Johor quakes: As Segamat residents count damage cost, experts say poor grasp of insurance must change

In Malaysia, many homeowners are uninsured or under-insured. After the recent Johor earthquakes, this needs to change, experts say.

Segamat resident Poon Ching Yee points to a widening crack in her home, the result of an earthquake that struck Johor on Aug 24, 2025. (Photo: CNA/Fadza Ishak)

This audio is generated by an AI tool.

SEGAMAT, Johor: Lawyer Poon Ching Yee was preparing breakfast for her family when a sudden, loud bang echoed through her home.

It sounded as if something heavy had fallen from the sky or a solar plate from her roof had crashed down.

The loud sound, which was also heard by her family members living in other parts of Johor’s Segamat town, caused her dog to bark non-stop.

Within minutes, Poon’s husband found news online confirming that an earthquake had occurred.

"Floods maybe, but I would never have expected that we would be affected by an earthquake. It was quite scary," the 37-year-old told CNA on Sep 4, more than a week after her family’s hair-raising experience in the early hours of Aug 24.

The earthquake and aftershocks in the days that followed caused the pre-existing hairline cracks in their Taman Yayasan house to widen significantly.

One crack was so severe it resulted in a hole big enough for her to peek into her neighbour's house.

The bank that provided her housing loan has told Poon to try submitting a claim as her insurance plan would cover it.

“I will try submitting (a claim) but my case is a bit different because there were cracks on the wall previously. It would depend on the adjusters who assess it," she said.

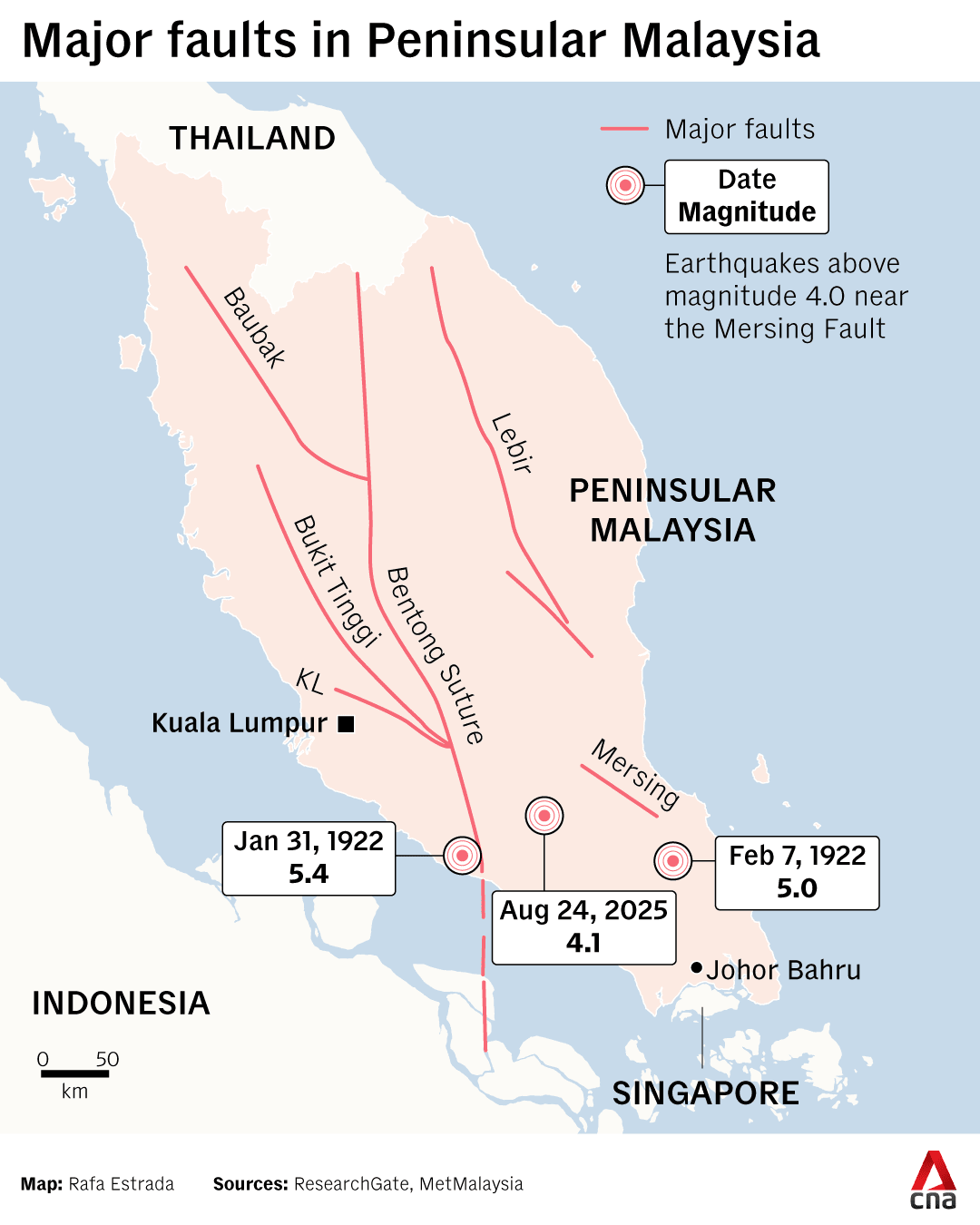

The 4.1-magnitude Segamat earthquake on Aug 24 and at least seven aftershocks have shaken residents and prompted a debate about the need for earthquake coverage in Malaysia, with experts calling for wider adoption of such insurance.

Public awareness of earthquake insurance is generally low due to the historical perception of Malaysia as being free from seismic risks, they said.

“Malaysia is not seen as an earthquake-prone country compared to neighbouring Indonesia or the Philippines,” said Chua Kim Soon, chief executive of the General Insurance Association (GIA) of Malaysia, an association that represents insurers.

There is a general lack of awareness regarding home insurance, and this is even more so for risks related to earthquakes, he said.

Malaysia is located outside the Pacific Ring of Fire, a major tectonic belt known for its high seismic activity that affects Indonesia and the Philippines.

The Aug 24 earthquake lay near the Mersing Fault Zone and originated from crustal movement, not volcanic activity or deep-sea subduction, Johor Mineral and Geoscience Department director Noorazhar Ngatimin told Bernama news agency.

“Many homes without mortgages, such as owners of fully paid homes or those with housing in rural and semi-urban areas, are often underinsured or uninsured,” said Chua.

According to Malaysia’s Department of Statistics, there were around 9.1 million households in 2024, but only 3.88 million fire and home insurance policies were recorded, indicating a take-up rate of about 43 per cent.

Marimuthu Nadason, president of the Federation of Malaysian Consumers Associations, told CNA that many people purchase insurance only for common risks such as fire, but this does not cover natural disasters such as earthquakes.

Public awareness about natural disaster insurance is very low, and insurers should do more to raise awareness of such coverage, he said.

“This is a pattern seen with floods. People only start to become aware of the need for flood insurance after a major flood has occurred,” he said.

When CNA visited Segamat last week, residents were still counting the cost of quake damage.

Insurance companies have received claims in relation to the quake, but the extent of losses is still being assessed, GIA’s Chua said.

The Segamat District Disaster Management Committee has received 64 reports of minor damage so far, including two at a local surau. The damage consists of cracks in walls and ceilings, and does not affect the structure of the buildings.

Deputy Works Minister Ahmad Maslan said on Monday (Sep 8) an allocation of RM550,000 (US$130,533) is needed to repair minor damage to government buildings and schools following six mild earthquakes in the district since Aug 24.

He said repair work on the 15 affected buildings is urgent and must be carried out before the end of the year.

The government buildings and schools have “minor damage such as cracks to the plaster surfaces and walls, as well as stretching between wall panels, columns, beams and ceiling”, he said.

“The estimated repair costs for all affected government buildings had already been submitted to the respective ministries for funding allocation.”

There was no reported loss of life or injuries as a result of the earthquakes.

GET QUAKE INSURANCE, EXPERTS URGE

The GIA of Malaysia said in a press release on Sep 4 that recent earthquakes in both Sabah and Peninsular Malaysia serve as a reminder that the country is not free from seismic activity and other natural disasters.

It said that while Sabah has long been known for its active seismic zones, tremors recorded in parts of Peninsular Malaysia highlight that homeowners nationwide face real risks from earthquakes.

Sabah has a history of earthquakes, with the most notable being the 2015 Ranau earthquake near Mount Kinabalu. The magnitude 6.0 earthquake resulted in 18 deaths on Mount Kinabalu, including that of seven Singapore primary school children who were scaling the mountain.

In Malaysia, fire insurance is the most common policy linked to housing loans, mainly covering fire, lightning and gas explosions, GIA's Chua said. Fire insurance does not cover natural disasters such as earthquakes, floods and landslides.

Instead, houseowner and householder insurance are comprehensive insurance policies that cover fire and other specified risks such as earthquakes, floods, and windstorms, for both home structures and their contents, said Chua.

Following the earthquakes in Johor, insurers are seeing more enquiries about earthquake insurance nationwide, he said.

Homeowners are able to extend the coverage of a standard fire policy to include earthquake and volcanic eruptions at the rate of RM1 for every RM10,000 of coverage, he said.

For a landed two-storey house built in 2000 with a reconstruction cost of RM1 million and home contents worth RM200,000, householder insurance premiums would cost about RM4,000 yearly while fire insurance policy alone would cost about RM1,500 yearly, according to Simon Ng of ORC Risk Consulting, a risk management firm.

Strata buildings such as condominiums and apartments would have insurance that covers fire and earthquakes, but this coverage is not mandatory for landed homes, he said.

Many landed homeowners who have paid off their bank loans would not even purchase basic fire insurance, Ng added.

“It’s not only about insurance (for) earthquakes or natural disasters, but home insurance in general. I believed that many owners of landed properties might not have any form of home insurance that covers them,” he said.

“In Malaysia, home insurance contains two parts: The property itself and the home contents. If owner buys (houseowner or householder) insurance, the insurance covers both property and the home contents. The coverage would also cover natural disasters such as earthquakes,” he said.

Segamat resident Chew Leh Tong, 52, has fire insurance due to a mortgage. He admits, however, that the policy is unlikely to cover damage caused by the recent earthquake – several cracks that appeared in his home of 10 years.

Chew, who works at an events company, said he would consider buying earthquake insurance.

“I can’t just pack up and leave from here, so there will be a need to be insured,” he said.

Awakened by the severe shaking of his front grilles on Aug 24, Chew said neither he nor his neighbours had expected an earthquake to occur.

“Now everyone is worried about what is next," he said.

Malaysia’s Meteorological Department director-general Mohd Hisham Mohd Anip has warned that aftershocks along the ancient Mersing fault line - the epicentre of the Aug 24 earthquake and aftershocks - may still occur until all the energy along the fault line is fully released.

"While Segamat is quite a distance from Mersing, the fault connectivity is believed to continue underground and functions as a weak zone in the earth's crust," he was quoted as saying by The Star on Sep 7.

The Mersing Fault Zone is one of the major fault belts in the peninsula, along with others like Bukit Tinggi, Kuala Lumpur, Lebir, Bok Bak, Bentong and Lepar.

While earthquake sequences like what was seen in Segamat usually calm down over time, they are the “drumroll” – or foreshocks – before something bigger, said Azlan Adnan of Universiti Teknologi Malaysia’s (UTM) faculty of civil engineering.

“The reasonable worst case for an old Peninsular fault that becomes reactivated could be around magnitude 5 to 5.5,” said Azlan, a professor of structural earthquake engineering.

He added that one cannot rule out a magnitude 6 quake with more serious impact.

“That is why we must plan with the worst case in mind, not just hope for the best.”

Experts had previously told CNA that the recent earthquakes serve as a reminder that Peninsular Malaysia, Singapore and the surrounding region are not immune to the natural disaster, noting how a pair of Johor earthquakes at magnitude 5.0 and 5.4 in 1922 were widely felt.

While making earthquake insurance mandatory for every single property in Malaysia now might be too extreme, Azlan believes a step-by-step approach is necessary.

“The first step is for homes and buildings with bank loans in risk zones, vital facilities like hospitals and schools, and new developments to have earthquake coverage by default,” he said.

“This is how we protect both people and the economy.”

To keep premiums affordable, Azlan suggested the government could set up a national disaster insurance pool, and homeowners who strengthen their buildings are rewarded with lower premiums.

“This is exactly how countries like the United States and Japan manage seismic risk,” he said.

Samuel Tan, chief executive of Olive Tree Property Consultants in Johor Bahru, told CNA that earthquake insurance will become a bigger consideration for homeowners and property investors, especially for high-rises and in locations that are considered vulnerable.

“Earthquake insurance in Malaysia will eventually no longer be optional but a necessary safeguard due to increasing seismic activity and climate uncertainties,” he said.

PSYCHOLOGICALLY SCARRED, BUT MORE PREPARED

The most profound impact of the recent tremors in Segamat, for now, appears to be psychological.

While life in the town appears back to normal, residents now possess a heightened sense of awareness and know the ground can shift without warning.

Auxiliary police officer Akhirulzaman Rosli, 40, said the first Aug 24 quake startled his family awake, and he initially mistook the loud bang for a fox on the roof.

The metal grille of his home began shaking violently for what felt like an eternity, but likely lasted for a few seconds in reality, he said.

“Now, my wife said that any loud sound will remind her of the quake. It has impacted us for sure,” said Akhirulzaman who has two children.

He said his older child has been taught in school what to do if an earthquake occurs again.

“I am most worried about my child, especially if she is in school. If at home, I have told my family to just run out of the house to an empty space,” he said, pointing to the plot of empty land next to his village home.

Babysitter Rosilawati Nur Muhamad, 35, has prepared a bag with emergency items in case another earthquake occurs. Her go-bag consists of dry food, water, solar lights, clothes, a tent and a fan, among other things.

Her three children, aged six to 12, now sleep in the living room located next to the front door of their rental house.

“I was relaxed after the first earthquake but after the second quake, I decided to pack some bags to stand by. I can’t sleep so well at night now,” she said.