Malaysia ringgit rally: Importers cheer, tourism braces for slowdown, Singaporeans unfazed

Currency fluctuations are a double-edged sword, with some industries gaining while others losing, but analysts see the ringgit’s appreciation as a net positive for Malaysia.

An electronic board displays the currency exchange rate between the Singapore dollar and Malaysian ringgit at a money changer in Johor Bahru on Nov 17, 2025. (Photo: CNA/Zamzahuri Abas)

This audio is generated by an AI tool.

JOHOR BAHRU/SINGAPORE: The Malaysian ringgit’s rally to its highest level against the United States dollar in over a year has been a boon for Malaysian garment maker Chua Hunt.

Chua’s company, D&R Garments Manufacturing, has a factory in Xiamen, China, and the stronger ringgit has made it cheaper to import fabrics, allowing the firm to secure higher-grade materials at better prices.

“This cost improvement has meaningfully offset any headwinds from exports,” said Chua, D&R’s chief executive. “At the strategic level, this reinforces our commitment to quality upgrades and better margins, strengthening our company’s position.”

The company plans to take advantage of the stronger ringgit by accelerating procurement cycles, optimising production scheduling across Malaysia and China to maximise efficiency, and maintaining flexible pricing mechanisms with international clients to protect margins and remain competitive.

“The stronger ringgit is … an opportunity,” Chua said.

Meanwhile, Johor Bahru motorcycle dealer Yamaha Star Centre Singdeca Enterprise has seen more customers upgrading their rides and buying motorbikes with more horsepower as a result of higher spending power, said manager Hafiz Norzaman.

“We have seen customers coming from all over, including from (distant towns) like Kulai, Senai and Kluang to upgrade their bikes to a more comfortable model,” he said.

Buoyed by the ringgit’s strength, which has resulted in cheaper imports of bike and bike parts, the dealer has also been able to offer more attractive discounts to its customers.

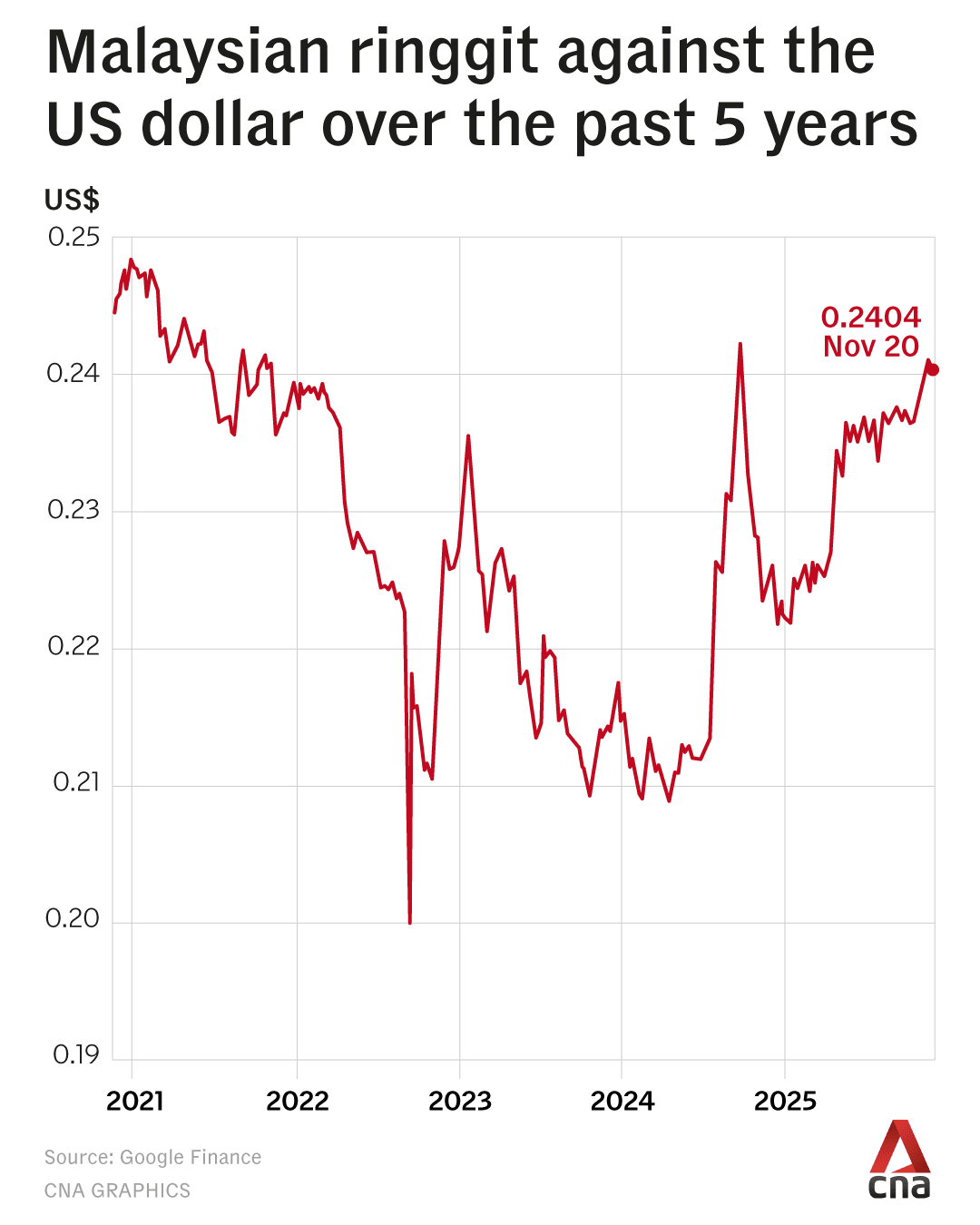

The ringgit’s rebound over the last two years has been stark. On Nov 11, it surged to RM4.16 for US$1, a contrast to February 2024 when it fell to its lowest level since the Asian Financial Crisis of the late 1990s, dipping to RM4.79 for US$1.

The Malaysian ringgit has also outperformed the Singapore dollar and on Nov 12 hit a low of RM3.1642 for S$1 - it’s strongest level in more than a year - according to a Maybank report published last week.

While currency fluctuations are a double-edged sword – exporters and tourism players could see weaker demand with a stronger local currency – analysts see the ringgit’s appreciation as a net positive for Malaysia.

The stronger ringgit reflects a combination of external factors and domestic fundamentals, they told CNA.

REASONS FOR RINGGIT’S RALLY

Anticipation of interest rate cuts next month by the US Federal Reserve and in 2026 “appears to be the main driving force” for currency appreciation for the stronger emerging markets including Malaysia, said Mohd Afzanizam Abdul Rashid, chief economist at Bank Muamalat Malaysia.

The US is trying to address a weakening labour market and elevated inflation, and latest media reports suggest its Federal Reserve officials are divided over whether to reduce interest rates in December. In general, higher interest rates increase the value of a country’s currency.

A smaller interest rate gap between US and Malaysia will improve the ringgit’s appeal, Mohd Afzanizam said, as investors start moving money out of USD assets into other markets like Malaysia.

The Malaysian government's efforts to narrow fiscal deficits from 4.1 per cent of gross domestic product (GDP) over the first nine months of 2024 to 3.3 per cent of the first nine months of this year has also contributed to the ringgit’s appreciation, he added.

“The ongoing fiscal consolidation exercise has led to improving finances following the implementation of several measures on taxes as well as subsidies rationalisation,” he explained.

“This is deemed credit-positive, which has enticed the risk appetite among the fixed-income investors,” he said, adding that they would buy more ringgit assets such as bonds or equities.

Malaysia Prime Minister Anwar Ibrahim affirmed in Parliament on Tuesday that fiscal discipline and systematic management of the economy have enabled the ringgit to record the best performance in Asia this year.

Anwar told Parliament in October the ringgit strengthened against several regional currencies, gaining 9 per cent against the Indonesian rupiah, 6.6 per cent against the Philippine peso, 3.5 per cent against the Chinese yuan, 1.5 per cent against the Japanese yen and 0.8 per cent against the Singapore dollar, according to media reports.

He highlighted targeted subsidy measures, including adjustments to RON95 petrol prices, which he said have had a “positive impact” on the ringgit, local media outlets reported.

Cassey Lee, senior fellow and coordinator of the Regional Economic Studies Programme at Singapore’s ISEAS-Yusof Ishak Institute, said the ringgit’s rise has been supported by strong export growth, underpinned by expectations that the momentum will continue, especially with the reciprocal trade agreement between Malaysia and the US.

The rise is expected to continue next year.

OCBC senior ASEAN economist Lavanya Venkateswaran noted that while the pace of the ringgit’s appreciation could slow in the short term, the upward trend is set to continue as long as Malaysia’s fundamentals remain strong and the US dollar does not rebound sharply.

OCBC’s forecast is for the ringgit to reach 4.16 to US$1 by end-2025, and 4.04 by end-2026, she said.

“If the US economy weakens moderately further and the US Federal Reserve responds by cutting its policy rate, it is likely that the ringgit might continue to strengthen,” said Lee of ISEAS-Yusof Ishak Institute.

Malaysians have already been flocking to money changers to get more bang for their ringgit, exchanging it for currencies like the Japanese yen, Chinese yuan, Thai baht, Vietnamese dong as well as the Indonesian rupiah. Holding these currencies now may yield more value if the ringgit drops in value in the long term.

Johor Bahru-based Sabahan Mado, who was changing some ringgit to rupiah this week told CNA: “It’s better to change now when the ringgit is strong. If it gets stronger, I will change more. It's the smart thing to do.”

SINGAPORE DEMAND SET TO HOLD UP

Businesses set to see some downsides from Malaysia’s stronger currency include tourism players and exporters.

Johor hotels are bracing for a 25 per cent dip in tourism in the coming festive season compared to previous years, said Malaysian Association of Hotels Johor chapter chairman Ivan Teo.

This is due to an expected drop in tourists from Indonesia and Thailand, which are Malaysia’s third- and fourth-highest sources for international arrivals in recent years.

“Tourists from these countries who come to Malaysia tend to be more sensitive to the currency fluctuations, and therefore we have seen weaker demand from them,” said Teo.

Visitor arrivals from Singapore, however, have remained steady, and this is likely because Singapore tourists have higher purchasing power and are less sensitive to the ringgit's appreciation, he said.

“Demand from Singapore continues to be strong and we don’t expect it to change ahead of the school holiday season (beginning this week),” he added.

Johor Tourist Guides Association chairman Jimmy Leong agreed that demand from Singapore visitors has been steady while that from Indonesia and Thailand has “dipped slightly”.

“For Singaporeans, it’s still value for money to shop, engage in gastronomy tourism, medical tourism and other sectors (in Malaysia),” he said.

From around RM3.5 per S$1 in January 2024, the ringgit rose to RM3.19 per S$1 on Thursday (Nov 20).

Singapore visitors in Johor Bahru said the stronger ringgit has not deterred them from crossing the Causeway.

Edmund Lee, a Singaporean who works in the finance sector, said he would still enter Malaysia roughly every three weeks to buy groceries and meet some friends in Johor Bahru for meals.

“For me, it doesn't matter because I don't spend much here,” said Lee. “Even if you (spend 500 or 1,000 ringgit), … (the) difference is about 20 ringgit or whatever.”

Singaporean Mohd Taufik Mustafa said he only felt a “slight difference” after spending RM300 to RM400 on a grocery run. “It's not like when the exchange rate was RM3.09, RM3.02, or RM2.80 (to S$1), then it would be more noticeable.”

Businesses in Johor Bahru who depend on a Singapore clientele have seen little impact.

At Legend Car Wash, located less than a kilometre from the Woodlands Causeway, the number of customers from Singapore has been unchanged, said manager Ramesh Ponnayah. More than half of its patrons are Singaporeans.

“They still choose to spend money here,” said Ramesh.

REACHING OUT TO NEW MARKETS

Malaysian tourism players, however, said they would be proactive in making up for the decrease in demand from certain countries.

Teo said tour companies are now keen on promoting packages to Chinese tour agencies as tourists from China, like Singaporeans, are less sensitive to the movements of the ringgit.

“We are trying to work with partners in Guangzhou to bring in tourists directly to Johor, as there are already direct flights to Senai Airport,” he said.

With Malaysia targeting 47 million visitors as part of its Visit Malaysia 2026 campaign, Leong said tour companies should not be deterred by a stronger ringgit.

“We have to also look at it from another perspective - with the stronger ringgit, it's cheaper for us to do promotion and marketing in other countries,” he said.

As for Malaysian exporters, economist Lee Heng Guie said furniture and glove makers that use raw materials originating from Malaysia are among those that will face challenges.

“They would face a double-whammy impact due to the strong ringgit (making products costlier for their overseas customers) and the 19 per cent tariffs imposed by the US,” said Lee, executive director of the Socio-Economic Research Centre.

Car rental service provider Wahdah, one of Malaysia’s largest, encapsulates the mixed effects of a stronger currency.

Chief executive Muhd Raden Anwar had initially thought a stronger ringgit would make it cheaper to import vehicles and maintenance spare parts from countries like Japan and China.

But the cost savings have turned out to be “modest rather than dramatic”, he said.

Wahdah has, instead, seen fewer bookings by foreigners this year, said Muhd Raden without providing figures. More than half of its active customers are from overseas and Singapore, Indonesia and Thailand are important markets for the company.

“This might be because some … travelers are still 50-50 with the current currency situation. As the ringgit strengthens, their purchasing power narrows, and some families may be more cautious with discretionary spending,” he said.