Commentary: Budget 2024 - Revised property tax will lighten the load for first-time home buyers

The new property tax changes will significantly reduce the costs of owner-occupied residential properties in the coming years, says NUS Business School's Sing Tien Foo.

HDB flats in Toa Payoh at night. (File photo: CNA/Jeremy Long)

This audio is generated by an AI tool.

SINGAPORE: Unlike buyer's stamp duty and additional buyer's stamp duty, which are taxes on transactions, property tax is a form of wealth tax, which contributes a steady source of revenue to the government coffers to fund social, infrastructure and development, defence and other expenditures.

Two years ago in his maiden Budget speech, Finance Minister Lawrence Wong announced a two-stage increase in property tax rates for residential properties. This was meant as a wealth tax, targeted at all investment properties, as well as the higher-end segment of owner-occupied private properties.

Those changes, coupled with the stiff rising rental market resulting from strong demand and COVID-19-related supply constraints, caused a double whammy not just to property investors, but to the wider market.

Housing rents in some Housing and Development Board (HDB) flats rose by more than 50 per cent, even in non-mature estates such as Woodlands, Sembawang and Sengkang. The Urban Redevelopment Authority (URA) non-landed rental index also rose by 45 per cent between the first quarter of 2021 and the second quarter of 2023.

During the broad-based increase, it would have been possible for investors to pass on some of the tax costs to tenants by increasing rents. However, home owners who used their properties for their occupation purposes would have had to bear higher taxes, driving up their living costs.

"We had originally expected the property tax changes to impact mainly the top 7 per cent of owner-occupied residential properties. The annual value increases resulted in the proportion of affected owner-occupied properties nearly doubling to 13 per cent," Mr Wong said in his Budget 2024 speech on Friday (Feb 16).

YOUNG HOUSEHOLDS TO BENEFIT

Property taxes are calculated based on annual value (AV), which is the estimated yearly rent if a property were rented out. Staggered rates mean owners pay more taxes for expensive properties compared with cheaper ones.

Last year, the government announced a one-off tax rebate of up to 100 per cent for owner-occupied homes, capped at S$1,000, to help cushion the impact of rising costs. It will continue to monitor the market and provide another rebate next year if needed, Mr Wong said on Friday.

Meanwhile, the new property tax revisions announced by Mr Wong, which will take effect from January next year, will help further alleviate rising costs of home ownership, especially for young households who collected the keys to their new HDB flats in the last few years.

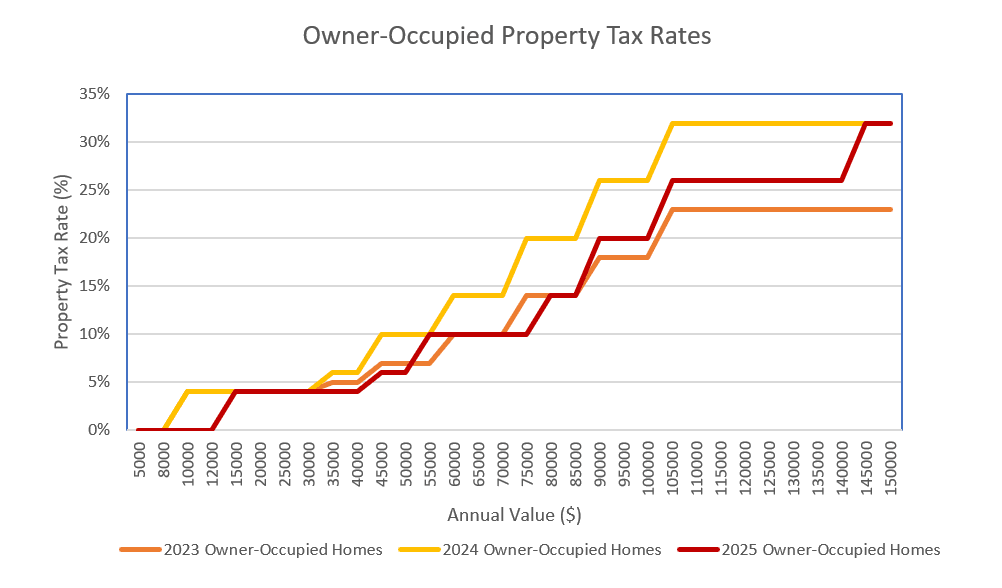

The revisions do not change the tax rates but widen the bands at both tails of AV distributions. At the lowest band, where the property tax rate is 0 per cent, the threshold will be raised from S$8,000 to S$12,000. The AV for the highest 32 per cent band will be raised to over S$140,000, from over S$100,000 currently.

The figure below illustrates the changes in the tax rates in the last three rounds of revisions.

A TIMELY RELIEF

The tax revisions do not affect rental (non-owner occupied) properties. However, the increases in the completion of new private properties and HDB flats in the last two years have, to some extent, eased the tight rental market. The URA private property rental index has shown a decline of 1.8 per cent in the last quarter of 2023.

The new property tax changes will significantly reduce the costs of owner-occupied residential properties in the coming years.

The lower property costs are unlikely to have a direct impact on new property prices. However, to many young families who have just bought their first homes, this tax revision is a timely relief to reduce the financial burden of these first-time home owners.

Sing Tien Foo is the Provost's Chair Professor of Real Estate at Business School, National University of Singapore. The views and opinions expressed here are those of the authors and do not represent the views and opinions of the National University of Singapore, its subsidiaries, or affiliates.