Commentary: This bullish property market will not last forever

Unlike sellers who enjoyed significant capital gains post-pandemic, new home owners must raise the upfront cash and CPF required for a property purchase, or participate in a competitive rental market, says real estate agent Jooann Tay.

General view of private and HDB properties in Singapore. (File photo: TODAY)

SINGAPORE: Global uncertainties have reached unprecedented levels as political tensions, high inflation and interest rates persist. But even as the value of stocks and cryptocurrencies plunged, the Singapore property market has maintained strong momentum.

Post-pandemic, the property market has woken up from a seven-year slumber, with the last peak in 2013. Private residential and Housing Development Board (HDB) resale prices have risen more than 20 per cent from the third quarter of 2019 to the same period in 2022, according to Urban Redevelopment Authority (URA) and HDB data.

The key drivers of peak prices come mainly from a lack of immediate housing supply. The wrath of COVID-19 has left our construction sector with labour shortages and supply chain disruptions, resulting in delayed project construction and a prolonged median wait-time of 4.3 years for new Built-to-Order (BTO) supply.

To rein in demand, Singapore on Sep 30 introduced a slate of cooling measures including tighter borrowing criteria and wait-out periods for private home owners buying HDB resale flats.

FIRST-TIME HOME BUYERS FACE THE MOST DIFFICULT PREDICAMENT

Record-high prices may suggest that Singapore property is now a seller’s market. This may not be entirely true when sellers are also seeking to replace their homes.

But unlike sellers who may have enjoyed significant capital gains post-pandemic, new home owners must now raise the upfront cash and Central Provident Fund (CPF) savings required for a property purchase, or otherwise participate in a competitive rental market.

On the ground, my team has seen more locals applying for rentals, with a sizeable number citing the need for interim housing. Most of these renters are waiting for their new homes to be ready while others rent because of “buyer’s fatigue”, where they experience mental and physical exhaustion from house-hunting.

That exhaustion stems mostly from the tough battle between rising prices and interest rates, which takes a hit on housing affordability. Gone are the days of sub-zero financing as fixed home loan interest rates surge past 4.25 per cent.

BUYERS AND SELLERS EXPECT A CORRECTION SOON

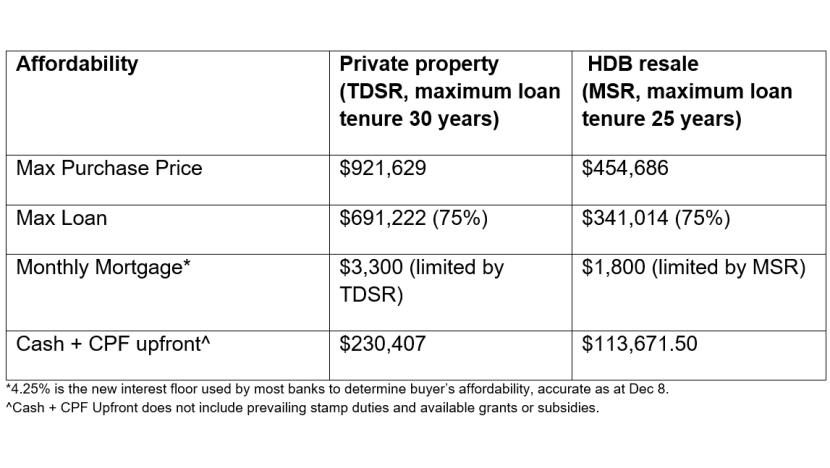

Resale HDBs may appear to be the favourable option when we compare them with private residential homes – contrasting mortgage servicing ratio (MSR) for HDB flats and total debt servicing ratio (TDSR) for private homes in the table below – when calculating affordability for a S$6,000 income household.

But one has yet to consider the significant COV (Cash Over Valuation) common in bullish markets – where HDB’s valuation of the property is lower than the purchase price.

Realistically, this individual or couple earning S$6,000 a month would only be able to afford a 4-room flat in older HDB estates, which has a price tag of around S$400,000. The shorter leases of such units – under 60 years – come with pitfalls for buyers, as Bala’s Curve (the informal name for how the Singapore Land Authority determines the value of HDB flats) shows that your HDB flat depreciates more quickly towards zero with time.

And for those looking to sell their HDB flat, profit is not guaranteed. As supply stabilises and the market corrects, your HDB flat’s price will decline with age. One of our clients held on to their flat for over 20 years, only to make a negative sale due to accrued interest compounding over time.

After cooling measures were announced in September, buyers are becoming more apprehensive about the property market, with a general sentiment that a correction will come soon with the onset of global recession.

RISING RESALE PRICES RAISE QUESTIONS ABOUT WEALTH PRESERVATION

We need to understand that the bullish market will not last, especially for HDBs. The sky-high prices of resale HDBs have been driven by sellers, who managed to cash out handsomely when demand for immediate housing surged post-pandemic.

These premiums will be eroded gradually as the 100,000 new flats launched from 2021 to 2025 are eventually injected into the resale market within the next decade.

Wealth preservation will be a question then. Will the high price you pay today for that resale flat with a shorter lease be worth more than a newer flat with a freshly completed minimum occupation period (MOP)?

The Prime Location Public Housing (PLH) model launched in November 2021 is another reminder to the public that HDB flats – especially those located in desirable neighbourhoods – are not speculative assets.

The PLH model encourages higher owner-occupation intent by having stricter conditions such as a 10-year MOP and tighter rent conditions post-MOP. It also deters buyers from investing in prime-location flats by requiring that they pay a percentage of the resale price to HDB.

Amid concerns over rising resale prices, the question of whether HDB owners should be required to sell their flats upon buying private property has been raised in Parliament. It seems like a sound recommendation for floating ready housing supply into the resale market.

Public housing should remain affordable. HDB’s steps towards explaining how BTO flats are priced, along with the enhanced MOP and transparent profit-taking under its PLH model are all welcome.

However, our high resale prices need to be curbed or a bigger problem may present once ramped up BTO supply comes on the market.

It may also be worthwhile considering raising income ceilings on HDB loan eligibility, mainly for BTOs and executive condominiums. This will provide more first-time home owners access to public housing, given that they are often the most vulnerable to getting priced out of the property market.

Jooann Tay is a licensed real estate salesperson and content creator behind the channel House Hunt with Joo.