How are Chinese firms responding as foreign buyers ‘don’t want anything made in China’?

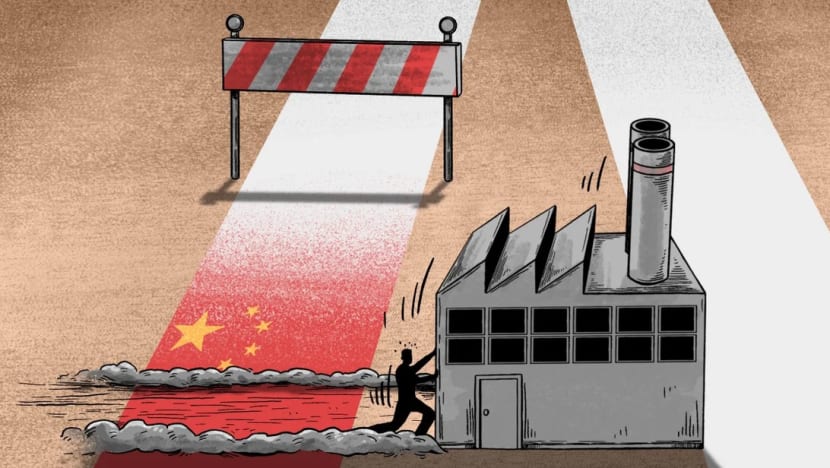

The path forward for many China-based manufacturers involves moving some production elsewhere. (Illustration: SCMP/Lau Ka-kuen)

- "This is a trend that will not stop," manufacturing analyst warns as China pull-out intensifies in the face of geopolitical strife, demographic crisis and supply-chain upheavals

- China exporters, despite now seeing fewer orders due to excessive overstocking during the pandemic, are looking to the future as they build factories abroad

The writing is on the wall when it comes to the future of Norman Cheng’s operations in China, and like the protection offered by helmets his company produces, he sees a shift away from China as a matter of self-preservation.

To that end, he intends to open a smart factory in Vietnam next year – a US$30 million undertaking that embraces automation and will essentially be a replica of the plant he opened just last month in the southern Chinese manufacturing hub of Guangdong province.

The decision by one of the world’s largest helmet makers, Strategic Sports, was a long time in the making, and it was not borne out of capacity concerns. Cheng says they have plenty of that in China, where their first automation plant went into operation two years ago, capable of producing millions more helmets a year.

Instead, the move is a deliberate and tactical attempt to hedge against ever-growing geopolitical risks and retain his Western clients – many of whom have grown uneasy and more cautious about their supply chains, looking to hedge their bets by sourcing from a bigger pool of countries.

“We wouldn’t have had to build a new factory in Vietnam if we were only considering production capacity,” Cheng explained. “But from a geopolitical point of view, I have to have it in Vietnam.

“American clients have pushed us to go to Vietnam, and since they are very committed to placing orders there, we are going there.”

Currently, Strategic Sports employs more than 4,200 people, with more than 10 facilities spread across Asia, Europe and North America. And the most recent available figures show it took in US$210 million in 2021. Its 40 production lines make helmets for all types of uses, including sports, security and construction.

But even with those expansion plans, he has no intention of abandoning China. On the contrary, even after the opening of his Guangdong plant in Huizhou was delayed for nearly two years due to China’s strict zero-COVID controls, it is now a critical cog in his production machine. He chose Guangdong because the manufacturing hub has been building up sophisticated industrial clusters for decades.

But relying solely on China operations is no longer considered the safest bet for manufacturers, as the country’s “world’s factory” status is not as strong as it was in the past. Compounding concerns is the fact that China faces a worsening demographic crisis that has made it more difficult for companies to hire skilled labourers.

In Vietnam, Cheng’s planned facility will feature a high degree of automation that will allow 400 workers to make about 8 million helmets a year. It will also embrace green energy, with solar panels and rainwater-recycling capabilities.

And while his Huizhou factory mainly fulfils orders from European clients, Cheng admitted that those clients have expressed interest in trying to source from his Vietnamese factory in the future, with an eye on shipping to some Southeast Asian and European markets.

For the time being, however, many customers already have what they need. He said that’s because many overestimated market demand during the pandemic, when interest in sporting goods skyrocketed.

As a result, they kept buying, thinking that supply-chain disruptions could stretch into at least 2024. And they asked him to step up production last year. Now their inventories are overstocked, and they’ve had to rein in purchases this year, resulting in Cheng seeing a nearly 70 per cent drop in orders received.

“Now that it looks like the pandemic is over, demand has dropped to the level of 2018 and 2019, but our clients have already bought what they need for the next two to three years,” he said. “The orders this year account for only around one-third of what we got last year.”

And he says the trend is being seen across the board, “not only in our industry”.

“Many [firms] in the bicycle, sports equipment and clothing sectors are facing the same challenge,” he said, “as the inventory pressure facing European and American clients is very high.”

Dan Digre, CEO of loudspeaker manufacturer Misco Speakers, based in the US state of Minnesota, said he had to delay shipments for four to five months due to his clients’ excessive inventories. Still, he does not expect the trend to derail supply-chain adjustments.

“It’s a tricky time now … we’re not seeing supply-chain delays, but demand push-backs,” he said, referring to customers requesting that product deliveries be postponed. “There is no delay (in embracing) the China-plus-one model, but companies will slow production with the weak demand.”

The model, as it has commonly become known, involves manufacturers staying in China, but reducing their outsized reliance on it as a production base by shifting operations elsewhere.

Digre said his company also adjusted its supply chain to avoid punitive tariffs imposed by the US and China on each other amid their trade war that began in 2018.

“The company has moved its production from the US to China to escape the high import tariffs on certain components. At the same time, some finishing products made in China will be moved to the plus-one production lines to avoid import tariffs when they are shipped back to the US,” he said.

Matthew Fass, president of Maritime Products International in the US state of Virginia, said the inventory situation, the trade war and depressed demand have all complicated the decision-making process surrounding supply chains.

“We are still trying to understand the ‘new normal’ with supply-chain management and even consumer trends coming out of COVID-19,” Fass said. “This current dynamic does make it more challenging to understand the best ways to work toward healthy supply-chain diversification.

“It is a misperception (to think) that many of the seafood supply chains exist in China based solely on some easily interchangeable availability of labour or a favourable regulatory environment,” he said, noting how supply chains take decades to build up.

In the midst of this growing trend by companies to relocate and diversify operations to reduce their China exposure, domestic analysts have been sounding alarms about economic impact. And many have called on Beijing to take steps to retain leading foreign companies amid such supply-chain adjustments, while also urging Chinese companies to upgrade their industrial chains.

Chinese leadership has responded with an all-out push to woo foreign investors. But still, China reported a drop in foreign direct investment inflows during the first four months of this year. And its recent national security raids of foreign consultancy firms have pushed foreign companies to further reassess the risks associated with operating in China.

“There’s been talk that the US-led decoupling is a delusion, but I don’t agree. Once companies leave, they won’t come back,” said Liu Kaiming, head of the Shenzhen-based Institute of Contemporary Observation, which monitors the working conditions of Chinese contract manufacturers.

“A large number of Chinese companies also continue to invest in overseas capacity to survive,” Liu said. “This is a trend that will not stop.

“China’s re-export trade to ASEAN (countries) over the past two years has been substantial, mainly in the export of raw materials, which will actually increasingly be produced in Vietnam and other emerging markets.”

Raymond Yow, a US trader who imports home-improvement products such as household decorations, cement boards, solar panels and LED lights to American retailers, attended the Canton Fair in Guangzhou last month, browsing new products and meeting manufacturers.

But he also planned to go to Vietnam and Indonesia to explore potential new and cheaper supplies.

Yow was already thinking about importing from Indonesia – where wood resources are abundant and prices are low. But an increase in overseas consumer opposition to Chinese-made products, especially in the middle parts of the US, has put pressure on his retail clients, giving him further impetus to take action.

“‘Replace those made in China if you could,’ they would suggest,” he said.

Nonetheless, Yow noted how doing business in China still has its “incomparable advantages”, compared with Southeast Asia. He pointed to greater e-commerce convenience, relatively efficient logistics, and more sophisticated industrial and supply chains.

But because of that external pressure, he has to seek more diversification options, even though the undertaking means a lot more work.

Wang Gang, head of a company that makes thermoelectric coolers in the northern Chinese province of Hebei, is also facing a quandary arising from geopolitical challenges.

“It was in 2017 and 2018 when we first felt the discrimination against Chinese products, as European clients were reluctant to label their products as ‘made in China’ because they were often considered cheap and low-end, which could hurt their company image,” he said.

Their thermoelectric coolers, widely used in telecommunication cabinets, have subsequently been rejected by many Western markets, especially the United States, due to national security concerns.

“One of our most important clients in the US market told us they don’t want anything made in China. That’s why they asked us to relocate our factory to Vietnam, to address their concerns,” he said. But still, Wang does not plan on relocating to Southeast Asia, as such a move would be unrealistic for a small business like his.

But this is now the reality facing many of China’s exporters – US companies are favouring other Asian countries, and this is occurring amid a weak global economic outlook and growing tensions between China and the US-led West.

Efficiency in production and logistics, which China has used to consolidate its supply-chain dominance in the past, are increasingly being overshadowed by the more pressing need to guard against sudden cut-offs stemming from geopolitical conflicts such as the Ukraine war, according to a senior executive with a Taiwan-based manufacturer that has plants in China and neighbouring countries

“When diversifying their supply chains, global brands [prioritise] order allocations,” said the executive, who declined to be identified. And with global demand so weak, “we must first keep operations in Vietnam, then continue to increase production in India, while the production of Chinese factories will be the last consideration, due to the US-China tensions”.

Peter Bogh Hansen, China policy director with the Confederation of Danish Industries, confirmed that surplus inventories among buyers, combined with other factors such as geopolitics, logistics and energy challenges, are forcing companies to change their global business strategies to have a more regional focus.

“I doubt that the economic situation in Europe will have much impact on Danish companies’ decision to reduce their dependence on Chinese supply chains,” Hansen said. “That decision has mostly to do with concerns about the geopolitical situation.

“But perhaps it means that Danish companies will be considering alternative locations closer to China, i.e. in other Asian countries, rather than moving supply-chain functions back to Europe.”

This article was first published on SCMP.