How Ant International is shaping the future of financial inclusion

Focusing on the four pillars of travel, trade, technology and talent, the international arm of Ant Group aims to bridge the digital gap and create a robust ecosystem for global commerce and digital technologies.

With the transition to a digital economy, financial inclusion is vital in helping to reduce poverty, enhance financial literacy and promote economic growth. Photos: Shutterstock, Ant International

This audio is generated by an AI tool.

In a world marked by significant economic disparity, financial technology (fintech) is emerging as a key solution in delivering financial services to traditionally underserved populations.

A study by Nanyang Technological University’s Centre for Sustainable Finance Innovation revealed that countries with more advanced fintech ecosystems fared better in sustaining GDP growth and maintaining employment during economic uncertainty. Conversely, nations with fintech sectors that were less developed witnessed a significant surge in demand for fintech services post-pandemic, with Southeast Asia experiencing a 50 per cent increase between 2019 and 2020.

At the heart of this fintech revolution is financial inclusion, which has the potential to alleviate poverty, empower small businesses, enhance financial literacy and strengthen economies.

According to Mr Peng Yang, president of Ant International, efforts to promote financial inclusion are expected to ramp up in the next decade, driven by the burgeoning role of central banks and new technologies such as artificial intelligence (AI) and large language models.

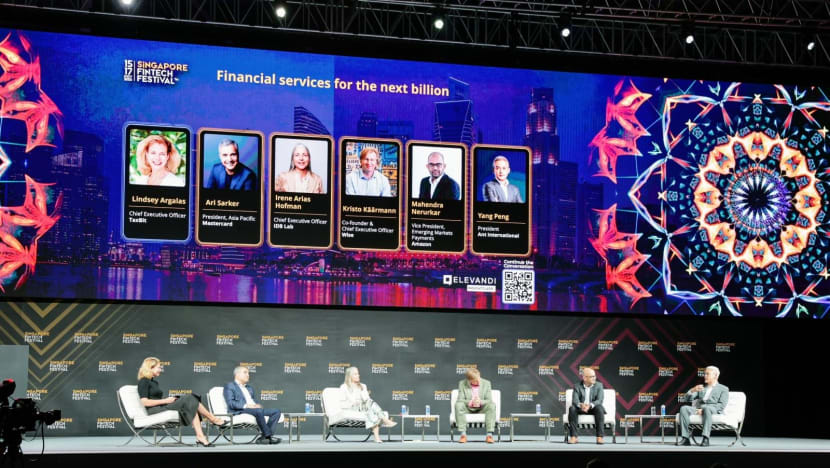

At the Singapore FinTech Festival 2023, he emphasised the growing impact of initiatives like open banking and national quick response (QR) schemes. “Such innovations benefit the underbanked communities and small- and medium-size enterprises (SMEs) by integrating them into the global financial network. They herald a new era of cross-sector collaboration, ensuring expansive growth while safeguarding privacy and security,” said Mr Yang.

FORGING A PATH TO FINANCIAL INCLUSION

Headquartered in Singapore, Ant International is poised to transform financial services with its growing global presence. With its strategic focus on the 4Ts (travel, trade, technology and talent), the international arm of Ant Group is developing cutting-edge digital solutions designed to bridge the digital divide and power the future of global commerce with digital innovation that will benefit a range of communities, from consumers to SMEs and merchants worldwide.

Said Mr Yang: “Despite global economic uncertainties, evolving financial infrastructures, rapid digitalisation and tech advancements offer unparalleled opportunities. Our focus on travel, trade, technology and talent lays the cornerstone for global inclusion and prosperity. We will accelerate innovations in digital payments and commerce to link up these areas of global collaboration.”

One such innovation under the travel pillar is Alipay+, the company’s flagship cross-border mobile payment service. With a network encompassing 57 countries and regions, it now connects over 88 million merchants with 1.5 billion user accounts, enabling effortless travel and cross-border transactions. Merchants can also leverage the Alipay+ D-store to digitalise their payment processes and operations across multiple platforms and social media channels.

In the latter half of this year, Alipay+ saw a 30 per cent growth in total payment volume and a significant increase in daily transactions.

Most recently, it launched a year-end campaign with partner e-wallets to promote sustainable cross-border travel. Focusing on popular Asian destinations such as Singapore, Malaysia, Hong Kong, Thailand, Japan and South Korea, the campaign offered diverse deals through collaborations with global brands and local businesses to ensure a broad selection for travellers. Additionally, it aimed to foster responsible travel behaviours by rewarding the use of digital payments and public transport, as well as promoting exploration of local culture in an effort to support local economies.

Ant International’s technology pillar is embodied by Antom, a suite of platform-level services and toolkits, to help merchants grow their revenue and consumer base across Asia and beyond.

In the realm of trade, global digital payments and financial services provider WorldFirst (which Ant Group acquired in 2019) has served over one million SMEs engaged in international trade, and plans to extend its solutions to a broader market in Southeast Asia next year. As part of this effort to help SMEs expand globally, it launched the Global Voyage programme in 2022 to help them streamline the process of opening stores on around 30 major e-commerce platforms – such as Amazon and AliExpress – within 24 hours.

Further enhancing its portfolio, WorldFirst also signed a memorandum of understanding with Asset World Corporation (AWC), Thailand’s leading integrated lifestyle real estate group, to introduce a suite of payment and digital financial solutions for AWC’s various business operations.

In the first nine months of this year, there was a notable increase in business-to-business buyers from emerging markets using the platform to import goods from China. This surge in activity boosted the total trade value on WorldFirst’s platform by 83 per cent compared to the previous year.

Similarly, ANEXT Bank, Ant International's digital wholesale bank in Singapore – which is regulated by the Monetary Authority of Singapore – focuses on supporting regional micro, small and medium enterprises (MSMEs) in their pursuit of international expansion. Since its inception in July 2022, it has seen an average 40 per cent month-on-month increase in cross-border transactions, underscoring its growing importance in the sector. Today, over 65 per cent of its customers are made up of MSMEs.

Through its SME Friends of ANEXT programme, the digital bank has partnered with several clients to reimagine the future of digital financial services. This initiative brings together business owners from diverse backgrounds and expertise to share their experiences and challenges to contribute to the evolution of digital banking.

Looking ahead, ANEXT Bank is focusing on enabling its clients to seamlessly integrate financial solutions into their day-to-day operations through its ANEXT Programme for Industry Specialists (APIs). This strategy, in collaboration with industry specialists, is set to broaden the range of services for SMEs on their platforms, enabling them to manage finances directly within their operational ecosystem.

Under the talent pillar, Ant International is bridging the global digital skills gap by nurturing the next generation of digital experts. In partnership with the International Finance Corporation, the company launched the 10x1000 Tech for Inclusion programme in 2018. The initiative aims to train 10,000 tech specialists in emerging markets from both public and private sectors over the next decade. Since its inception, the programme has expanded to include more partners from across the region, including Singapore, Malaysia, Indonesia and Hong Kong.

“Technology should make the world a closer, friendlier place. Together with our partners, we’re committed to bringing about small yet impactful changes globally,” said Mr Yang.

Discover how Ant International is championing financial inclusion in the digital age.