analysis Asia

Why is Thai tourism stuttering and will its renewed focus on ‘quality over quantity’ work?

Thailand could miss its tourist arrival target for 2025, but authorities are placing more value on “quality” tourists who spend more. The strategy could be challenging, say experts.

This audio is generated by an AI tool.

BANGKOK: Consistently the crownholder of Southeast Asia’s most visited country, Thailand came close in 2019 to a symbolic threshold it had never reached before: 40 million tourists.

It narrowly missed the mark but six years later, it is nowhere close to recreating that golden period for one of the country’s most important industries.

It was overtaken by both Malaysia and Japan in terms of international arrivals in 2024, which welcomed 38 and 36.9 million visitors last year, compared to Thailand’s 35.5 million.

Four years after reopening its borders following the COVID-19 pandemic with the hope that tourists - especially from China - would flood back, Thailand is once again recalibrating its tourism strategy.

With its international tourism industry dipping, Thailand is now doubling down on a “quality over quantity” gameplan, with a focus on higher-spending visitors.

The Kingdom has been promoting this approach since 2018, but its recent resurgence as one of five strategies outlined by Tourism and Sports Minister Sorawong Thienthong at the Thailand Tourism Forum earlier this year stresses deeper and more meaningful experiences over large volumes of visitors.

The Thailand Tourism Authority (TAT) is also shifting its focus to markets like Europe, the United States and the Middle East to fill the void left by China, whose numbers have largely evaporated since the pandemic.

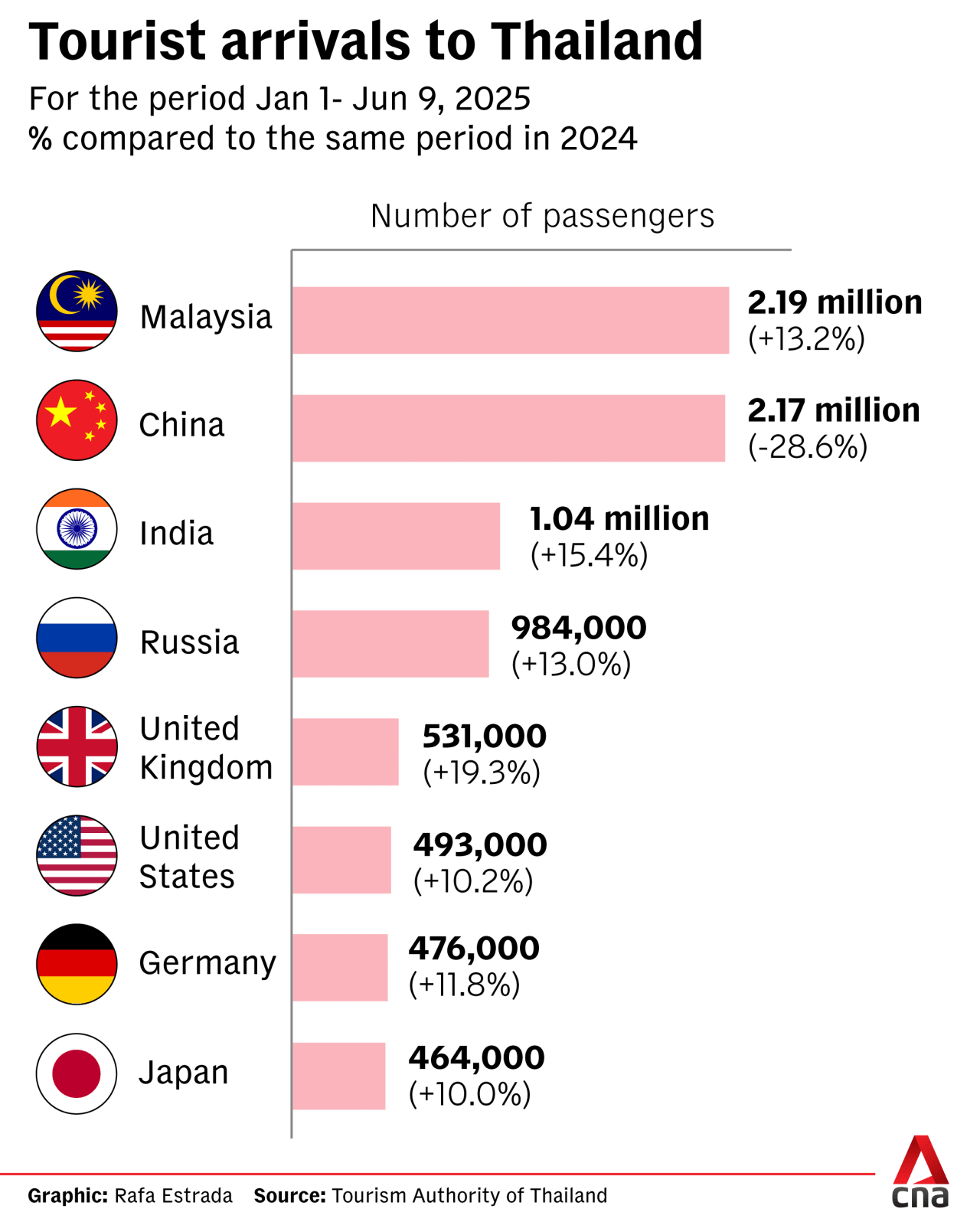

The TAT announced in June that tourist arrivals between Jan 1 and Jun 9 from a number of countries had risen, compared to the same period last year. These included Germany, Italy, multiple Gulf nations, the United Kingdom and Australia.

“These are high-purchasing-power travellers, exactly the type of tourists Thailand’s revised strategy is now prioritising,” TAT governor Thapanee Kiatphaibool said.

It has been pushing new and tactical long-haul air routes, promoting sports tourism and cultural festivals and focusing more on eco-tourism.

But with geopolitical tensions rippling across travel corridors and economic uncertainties lingering, experts have questioned whether Thailand risks chasing shadows instead of focusing on developing a long-term sustainable tourism industry.

“2025 is a pivotal point really in the recovery from the pandemic where Thailand does need to rethink what it's doing,” said Gary Bowerman, a tourism policy and consumer trends analyst.

“This isn't going to be a quick turnaround,” he said.

The country is set to miss its own target of 39 million foreign arrivals in 2025, a number still down on the peak of 2019 (39.8 million). This followed the 38.3 million foreign visitors who visited the Kingdom in 2018.

Tourism began recovering from the pandemic in 2022, with 11 million arrivals. This more than doubled in 2023 to 28.2 million.

TAT now aims to simply match last year’s total arrivals figures of 35.5 million, despite the first half of this year’s numbers being sluggish, 3 per cent down on the same time last year.

Achieving the downsized goals would still require consistent performance from long-haul markets.

That is far from guaranteed, given the potential impact of tariffs on the global economy, consumer confidence issues and “sheer accessibility” following air route disruptions of recent weeks due to conflict in the Middle East, said Hannah Pearson, the founding partner of tourism consultancy firm, Pear Anderson.

“The danger for Thailand is that they could see a drop not only from China, their main source market, but also from European long-haul markets, too, who typically stay longer and spend more than short-haul and domestic visitors,” she said.

The TAT has been promoting its quality over quantity strategy since 2018, yet in the same period has also pushed for continuous growth and even targeted as many as 68.5 million arrivals in 2028.

It has industry analysts like Wolfgang Georg Arlt, the executive director of the non-profit Meaningful Tourism Centre, questioning if Thailand’s sustainable growth policies are sincere.

“It is not entirely convincing that the renewed proclamation of ‘we do not want too many visitors anyway’ is not just a ‘the grapes are too sour’ attitude,” he said.

Bowerman said Thailand needs to stop making “rash predictions”, which when they fail to eventuate, can spook industry stakeholders.

“That magical 40 million is something that the country doesn't need to try and strive to surpass anymore,” he said.

“It has to actually roll back a bit and look at what it's got. How can it leverage more from what it already has?”

THE MISSING CHINESE

There is little to show for efforts in recent years by Thai authorities and industry players to court Chinese tourists.

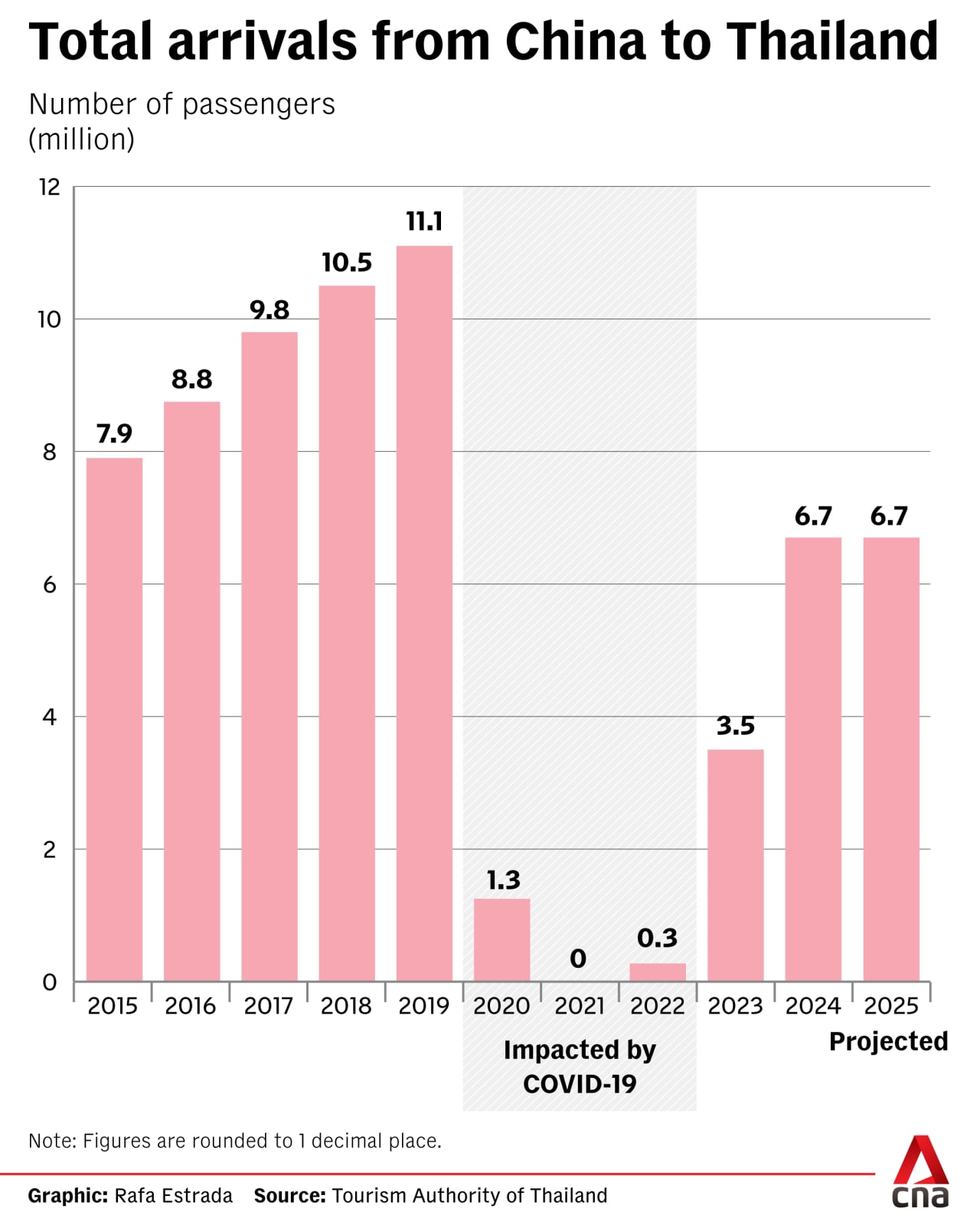

In 2019, 11.1 million visitors from China arrived in Thailand. In the first five months of 2025, the number is less than 2 million, down nearly one-third from 2024.

But Thailand cannot afford to forsake the Chinese tourist market, experts say, despite several years of poor performance that is dragging down the country’s entire industry.

It is a “main concern” for the Thai tourism industry, said Bjorn Courage, the president of the Phuket Hotels Association.

There are multiple and complex reasons why a once-reliable source of visitors and revenue has dried up.

Principally, experts observed, Thailand is not viewed as a safe destination. The kidnapping of Chinese actor Wang Xing, who was lured to a Myanmar scam compound when visiting Thailand in January, has raised a “scare factor” around the kingdom,” Bowerman said.

Popular Chinese films like "No More Bets", which tells a story of human trafficking victims lured from China to an unnamed country that resembles Southeast Asia, released in 2023, also significantly dented arrival numbers at the time.

The shooting of a Chinese national in Bangkok’s luxury Siam Paragon mall the same year also caused perceived safety concerns and saw a contraction in arrivals.

“With the latest Thailand-Cambodia border conflict, it could perpetuate the idea of Thailand being an unstable country to visit,” Pearson said.

Recent political street protests, uncertainty about the unity of the Thai government and the discovery of suspected explosive devices in two southern tourist provinces last week are likely to add to the tourism sector’s woes.

“This is a vital time to engage Chinese travellers ahead of the upcoming summer school holidays, one of the most important travel periods of the year. These factors will increase the uncertainty and nervousness that have been evident in the Chinese market,” Bowerman said.

Beyond this issue, the dynamic of Chinese outbound travel has shifted, he said, meaning mass group travel, including chartered flights from lower-tier cities in China, is likely a thing of the past.

It has not stopped Thai authorities from ramping up efforts to win over the lucrative Chinese market using tactics that worked in the past.

In April, the Association of Thai Travel Agents urged the government to spend close to US$10 million to subsidise 1,000 flights over three months from 20 Chinese cities to create buzz around Thailand as a destination.

TAT said it was seeking funding for a similar scheme called the "Thailand Summer Blast - China & Overseas Market Stimulus Plan".

Other strategies are also afoot. In recent months, the TAT has teamed up with technology company Baidu to try and strengthen Thailand’s tourism appeal among “high-quality” Chinese travellers.

It focuses on digital marketing and AI-powered travel insights.

It also ran the "Sawadee Nihao" campaign in late May, inviting hundreds of travel agents, media representatives and influencers to Thailand to see how safe and inviting the country was.

“At the moment, it's not reaping rewards,” Bowerman said of such initiatives.

“If you speak to Chinese tourists, there’s a real affinity, a fondness for Thailand, but there's also the feeling that it hasn't really kicked on, it hasn't invested, that it's still the same as it was 10 years ago in many ways,” he said.

Arlt said that domestic economics in China means fewer first-time international travellers are entering the market. And more potential repeat Chinese visitors may feel they’ve “ticked it off as done” when it comes to Thailand, he said.

“Thailand would need to tell you why you should go to Thailand again. It’s out of fashion in China and has not done much to change that. Lower prices are not the answer,” he said.

Trying to attract gamblers by legalising entertainment complexes with casinos could also backfire, said Pipat Luengnaruemitchai, chief economist at Kiatnakin Phatra Securities.

A draft law on the matter is set to be debated in the next session of the Thai parliament, with the country eyeing opening four casinos in four locations - Bangkok, Chonburi, Chiang Mai and Phuket.

“We’ve heard the story that the Chinese leader may not be very happy about Thailand having a casino for Chinese to come to. But even if it's approved today, it's probably not going to be operational in five, six years so in the meantime, challenges remain,” he said.

With a new breed of Chinese traveller with different priorities, Thailand has to innovate to survive, said Krittinee Nuttavuthisit, an associate professor of marketing at the Sasin School of Management at Chulalongkorn University.

Younger, independent Chinese travellers now seek unique, authentic experiences rather than standard package tours, she said. And to attract them, Thailand should move beyond conventional offerings and focus on delivering fresh, engaging travel experiences that highlight local charm and foster deeper community connections.

WHAT DOES QUALITY MEAN?

Behind the “quality over quantity” slogan lies a deeper ambiguity about what quality really means in practice.

How Thailand positions itself - and the type of traveller it wants to attract - is proving to be a pressing challenge.

For many in the hospitality sector, the term can be equated with luxury: High-spending travellers booking premium hotels, fine dining experiences and private transfers. Thailand has asserted itself in these areas in recent years.

“The perception of Thailand as a budget destination is increasingly outdated,” said Ian Di Tullio, Chief Commercial Officer at Minor Hotels, an international hotel group headquartered in Bangkok.

He said that Thailand is now a global leader in experiential wellness, design and gastronomy, citing the luxurious spotlight cast on the country by its starring role in the HBO series, White Lotus, the six Bangkok entries on the latest World’s 50 Best Restaurants list and the potential to host a Formula 1 grand prix in 2028.

The government is also making upgrades to infrastructure like its airports, rolling out high-speed rail projects and digital visa systems that simplify entry.

“Premium travellers expect premium service at every touchpoint,” Tullio said.

Courage highlighted major infrastructure upgrades under consideration in Phuket, such as the Kathu-Patong Tunnel and nationwide connectivity projects including a new luxury train between Bangkok and Chiang Mai as examples of the government trying to “balance growth with quality”.

Thailand has fostered and developed an “incredible soft power” over many decades and has successfully catered to everyone, from backpackers to luxury travellers, as a country with culinary, cultural and natural riches, Pearson said.

Without necessarily pivoting away from that, it must do more than equate quality with high spend, she argued.

“Luxury travellers have the high spend,” she said, “but it does not necessarily translate into revenue for the local community.”

Krittinee agreed, saying that the strategic policy shift should elevate the overall quality of the tourism experience for everyone involved: Communities, businesses and visitors alike.

She cited certain community-based tourism projects in Bangkok, Chiang Mai and Phuket, such as those run by social enterprise Local Alike, as examples of how value can be redefined beyond price tags.

It offers immersive visits to local communities, who are empowered to manage their own projects and build their tourism capacity from the bottom up.

“It’s about creating experiences that are meaningful, responsible and inclusive where both locals and tourists benefit, and where tourism supports rather than strains local environments and societies,” she said.

Despite these successes, most initiatives remain small and limited in reach, she said, and required more promotion and visibility.

RELYING ON NEW MARKETS - COMPETITION IS HIGH

Thailand is facing the running task of rebranding in a world that is less predictable and more competitive than ever.

Southeast Asia has become a “hyper-competitive space” for international tourists, Pearson said, with destinations like Malaysia and Vietnam courting the same travellers Thailand hopes to lure.

Tourism Malaysia has embarked on roadshows and was the “preferred destination” at one of the biggest travel trade shows in China in May. The country also extended its visa-free entry policy for Chinese nationals for another five years.

Vietnam has expanded its e-visa policies, increased direct flights and reopened train services running between Nanning and Hanoi in May, which had been suspended for five years.

“But neither of them are actually doing anything particularly well. It’s just perhaps that there is a bit of a shift from Thailand,” Bowerman said.

Chinese have not stopped travelling; their outbound numbers are projected to exceed those from 2019, according to marketing technology company, China Trading Desk.

There is now fiercer competition, regionally and globally, for their spending power that Thailand is missing out on.

“The game has changed since the pandemic. Any country’s loss is another country’s gain,” Pearson said.

It means Thailand has to fight harder to retain its market share. Other countries are making major investments to woo travellers from around the world, Bowerman said, highlighting efforts from the Middle East, Central Asia, Japan and South Korea to attract visitors at the expense of Southeast Asian countries.

“You need to both look at your acquisition strategy, look at the front door. How do you open the front door to more tourists? But you've got to lock your back door, and that's what I don't think Southeast Asia is doing at the moment. It's not looking enough at retention,” he said.

The Thai economy is feeling the impacts of a vanishing Chinese market - total tourism revenue projections for 2025 have also been dropped by the TAT to US$60 billion from US$69 billion. In 2024, tourism accounted for approximately 12 per cent of Thailand's GDP.

Pipat noted that Thailand’s economic growth was still disproportionately tied to tourism recovery, creating “big headwinds”.

“The strong engine of growth is being shut down. So this is a key concern, both in terms of domestic consumption and the economy in general. Businesses are actually suffering from this,” he said.

At the same time, doubts swirl over whether elite tourists from Europe, India or the Middle East can fill the void; while the latter two are rising in profile, they remain small in absolute numbers.

In a world shaped by shifting allegiances, economic headwinds and geopolitical turbulence, Thailand may not be able to rely on any single market again. Yet even as authorities promote new markets and premium branding, few deny that the Chinese market remains irreplaceable.

“You have to continue trying to work the Chinese market. That's just inevitable for a Southeast Asian country,” Bowerman said.

“You wouldn't disregard the Chinese market. It's too valuable.”