A decade on, a Singapore-China project is turning landlocked Chongqing into a global logistics hub

As the Singapore-China Chongqing Connectivity Initiative (CCI) marks its 10th anniversary, CNA visits businesses on the ground to examine the gains - and the bottlenecks that remain.

Chongqing by night. The southwestern Chinese metropolis marks the 10th anniversary of its flagship connectivity initiative with Singapore this year. (Photo: CNA)

This audio is generated by an AI tool.

CHONGQING: The late afternoon sun slants across rows of white and teal electric trucks parked in formation at Qingling Motors’ delivery yard in Chongqing’s Jiulongpo district.

Inside the factory, machinery thunders. Outside, forklifts shuttle between warehouse bays - some bound for Southeast Asia, others headed for new markets.

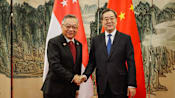

That outward momentum was echoed at the 21st Joint Council for Bilateral Cooperation (JCBC) meeting in Chongqing on Monday (Dec 15), where Singapore and China signed 27 agreements.

Among the deliverables were two new rail freight services from Chongqing’s Yuzui Station - one linking to Singapore via Qinzhou port and another running directly to Kazakhstan - marking the station's first international cargo shipments.

The announcements come as the China-Singapore (Chongqing) Demonstration Initiative on Strategic Connectivity (CCI) marks its 10th anniversary - a milestone that carries particular weight for companies like Qingling Motors.

The Chongqing-based commercial vehicle maker, which began global trade operations in 2018, has been leaning heavily on the decade-old initiative to accelerate its overseas ambitions.

Qingling’s experience reflects the broader promise of the CCI - a project designed to connect entire regions.

Yet businesses say the initiative’s strengths also expose its biggest challenges: coordinating cross-border institutions, aligning interests and persuading firms to rethink long-entrenched trade routes.

“The launch of the Chongqing-Central Asia rail service has brought significant logistics optimisation and market expansion opportunities for manufacturing companies such as Qingling,” Tan Tao, the company’s deputy director of overseas marketing, told CNA.

Operating on fixed frequencies and schedules via the Khorgos border crossing, the new service is expected to halve transit times to Kazakhstan and Uzbekistan from a month to around 12 days.

“Companies can benefit from more stable and reliable cross-border transport channels, reducing the risk of logistics delays,” Tan said.

The company has already begun exporting complete vehicles and knock-down kits to Central Asian markets, and sees longer-term synergies between the new rail corridor and its plans to deploy hydrogen fuel-cell heavy trucks in Xinjiang.

“As a key node along the Belt and Road Initiative (BRI) route, Central Asia represents an important emerging market,” Tan said.

“The opening of this rail link helps us expand into new markets and enhance international competitiveness.”

A DIFFERENT KIND OF G2G PROJECT

Launched in November 2015, the CCI broke from the template of earlier government-to-government (G2G) projects between Singapore and China.

Suzhou Industrial Park and Tianjin Eco-City were built around physical assets - industrial zones and townships. The CCI was conceived as a network designed to stitch together markets, systems and flows.

The Sino-Singapore Chongqing Multi-Modal Distribution and Connectivity Centre sprawls across a logistics zone beside the Yuzui rail terminal.

It is home to Sino-Singapore Connectivity Solutions (S1), one of the joint ventures set up under the CCI.

S1 was incorporated in November 2017. Its sister firm, Sino-Singapore (Chongqing) Demonstration Connectivity Development (S2), followed in February 2018 to develop and operate the distribution centre.

Inside the warehouse, towering blue-and-orange racks hold white-wrapped pallets of polycarbonate resin, chemicals and consumer goods - cargo consolidated from surrounding provinces before being sent south to Qinzhou or west to Central Asia.

A worker in a high-visibility vest checks his phone beside a loading dock as an Evergreen container edges into position.

“The CCI is actually a borderless collaboration between both nations,” said Aloysius Kim, general manager of S1.

“The CCI is about connecting regions - western China and Singapore … The key objective is to develop Chongqing and Singapore as mutual hubs.” Kim said.

The Chongqing Connectivity Initiative is structured around four pillars: financial services, aviation, transport and logistics, and information and communications technology.

In its next phase, the CCI will also advance cooperation in newer areas such as education, technology and healthcare.

The goal is to facilitate trade, provide services and construct corridors linking China’s landlocked western interior to Southeast Asia and beyond.

OCBC established its first Chongqing branch in 2009 - the first Singaporean bank to settle in the city - six years before the CCI was formally launched.

“Compared to the other Singapore projects in China, the CCI goes beyond financial corporations,” Ang Eng Siong, CEO of OCBC China told CNA.

“It integrates logistics, trade and capital flows to create a comprehensive cross-border service system,” he added.

“This holistic approach helps western enterprises accelerate internationalisation and achieve global growth.”

A DECADE OF THE CCI

A decade on, numbers tell of a growing momentum.

Along the International Land-Sea Trade Corridor (ILSTC) - the route carrying everything from automotive components to electronics and chemical products between western China and Southeast Asia - container volumes have surged nearly tenfold since 2019.

In the first nine months of 2025 alone, 31 cross-border financing projects were completed for enterprises in Chongqing and western China through Singapore, bringing the cumulative total to US$21.8 billion.

Air connectivity between Singapore and Chongqing has also surpassed pre-pandemic levels, with 24 weekly flights now operating between both cities as compared to having no direct connecting services a decade ago.

For Qingling, what’s even more significant is the market access the CCI framework has enabled.

Breaking into a market as highly developed as Singapore’s required more than technical modification - it demanded compliance with stringent market-entry standards covering safety, performance and regulation.

With support from the Chongqing management authority, Qingling worked with local Chinese and Singaporean partners to redesign its vehicles - aligning them with European Union certification standards.

The process took 18 months and in March 2024, the company debuted its right-hand-drive EQ2 electric truck at a trade exhibition in Singapore - also signing a partnership with local distributor Motorway Group - a deal that has since been designated a CCI demonstration project.

“Without CCI acting as a bridge, this project would never have taken off,” Tan said, adding that the administrative bureau coordinated local certification bodies, handled product inspection and sample vehicle preparation, and liaised with Chongqing's commerce authorities.

“Otherwise, we would not have been able to secure all of it so quickly,” he added.

The trade corridor has shortened export timelines by six to eight days compared with traditional coastal routes.

The company now operates more than 30 authorised dealerships in other Southeast Asian countries like the Philippines and Vietnam, including 12 maintenance centres and a central spare-parts warehouse.

It is targeting exports of 20,000 units next year and 30,000 the year after, with CCI-linked channels expected to account for half of total exports by 2027.

Digitisation has also improved operations along the corridor.

Kim from S1 recalled early days when cargo owners had to make multiple calls to multiple parties just to locate a container.

“But today with data exchange across different parties along the ILSTC, cargo owners can track and trace,” Kim said.

“They go to a platform … to locate their container - (whether it’s) offloaded at Qinzhou port, loaded onto a vessel, (or) en route to Singapore.”

That visibility, he added, builds confidence and enables better planning for everyone along the chain.

OCBC China leveraged the CCI framework to structure green finance deals for enterprises in western China.

The bank’s group-level sustainable finance portfolio now stands at around S$50 billion (US$38.7 billion) - roughly 16 per cent of total loans. It has also recorded a 32 per cent year-on-year increase in sustainable financing in 2024.

Among the deals is what Ang describes as “the first deep integration of green financing plus carbon credit” - a bundled loan and carbon credit facility tied to environmental, social and governance (ESG) performance.

“In the early years, green financing was not such a big thing,” Ang said. “In China, it was even later - as late as 2022 or 2023.”

“When I visited Chinese corporations in western China, ESG had not gained prominence but now through the CCI’s green focus and sustainability, enterprises in Chongqing are really prioritising these parts now.”

Smaller players have also found openings through the CCI's Joint Innovation Development Fund (JIDF).

Ganwei IoT, founded in Shenzhen in 2004, built its reputation delivering smart city projects for clients including Hangzhou Industrial Park and Dongguan municipality.

Through the JIDF, the company partnered with Vilota, a deep-tech spinoff from the National University of Singapore, to co-develop an autonomous drone platform called "Low-Altitude Vision”.

The system, designed for agricultural greenhouses where GPS signals cannot penetrate, has since been piloted in Chongqing, Sichuan, Shanxi and Malaysia.

Ganwei has also established a joint laboratory with the NUS Chongqing Research Institute to continue the collaboration.

“The involvement of the CCI improved our cooperation in two aspects,” said Gu Qiaoyu, Ganwei's deputy general manager, who elaborated that the platform provided policy guidance and funding.

“As a small and medium-sized enterprise, we are not very familiar with overseas markets, policies and certain laws. With financial and policy support, we are able to take bigger steps,” Gu said.

The COVID-19 lockdowns also presented unprecedented challenges.

When Yangtze River ports stalled in 2020, ILSTC services stayed operational. “It showed customers they had an option,” Kim said.

But turning a crisis-driven shift into long-term behaviour has been slower.

Infrastructure capacity is another constraint.

Qingling Motors’ Tan said train frequency to Qinzhou “is still relatively low”, while the port’s container handling capacity tightens during peak periods.

“When vessel booking is tight, costs rise. We hope there can be more support to ease some of these bottlenecks,” he said.

For smaller companies, barriers are more fundamental.

Singapore-based machine vision firm JM Vistec was matched through the JIDF with CISDI, a major Chongqing-based steel technology conglomerate.

The partnership opened doors into a new industry, said JM Vistec’s managing director Eugene Goh, but has yet to translate into commercial returns.

“At present, we haven’t converted anything into monetisation. There’s a lot of R&D on our side.”

Structural limits complicate deeper collaboration.

State-owned enterprises like CISDI cannot easily form joint ventures with foreign private firms due to “value alignment and technology outflow issues”, said Goh.

For Goh, the bigger challenge is relationship-building. “In China, problems are solved by talking face to face,” he said.

“If they (partners) see you, they remember you.”

Even companies that actively use the corridor said awareness gaps remain.

“Cross-border financing thresholds are relatively high, and the low-interest loan processes are still not smooth,” Tan from Qingling said, calling for clearer training and briefings on eligibility and procedures.

Operational mismatches also surface in day-to-day collaboration.

Ganwei IoT’s Gu noted differences in working styles.

“In mainland China, we emphasise speed and flexibility,” she said.

In Singapore, she noted, processes are more structured and tied to fixed timelines.

“We’ve had to continuously coordinate on timelines and pace.”

Data governance adds another layer of complexity.

Privacy regulations on both sides require dedicated data transmission lines, which raise operating costs and can make new digital services less competitive.

THE NEXT CHAPTER

This year’s JCBC meeting yielded 27 new memoranda and agreements, including a “Vision for Cooperation” outlining the CCI’s direction for the next decade.

Among the commitments: an expansion of the JIDF from 40 million yuan (US$5.6 million) to 100 million yuan, with a broader mandate to support green projects and initiatives beyond Chongqing and Singapore.

A new MOU on a “Digital ILSTC” will advance data sharing and promote the use of AI and blockchain along the corridor.

For companies operating within the CCI framework, the contours of the next phase are becoming clearer.

S1’s general manager Kim points to three priorities: strengthening cross-border trade services, expanding the ILSTC network, and embedding sustainability into the corridor’s operations.

His team is assisting a Chinese F&B brand in entering Southeast Asia - an example of how the CCI ecosystem is beginning to move beyond pure logistics towards broader trade facilitation.

S1 has also partnered with Chongqing Finance and Economics College to launch the Sino-Singapore International Trade and Supply Chain Academy to train talent for the corridor’s future growth.

OCBC China CEO Ang sees opportunity in China’s economic restructuring.

“The real estate market is still undergoing corrections, but new engines of growth are emerging - renewable energy, electric vehicles, technology and AI,” he said.

“Perhaps the CCI can look at these drivers beyond just green and sustainable financing.”

He added that geopolitical shifts are accelerating the “China-plus-N” strategy, with more Chinese companies looking to diversify production into Southeast Asia - where Singaporean banks and firms have strong networks.

For Ganwei IoT’s deputy general manager Gu, Singapore’s role as a launchpad remains central.

“Our target is not only Singapore. We are leveraging Singapore as a hub to reach Southeast Asia and the wider world,” she said.

“The cultural familiarity and Mandarin-speaking communities make it a smoother starting point for Chinese enterprises going global.”

Back at Qingling Motors, deputy marketing director Tan looked over rows of trucks bound for overseas markets.

The company has set up five regional marketing divisions - spanning Central Asia, Southeast Asia, the Middle East, Africa and Central and South America.

“The CCI is not merely a corridor,” Tan said. “In our overall export strategy, it should be a core hub - a golden springboard.”

“Over these ten years, the CCI has opened up a fast track for Qingling’s global expansion. It is not only a logistics channel, but a strategic fulcrum for Chinese and western enterprises to integrate into global value chains.”