How the world’s largest electronics market in Shenzhen is feeling the heat from China’s power bank crackdown

Consumers too have been impacted since China banned uncertified power banks on domestic flights from Jun 28, but why are some soaking theirs in salt water?

Once ubiquitous in Huaqiangbei, portable chargers are now a rarer sight amid China’s power bank crackdown. (Photo: CNA/Melody Chan)

This audio is generated by an AI tool.

SHENZHEN: “It’s a headache, this came all too sudden,” said a power bank vendor at Shenzhen’s Huaqiangbei, the beating heart of China’s electronics trade.

The shop owner, who wanted to be known as Mei, is stuck with more than 100 unsold portable chargers, even after sending hundreds back to the factory. Another vendor told CNA she is staring at thousands of yuan in stranded inventory, as store shelves fill with products no one dares to buy - or fly with.

The sprawling bazaar, billed as the world’s largest electronics market, has been thrown into disarray amid wider upheaval in China’s power bank industry. A string of battery-related safety scares has triggered mass recalls, a sweeping ban on uncertified devices aboard domestic flights and intense public scrutiny.

Retailers are feeling the heat as authorities ramp up enforcement to ensure only compliant portable chargers are sold. Consumers have also found themselves in the line of fire, grappling with confusion over recall notices and difficulties securing refunds and exchanges.

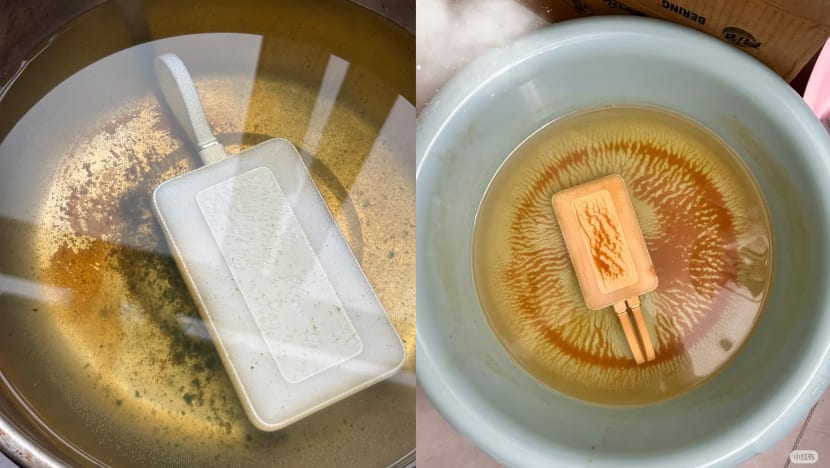

Some users were even told to destroy their portable chargers by soaking them in salt water to qualify for a refund - an instruction that swiftly went viral, prompting a flood of user-submitted photos, along with ridicule and frustration.

But analysts say there may be a silver lining amid the turmoil - the sweeping crackdown could ultimately raise industry standards and power through long-overdue improvements in safety and compliance.

CHARGING TOWARDS TIGHTER RULES

But first - how did it all come to this?

The latest trigger came on Jun 28, when China enacted a ban on uncertified power banks aboard domestic flights, citing fire risks.

In August 2023, Chinese authorities mandated that power banks and lithium-ion batteries would be subject to China Compulsory Certification (CCC) requirements.

The CCC mark is a mandatory national safety and quality certification. From August 2024, devices without a valid certificate have been banned from being manufactured, sold, imported, or used commercially. Enforcement, however, has been uneven.

But now, passengers are being barred from carrying power banks that lack the official CCC mark, the country’s civil aviation regulator stated in a notice issued just a day before the rule came into effect.

Portable chargers with faded or illegible CCC labels, or those subject to product recalls, are also prohibited, according to the notice by the Civil Aviation Administration of China (CAAC).

CAAC pointed to a string of mid-flight fire incidents linked to power banks, as well as mass recalls by major brands, as contributing factors. Two leading Chinese electronics manufacturers, Anker and Romoss, recently recalled more than 1.2 million portable chargers over battery-related fire risks.

Since then, thousands of power banks have reportedly been confiscated at airports across the country. At Urumqi Diwopu International Airport in Xinjiang alone, around 3,000 devices were being seized daily, according to a Jun 28 report by Xiamen Daily.

Beyond this, authorities have ramped up on-the-ground checks, tightening enforcement at electronics markets to ensure only compliant power banks make it to store shelves.

“There have been undercover checks these past two weeks. We’re all scared,” a vendor at Huaqiangbei who wanted to be known as Ling told CNA.

“If you get caught, there’s a fine,” added Ling, whose store also sells mini fans and hairdryers alongside power banks.

Under China’s Product Quality Law, sellers can face fines of up to three times the value of uncertified goods. That means a power bank priced at 100 yuan (US$14), for example, could result in a maximum penalty of 300 yuan per unit.

The shift is visibly playing out at Huaqiangbei.

Power banks that were once openly flaunted across shopfronts and tabletops have become harder to spot. CNA observed that many are now tucked away in drawers or stacked in boxes beneath counters, kept out of sight as sellers weigh the risk of being penalised.

“People here in Huaqiangbei are smart. If you don’t adapt quickly, you’ll be eliminated,” said Ling.

BALANCING COMPLIANCE AND CLEARANCE

Amid the heightened scrutiny, some vendors have decided to focus on hawking other wares for the time being.

One shop owner who declined to be named told CNA she had returned more than 100 non-compliant power banks to the manufacturer and shifted to selling other products like portable fans and hairdryers.

“The manufacturer took it back and said it would return with the CCC certification,” the shop owner said. She explained that since the domestic flight ban was announced, some factories have been retrieving stock from vendors and sending it back a week or two later with CCC labels affixed.

But many vendors are choosing to stay the course and sell power banks despite the heightened scrutiny and regulatory risks, even as not all the devices on offer appear to meet official standards.

At several shops CNA visited, vendors openly offered CCC-certified power banks but were also willing to discreetly sell uncertified ones. When asked directly, one shopkeeper pointed to a stack, saying: “If you are not taking flights, you get these. If you are, take this other batch.”

The uncertified power banks were selling for around 60 yuan, roughly 30 yuan less than certified models.

Other shops displayed portable chargers marked as flight-safe, but asked this reporter to delete photos of the devices after they were taken.

Similar scenes have played out across China. At Beijing’s Kemao Electronic City, the capital’s largest electronics market, vendors kept a low profile and discouraged photo-taking even as product packaging displayed signs claiming “with national CCC certificate, (you are) safe and secure”.

In some cases, even the authenticity of the CCC mark on power banks being sold has come into question.

On this reporter’s visit to Huaqiangbei, a vendor who gave her name as Zhan revealed a separate box of power banks affixed with CCC labels. She acknowledged that the devices were not truly certified – the manufacturer had simply printed the labels to make them appear compliant.

“The factory took them back to print the CCC labels and only sent them back today for packing. But we don’t want to lie to customers, so we just tell them honestly,” she said.

“For international flights, it’s okay because we’ve been selling these for years,” Zhan remarked.

“It’s a waste to throw them away,” she added. “We are making only a 2 yuan profit per portable charger sold. We want to clear them as soon as possible.”

Zhan claimed that after the existing stock was cleared, she would no longer sell power banks without the CCC mark.

But even the CCC mark itself has become a source of confusion. In the rush to comply, fake 3C stickers have been circulating online, with some listed for as little as 5 yuan each. Checks by CNA found that the search term “3C sticker” has been blocked on major e-commerce platforms, including Taobao, JD.com and secondhand platform Xianyu.

Under Chinese laws, legitimate CCC-certified power banks must display key identifiers: the manufacturer’s name and address, rated capacity, input/output specifications, the official CCC mark with factory code, and clear safety warnings. These markings help distinguish certified products from counterfeits.

Some power banks sold at Huaqiangbei and seen by CNA carried dubious-looking CCC labels, with inconsistent markings and aeroplane logos printed in a different ink. Others were also missing key identifiers required by regulations.

Another Huaqiangbei shopkeeper, Lei, claimed that not all power bank manufacturers are going through the process of getting all their products CCC-certified.

“It cost them 20,000 yuan to get the certification. It will increase the cost price,” Lei said.

As an example, he held up a 10,000mAh power bank affixed with the CCC mark. “It was priced at 50 yuan, now it’s 80 to 90 yuan,” he said.

Obtaining the CCC mark takes time, effort and money, industry players point out.

Wang Shuhai, the general manager of Nohon, a Hong Kong-headquartered consumer electronics firm with 18 years of experience in replacement batteries, told CNA that CCC certification for a single product can cost around 30,000 yuan to 40,000 yuan.

“That includes testing fees, factory audits and certificate maintenance … on top of that, the battery cells themselves require separate aviation safety certification,” he said.

“The whole process takes about three months.”

CONSUMERS CAUGHT IN THE CRACKDOWN

It’s not just electronics vendors feeling the heat - consumers are also caught in the fallout from China’s crackdown on uncertified power banks.

A content creator from Shandong, who goes by the username LoseHeart, said he relies on two portable chargers to support his video work. One of them, a Remax-branded device bought from an official Taobao store in March last year, is no longer allowed.

“My wallet’s already thin,” he said. “People’s incomes and budgets are tight. Forcing us to spend more just builds resentment.”

Still, he said he would avoid pricier models moving forward. “I’ll keep it within 100 yuan.”

David Liu, 27, a Taiwanese student in Shanghai, told CNA that both of his portable chargers - an Asus and a Xiaomi - only carry the CE mark, which is valid in the European market but not in China.

He was travelling in Guangzhou when the new aviation policy took effect and tried mailing the devices back to Shanghai. “Before June, I could send the portable charger anywhere in China, so I thought this would work,” Liu said.

But he was unsuccessful as logistics firms had already begun refusing to ship non-CCC-certified devices amid the latest crackdown.

“There wasn’t enough buffer time for the policy to take place, and they also (enforced the ban on) shipping companies from handling uncertified power banks, so a lot of customers had to give up on their portable chargers,” Liu said.

At the same time, owners of power banks under recall orders have also run into issues getting refunds on their devices or exchanging them for a certified replacement.

Chinese name brands like Anker and Romoss have announced product recalls. Anker has recalled more than 712,000 units across seven models, while Romoss recently pulled nearly half a million power banks spanning three models - both citing battery defects that pose fire risks.

In the initial recall notice for Anker’s A1681 power bank issued in late June, customers were told to return the devices to a designated warehouse in Dongguan, Guangdong. But many soon reported that major courier companies such as SF Express, JD Logistics, China Post and YTO Express refused to ship the items due to safety concerns and tightened regulations.

Ten days later, Anker issued an update. Users were instead instructed to soak the devices in salt water for 24 hours in a well-ventilated area, then dispose of them in a hazardous waste bin. To qualify for a refund, they had to submit a video of the process.

“This is to completely drain the internal battery and reduce potential safety risks before disposal,” Anker stated in a message sent to customers.

The instruction quickly went viral, prompting users to flood Chinese social media with photos and videos of themselves carrying out the act.

“They made me soak the power bank and upload proof, then said it’ll take four to eight weeks to send a new one. Every day it’s a different story,” one user wrote on the social media platform Xiaohongshu.

“It breaks my heart to see (my power bank) go. It works perfectly, doesn’t overheat, looks great and charges fast,” another commented.

POWERING TOWARDS BETTER STANDARDS

Even as retailers and consumers navigate the new landscape, analysts say China’s power bank industry is facing a long-overdue reckoning - one that’s exposing cracks in safety standards, compliance practices and supply chain integrity.

In both the Anker and Romoss recalls, the companies pointed to faulty battery cells as the root cause. The defective cells came from a shared supplier, Apex (Wuxi), which also supplies other major brands including Xiaomi and Baseus.

According to industry sources cited by Chinese news site The Paper, a subcontractor had quietly replaced key materials in the cells, potentially compromising safety. China’s market watchdog has since suspended dozens of Apex (Wuxi)'s CCC certifications and launched a formal investigation.

Battery cells typically account for close to half of a power bank’s total cost, making them a common target for cost-cutting.

“Margins are tight. Brands outsource, factories compete on price, and suppliers get squeezed,” one longtime manufacturer told The Paper. “If something goes wrong at the cell level, the whole chain is exposed.”

Peter Xie, the founder of Guangdong-based phone accessories maker Prosment, said that focus should be placed on the inspection and control of raw materials.

“Avoid making high-density cells and mobile power bank assemblies with overly tight dimensions,” he told CNA.

Wang Shuhai, general manager of Hong Kong-headquartered Nohon, said the effects of the “one-size-fits-all” rule have been swift, referring to the blanket enforcement of the CCC mark requirement on all power banks.

“After-sales pressure has surged,” he said, referring to the wave of customer returns for uncertified power banks that were legally sold before the mandatory CCC certification requirement came into effect in August 2024.

At the same time, certified brands are seeing a surge in demand, he said.

“Sales orders have jumped … consumers now prioritise products with clear compliance guarantees,” said Wang, while also noting that raw material prices are “higher than before”.

The recent enforcement of the compliance policy is accelerating a market reshuffle. “Many small and mid-sized sellers unable to absorb compliance costs are exiting the industry,” Wang said.

“Production capacity is increasingly concentrated among top-tier brands.”

According to a 2024 industry report, China’s shared power bank market was worth 12.6 billion yuan, with an estimated annual growth rate of around 20 per cent.

Still, Wang believes the shake-up is necessary. “This will improve regulatory oversight, accelerate innovation, and weed out low-quality products - bringing the industry back to a healthier track,” he said.

Tian Xuan, vice dean at Tsinghua University’s PBC School of Finance, described the industry shake-up as short-term pain for long-term gain.

“While its sudden rollout may inevitably cause inconvenience, it serves as a timely and effective measure to reduce potential hazards and ensure passenger safety,” he said, referring to the domestic flight ban on non-compliant power banks.

On the crackdown, he noted that vendors may face unsold inventory and slower sales.

“But the market will become more standardised, pushing the industry toward higher-quality competition,” he said.

Editor's note: This article has been updated with the latest name of the battery supplier as Apex (Wuxi), following a spinoff from Amprius Inc in 2022.