Carmakers unveil latest tech at Japan's largest auto show amid US tariff squeeze

A record number of more than 500 exhibitors are participating in this year’s Japan Mobility Show, which runs until Nov 9.

Attendees view vehicles showcased at the Mitsubishi Motors booth at the Japan Mobility Show 2025 in Tokyo.

New: You can now listen to articles.

This audio is generated by an AI tool.

TOKYO: At Japan’s biggest automotive showcase, the Japan Mobility Show 2025, manufacturers are unveiling a wide range of technologies – from practical family cars and next-generation electric vehicles to futuristic concepts and quirky innovations.

At the Toyota booth, the world’s largest automaker is showcasing inclusive mobility solutions designed for people of all ages and abilities. Among the highlights: self-driving prototypes for children and walking chairs to assist those with physical disabilities.

“We will change the future of the automotive sector,” said its president Koji Sato.

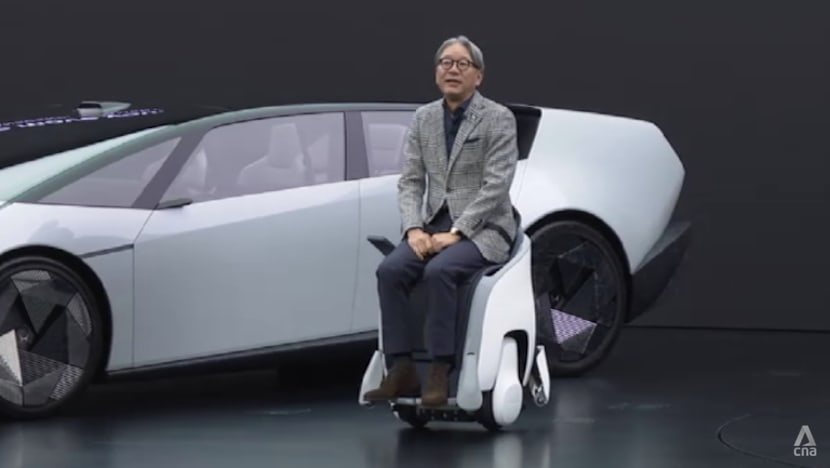

Nearby, Honda's president Toshihiro Mibe glided into the spotlight on a robotic chair steered by subtle shifts in his body weight. Among the automaker's exhibition is a “sustainable rocket” powered by renewable fuel.

Electric vehicles continue to be a major draw this year. Both legacy manufacturers and ambitious startups are showcasing new battery-powered EV models designed to balance affordability with extended driving range.

INDUSTRY AT CROSSROADS

The auto sector is a core industry for Japan’s economy. The automotive powerhouse – the third largest in the world – is home to 10 domestic car manufacturers.

As of last December, some 4.36 million workers were employed in more than 68,000 automotive-related firms, based on reports by private research institute Teikoku DataBank.

The United States remains Japan’s biggest market, accounting for about 32 per cent of exports in 2024, based on data from the Japan Automobile Manufacturers Association.

However, recent US tariffs have cast a long shadow over the industry’s outlook.

In April, US President Donald Trump imposed new tariffs on imported Japanese cars – adding an extra 25 per cent duty to the existing 2.5 per cent, before settling at 15 per cent in September.

Reports estimate the tariffs could wipe out about US$13 billion from Japanese automakers’ annual operating profits.

Some companies, including Toyota, are absorbing the increased cost. The automaker forecast its net profit could nearly halve this fiscal year, despite achieving a record 4.7 per cent growth in global sales in the first half ended June, and a year-on-year jump in US sales.

INDUSTRY LOOKAHEAD

Still, some observers remain optimistic about Japan’s automotive resilience.

“Toyota has a long-term view. That’s why Toyota doesn’t give up on ICE technology and hybrid technology,” said Takaki Nakanishi, CEO of the Nakanishi Research Institute, referring to conventional internal combustion engine vehicles that run on fossil fuels, and hybrids that combine gasoline engines with electric motors.

Despite a global push toward electrification, EVs remain a relatively small segment of the market in Japan, with buyers preferring hybrids.

But Nakanishi also warned that mid-sized automakers face tougher headwinds.

“A lot of competition is coming from traditional OEMs (original equipment manufacturing) and also new competition from the Chinese OEMs and companies such as Tesla,” he said.

“So, mid-sized companies like Honda and Nissan, I think they need to find a breakthrough in order to survive in this industry.”

Nissan, still reeling from collapsed merger talks with Honda earlier this year, expects an annual operating loss of about US$1.8 billion this fiscal year, weighed down by US tariffs.

The ailing automaker unveiled a refreshed model lineup at the mobility show, announced plans to sell its Patrol SUV domestically, and pledged to revive its Japan sales network.

Top executives from Nissan and some other carmakers like Toyota say they are now considering importing their US-built cars back to Japan – a move aimed at reducing trade frictions.

American cars account for only a fraction of new auto sales in Japan and are absent at the mobility show.

Despite the uncertain outlook, enthusiasm at the event remains high. More than 500 exhibitors – a record number – are participating in this year’s Japan Mobility Show, which runs until Sunday (Nov 9).

Source: CNA/dn(mp)