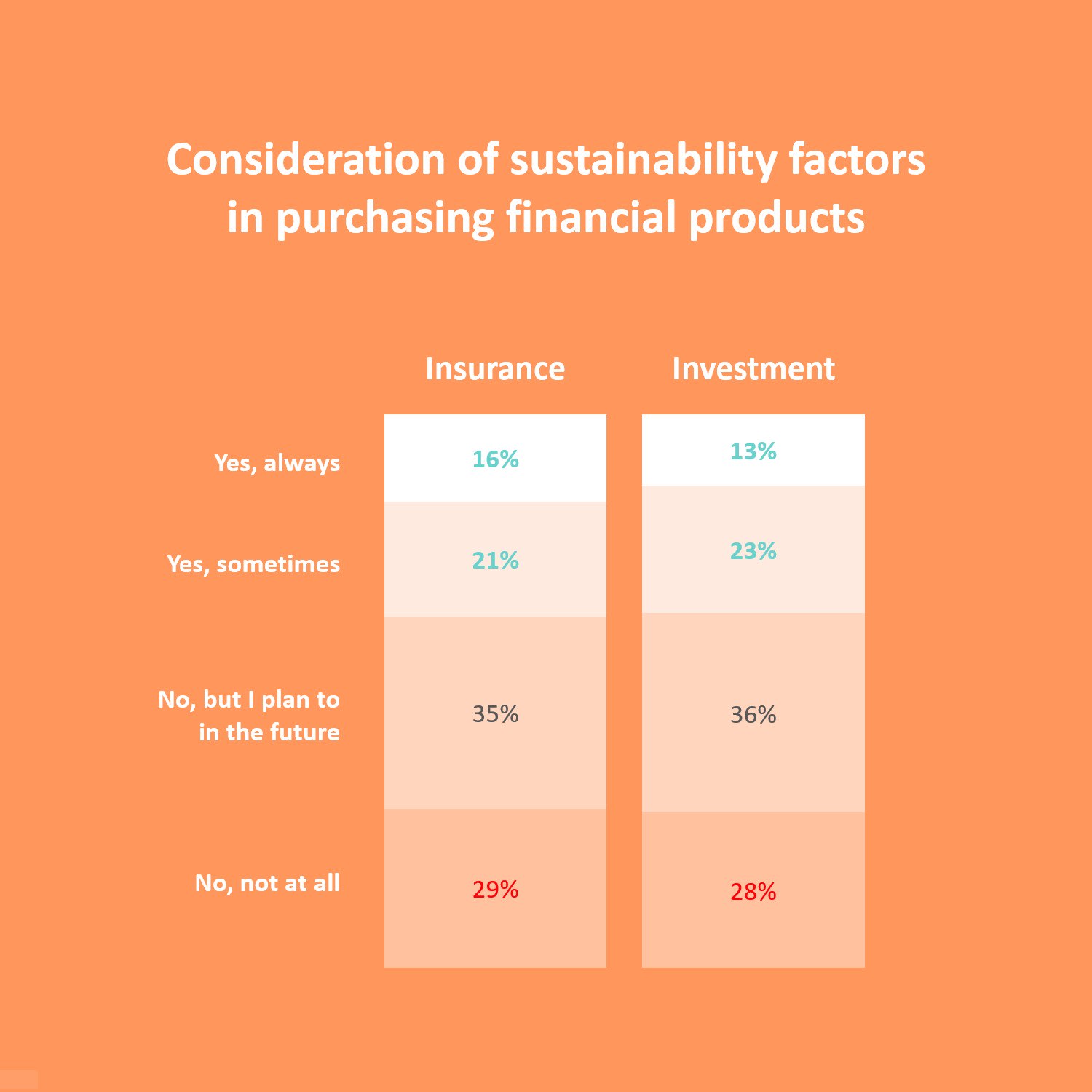

MAKE A DIFFERENCE WITH YOUR FINANCIAL CHOICES

According to the SFI, only 23 per cent of Singapore consumers are aware of investment products that incorporate sustainability. Encouragingly, the tide is shifting. More than three in 10 consumers who currently do not consider sustainability factors in products and services intend to do so in the future, indicating an increase in awareness of sustainable options.

This consumer shift makes it timely for insurers to expand their portfolios with products that channel investments into environmentally and socially responsible ventures. Among the most sought-after products are green investment funds, climate bonds and eco-friendly retirement plans.

Millennials and Gen X respondents, in particular, showed strong interest in sustainable retirement options and sustainability-embedded travel insurance, reflecting a growing appetite for products that align with both personal values and financial goals.

However, turning interest into action requires greater consumer education. One in four consumers surveyed in the SFI expressed uncertainty about how to start making sustainable investments or questioned the impact of sustainable financial products on the world.

Financial institutions and advisers play a crucial role in guiding consumers toward sustainable investment options, such as environment, social and governance (ESG) funds. In partnership with leading global asset managers, Singlife offers over 100 ESG funds on its GROW investment platform, equipping financial advisers with diverse options to help consumers invest sustainably. Customers seeking to create a positive impact can also choose from a range of ESG funds when purchasing an investment-linked policy with Singlife.

By aligning the efforts of consumers and businesses, a sustainable future that balances economic growth, environmental well-being, physical health and social equity becomes achievable. Singlife also publishes the yearly Financial Freedom Index report that surveys individuals’ readiness to achieve financial freedom. As individuals pursue their dreams of financial freedom, sustainability is becoming an increasingly important factor in their journey.

Learn more about Singlife’s Sustainable Future Index and Financial Freedom Index. This article is for informational purposes only and does not take into account specific investment objectives, financial situation and needs of any individual. The information provided is accurate as of Feb 5, 2025. This advertisement has not been reviewed by the Monetary Authority of Singapore.