OCBC to raise interest rates again for 360 savings account

An OCBC bank outlet in Singapore. (File photo: iStock)

SINGAPORE: OCBC Bank will raise interest rates again for its flagship 360 savings account, following a similar move in August.

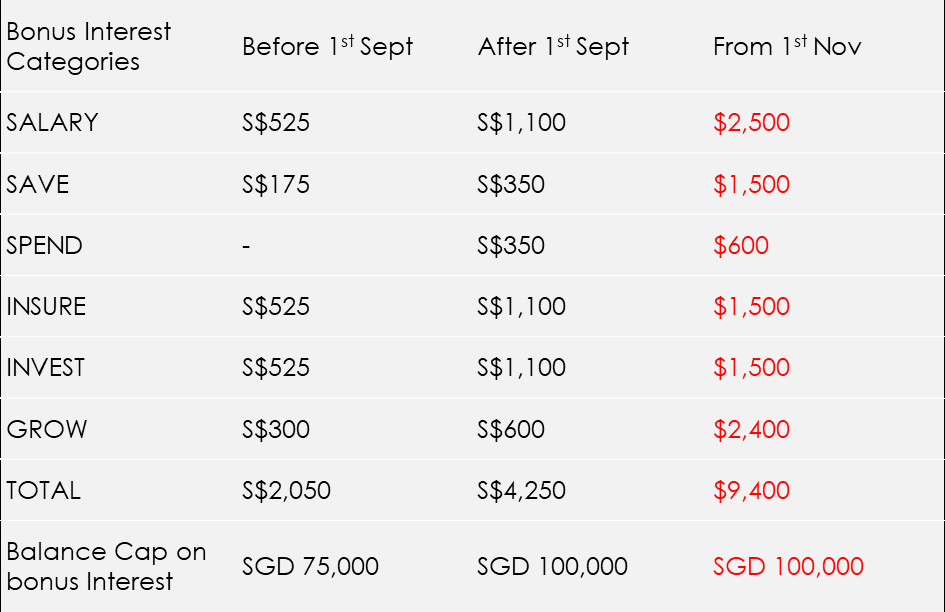

Customers will be able to earn an interest of 4.65 per cent per year from Tuesday (Nov 1) on the first S$100,000 in their account - an increase from the current 1.85 per cent - when they credit their salary, save and spend with the bank.

This is the highest level of interest in the history of the 360 savings account, said OCBC in a media release on Monday.

The criteria in the three categories - salary, save and spend - remain unchanged.

To qualify for the higher interest rates, customers must credit a salary of at least S$1,800 through GIRO, increase their account balance by at least S$500 a month, as well as spend at least S$500 on selected OCBC credit cards.

The pool of eligible cards will be widened for the spend category, to include the OCBC Titanium Rewards credit card, OCBC 90°N Visa card and OCBC 90°N Mastercard.

Those who meet the requirements for two more categories – Wealth (Insure) and Wealth (Invest) – can earn an interest of 7.65 per cent per annum on the first S$100,000 in their bank account from Nov 1, an increase from the current rate of 4.05 per cent.

“This round of enhancements will immediately benefit the seven in 10 OCBC 360 Account holders who already earn bonus interest from at least one category," said OCBC's head of wealth management Singapore Tan Siew Lee.

"And our move to bring a wider range of OCBC credit cards into the OCBC 360 Account construct will enable more customers to benefit from the spend category without any additional effort on their part."

Amid an environment of high interest rates, banks in Singapore have been making a push to remain competitive in the fight for deposits.

UOB also announced higher interest rates for its flagship savings account in August, while DBS raised rates for its signature Multiplier account.