Commentary: Though inflation is easing, Singaporeans are still feeling the pinch

What makes a healthy inflation rate would depend on GDP growth and, more importantly, income growth, says OCBC chief economist Selena Ling.

More employees have returned to the office in the post-pandemic era. (File photo: iStock)

This audio is generated by an AI tool.

SINGAPORE: One does not need a Master of Economics to have felt acutely the recent impact of inflation. In the last few years, prices of everything from kaya toast to Certificate of Entitlement (COE) premiums have risen.

Core inflation, which excludes accommodation and private transport costs, averaged 2.3 per cent from 2020 to 2023, about double the 1.1 per cent seen in the pre-pandemic period of 2015 to 2019.

In January, core inflation came in at 3.1 per cent year-on-year, slightly lower compared with 3.3 per cent in December 2023 and a far cry from the 5.5 per cent peak seen in January 2023 and February 2023. Does this spell good news for the economy?

This current cycle of high inflation first started during the pandemic, with food and energy prices surging as a result of supply chain disruptions. These disruptions persisted after Russia’s invasion of Ukraine in 2022.

Singapore was not spared from the impact, but several rounds of monetary policy tightening since October 2021 have helped to mitigate imported inflation and partially shielded us from the worst effects seen in other parts of the world.

Singapore’s headline inflation peaked at 6.1 per cent in 2022 and pulled back to 4.8 per cent in 2023 while core inflation climbed from 4.1 per cent to 4.2 per cent over the same period. The main drivers of inflation were food, transport, and housing and utilities which accounted for 21.1 per cent, 17.1 per cent, and 24.8 per cent respectively of the consumer price index.

For 2024, the Monetary Authority of Singapore expects both headline and core inflation to ease to 2.5 to 3.5 per cent. However, we cannot be too quick to celebrate as there may still be some challenges in taming inflation.

A STORY OF TWO HALVES FOR 2024

Shocks to global food and energy prices, whether due to geopolitical conflicts or other supply-related disruptions, are always a risk, although an unexpected weakening in the global economy could also lead to a faster easing of cost and price pressures.

If we zoom out and consider the global outlook, we see a story of two halves for 2024: A lacklustre first half followed by some improvement in the second half on the highly anticipated easing of inflationary pressures, partly due to high base effects. This in turn will enable the easing of global monetary policy settings from the US Federal Reserve and the European Central Bank.

This could pave the way for other Asian central banks to embark on their own monetary policy easing as well. However, the inflation trajectory could be bumpy, as seen in the hotter-than-expected January consumer price index reading in the US, even as the unemployment rate rose to a two-year high of 3.9 per cent in February.

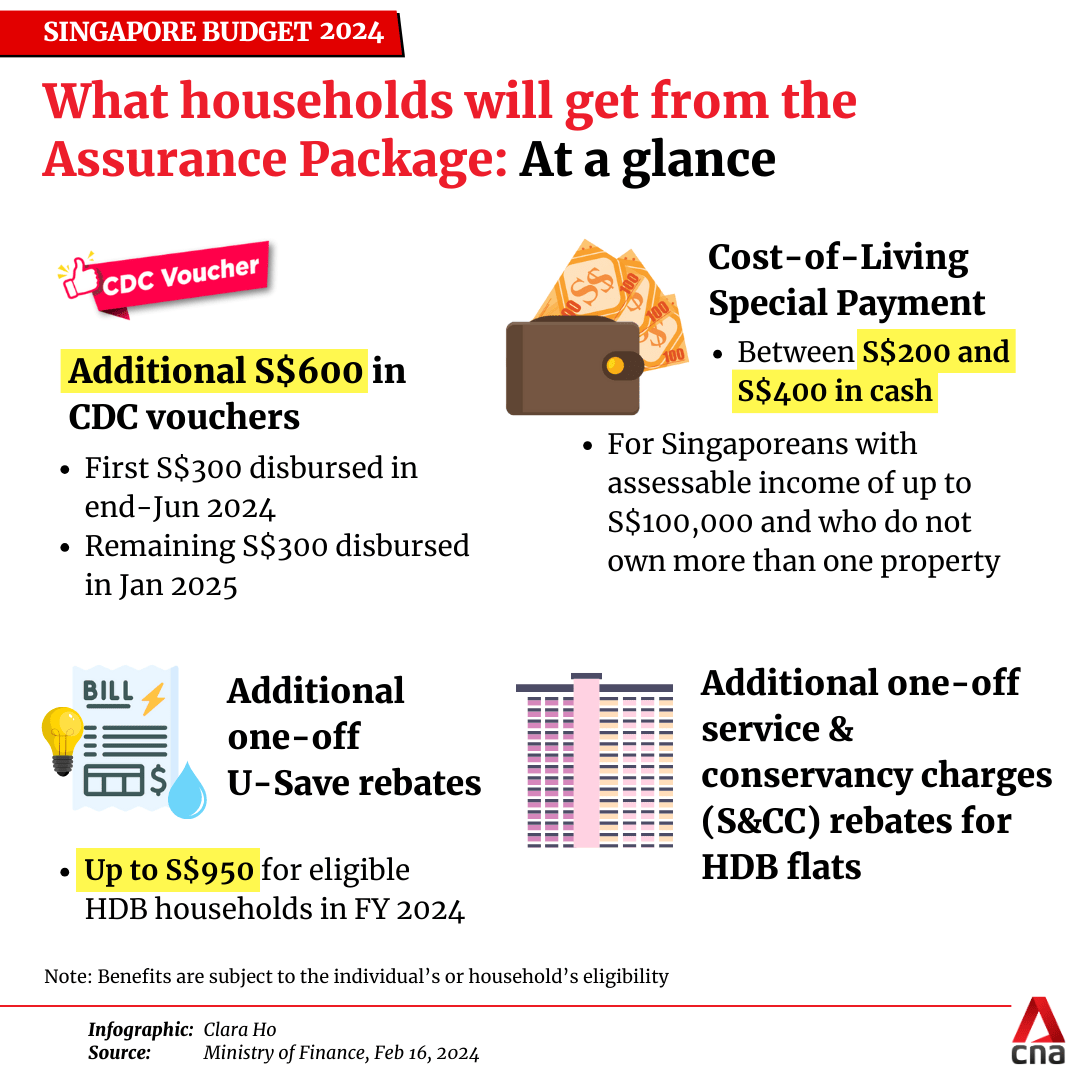

At Budget 2024, Deputy Prime Minister Lawrence Wong acknowledged that, while inflation was moderating, it remains on the high side. Hence, he announced handouts to provide near-term relief for cost-of-living pressures.

These include a one-off cash payment of between S$200 and S$400 (US$150 and US$300) for qualifying Singaporeans aged 21 and above, additional S$600 in CDC Vouchers for Singaporean households and extra U-Save rebates for HDB households.

Even so, Singaporeans are still likely to feel the pinch, exacerbated partly by the Goods and Services Tax hike to 9 per cent which took effect in January this year. Mr Wong highlighted that the best way to deal with inflation was to improve the productivity of businesses and workers, and to ensure real income growth.

NEED FOR GDP AND INCOME GROWTH

How does economic growth relate to inflation and the man on the street? A healthy and dynamic Singapore economy is underpinned by higher gross domestic product, with businesses seeing demand and producing goods and services, which in turn support employment, wages and innovation.

OCBC’s 2024 GDP growth forecast is 2 per cent, a modest improvement from 1.1 per cent in 2023. This is predicated on a global monetary policy easing cycle and stabilisation in both the global semiconductor cycle and the Chinese economy.

By sectors, manufacturing is tipped to stage a recovery to around 2 per cent growth, with construction staying resilient at close to 5 per cent. The services sector is expected to grow 2 to 3 per cent, as the pickup in visitor arrivals will offset some of the domestic belt-tightening brought on by cooling labour market conditions.

OCBC’s 2024 headline and core inflation forecasts stand at 3.4 per cent and 3.1 per cent, down from 4.8 per cent and 4.2 per cent in 2023, assuming stable global commodity prices and a cooling domestic labour market. Gradually improving growth prospects coupled with a slowly but surely moderating inflation should make a critical difference in easing cost-of-living pressures.

WHAT MAKES A HEALTHY INFLATION RATE?

What makes a healthy inflation rate cannot be decided in isolation but would have to be interpreted in the context of GDP growth and more importantly income growth, to ensure that no Singaporean is left behind.

Households in the lowest income decile saw inflation outpacing nominal wage growth in 2023. That said, lower-income households also enjoyed more healthcare and education-related subsidies, with households staying in 1-and 2-room HDB flats receiving the most government transfers at S$13,623 per household member on average in 2023, close to double that for 3-room HDB flats.

Inflation may have gotten a bad reputation in the last few years - but it is not necessarily a bad thing per se. A small amount of inflation can help drive economic growth by providing demand signals for production. It also incentivises spending today rather than in the future.

Deflation, on the other hand, may signal economic stagnation and inadequate demand, whereas excessive inflation has pernicious and destructive effects.

With inflation expected to moderate further towards the latter part of this year, I remain optimistic that this will bring much needed relief to both Singaporean households and companies struggling with high costs of doing business.

Selena Ling is the Chief Economist and Head of Global Markets Research and Strategy at OCBC.