Commentary: Nvidia’s icy reception in China is buying time for Huawei

Beijing is putting on a show that it doesn’t want American chips, says Catherine Thorbecke for Bloomberg Opinion.

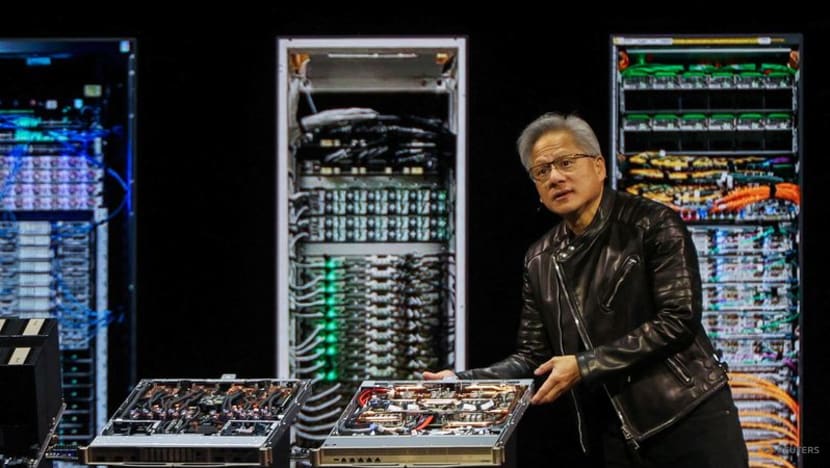

Nvidia CEO Jensen Huang delivers the keynote for the Nvidia GPU Technology Conference at the SAP Center in San Jose, California, US on Mar 18, 2025. (File photo: Reuters/Brittany Hosea-Small)

TOKYO: Don’t be fooled by China’s icy response to America’s policy reversal that will allow a key Nvidia artificial intelligence chip back on the mainland.

The country’s AI ambitions currently rely on Nvidia’s hardware, and authorities know that – even if they won’t admit it. But by fanning fears of alleged security or environmental concerns, they’re buying time for Huawei to catch up while keeping trade talks pressure on the US.

CEO Jensen Huang was greeted with fanfare by industry leaders in Beijing last month after news broke that the Trump administration will allow the sale of H20 chips to resume. It seemed like China got what it wanted: Loosening export controls designed to hold back its AI sector has been a key sticking point during tariff negotiations.

Yet in the weeks since the announcement, cyber authorities have summoned Nvidia to discuss alleged security risks related to the H20s, state media warned of potential backdoors that could cause a “nightmare”, and the government urged local companies to avoid using the much sought-after processers for AI development.

When asked about Beijing’s unexpected reaction, US Treasury Secretary Scott Bessent told Bloomberg TV that it “tells me that they are worried about the Nvidia chips becoming the standard in China”. This is an optimistic and simplistic take. It’s too soon for Washington to be celebrating over this feigned angst.

CHINESE COMPANIES UNLIKELY TO STOP BUYING H20S

Nvidia’s tech stack is already, overwhelmingly, the standard in the nation’s AI sector. There’s a reason that giants from Bytedance to Alibaba stockpiled billions of dollars’ worth of orders ahead of the now-reversed ban. Similarly, it seems a deliberate move that, despite all the talk of lurking threats, China hasn’t issued an outright ban itself.

While these warnings have drawn a lot of attention, they likely won’t be enough to deter companies eager to power their AI ambitions to stop buying H20s.

While a Communist Party mouthpiece did appear to blast alleged “backdoors” in these chips, and many Western news outlets ran with that headline, the reality is more nuanced. The made-to-go viral editorial in a People’s Daily WeChat account was far from an official rebuke, according to an analysis from the China Media Project.

Instead, it was meant to make Nvidia “squirm”. It worked. The Santa Clara-based chipmaker responded with a public denial of breaches and argued that adding any in the future would be “an open invitation for disaster”.

It’s true, as I’ve written before, that Beijing would very much prefer its AI industry to use offerings from Huawei instead of Nvidia. But the domestic alternatives aren’t ready for primetime – both in terms of performance and the quantity that can be produced.

Domestic AI champion DeepSeek was forced to delay the release of its new model because it was trying to train it on Huawei’s hardware instead of Nvidia’s, the Financial Times reported last week. But even with a team of Huawei engineers on-site, they couldn’t get it to work.

In an apparent compromise, DeepSeek is using Nvidia for training the model and Huawei for inference (the phase that involves running and deploying AI). It would be foolish for regulators to arrest DeepSeek’s momentum by not allowing it to use any US computing power at all.

TRUMP’S TRANSACTIONAL APPROACH

The most unusual aspect of this is still President Donald Trump’s announcement that Nvidia will pay the US 15 per cent of its revenue for AI chip sales on the mainland. It’s not hard to imagine the global backlash if such a pay-for-play deal had been set up by the other side.

But it also reiterates Trump’s transactional approach to these national security concerns. This isn’t lost in Beijing, especially at a time when the tariff truce has been further extended.

Beijing may be putting on a show that it doesn’t want America’s chips, but it’s really just building a bridge now until the domestic alternatives are ready. There are signs that this moment is approaching: Companies like buzzy startup iFlytek claim to have trained their models entirely with Huawei processers.

Still, most Chinese businesses much prefer Nvidia’s, in large part because of its supporting software system. Encouraging developers to build on top of Huawei’s rival platform over time is what will help improve it enough to eventually force a broader ecosystem shift.

When this turning point is reached, US-led export controls will lose much of their power. For Washington, a 15 per cent cut seems like an extremely low price to help smooth over this transition for China.