IN FOCUS: After COVID-19, where are the Singapore economy, workforce headed?

File photo of Singapore skyline. (Photo: AFP/Roslan Rahman)

SINGAPORE: Recession. Retrenchments. Reskilling.

As COVID-19 ripped through the Singapore economy, such words have become part of daily life.

When the then little-known disease made its way to Singapore in January, few could have anticipated the impact on people and businesses.

Very quickly, people’s normal routines – working in the office, eating out, face-to-face gatherings with loved ones and friends – were changed. Firms had to return to the drawing board to work out contingency plans to stay in business.

The economy swiftly slipped into contraction, setting a grim record for the second quarter even with nearly S$100 billion in stimulus, and is now set for its worst-ever recession.

READ: COVID-19 downturn to be more prolonged than past recessions, slow recovery for jobs market: MAS

With uncertainty about when the COVID-19 crisis will come to an end, coping with hurtling changes has been the only constant.

Economic scarring aside, the pandemic has, among other things, accelerated the adoption of technology - e-commerce, financial technology, video-conferencing, telemedicine or online teaching - as a way of life.

These have hit some people and firms harder than others in the form of collapsed businesses and lost jobs, as their activities depend more on close contact, or because of their age and skills.

“The pandemic accelerated many of the trends, like digitalisation (and) ebbing globalisation, that we’ve already been seeing prior to the outbreak. With the changes compressed into a very short time, this causes challenges at all levels - governments, businesses, individuals – as we all have to adapt in a much more time-constrained fashion,” said Institute of Policy Studies’ (IPS) senior research fellow Christopher Gee.

“Those who are agile enough to transform quickly, will survive.”

For home-grown additive manufacturer 3D Metalforge, demand dropped sharply at the start of the coronavirus outbreak. The 3D metal printing firm supplies critical parts and expertise to manufacture components used in various industries.

Demand has since recovered, according to its chief executive Matthew Waterhouse, and amid the shifts, it found opportunities.

For instance, supply line disruptions have prompted firms to turn to manufacturers closer to home for critical parts. With its 3D printing capabilities, 3D Metalforge has “been able to step in when companies needed things in a very short timeframe”.

Mr Waterhouse said such opportunities could be here to stay.

READ: Companies seek new opportunities to stay afloat amid COVID-19 pandemic

He noted ongoing chatter among companies, especially in the United States and Europe, “about bringing manufacturing nearer to the point of use” as the pandemic crippled global supply lines.

“As companies move their manufacturing back to the US, I think they are going to want to focus on high-value manufacturing, which is where additive manufacturing fits in.”

The attention on digital supply chains has also grown.

“In the old days, they’d create a mold or jig and store it in the workshops. Now they can create a digital file and pass it on to manufacturers like us to produce the part,” said Mr Waterhouse.

“(Creating digital files) was already gathering pace (and) the area that I think has accelerated even further is taking that digital file and storing it in the cloud so that if you need to manufacture in place A or place B or C, you've got it available where you need it.

“It’s the idea of supply chains becoming more virtual, more flexible with the use of a 3D printer and additive manufacturing to produce things wherever you need. We've got a very key role in the end point of these digital supply chains,” he added.

AT A “CRITICAL JUNCTURE”

Just as how companies like 3D Metalforge are in search of a silver lining amid the crisis, the Singapore economy will have to keep transforming.

“The post-COVID-19 global economy will be different. Our future economy must be responsive to structural shifts, many of which have been accelerated by COVID-19,” said Deputy Prime Minister Heng Swee Keat in a ministerial statement on Oct 5.

READ: Commentary: Winds in the Singapore economy sails are starting to stir

Apart from weakening support for globalisation and renewed impetus to adopt digital technology, other structural shifts include the rise in Asia’s economic weight, growing emphasis on sustainability and slower resident labour force growth at home.

As such, the Singapore economy is “at a critical juncture” with high stakes involved.

Mr Heng told Parliament: “We must take the actions now that will allow us to not just get through COVID-19, but more crucially, gain ground that will pave the way for our next lap of economic growth in the next five to ten years.”

HOW TO TRANSFORM

So, how can the Singapore economy transform for the future?

Observers that CNA spoke to think it is unlikely that the country will veer away from a diversified economic structure.

After all, it is this diversification that has steered the small and open economy through previous crises and even in this downturn, there remain bright spots.

Manufacturing, for one, is among those that have withstood the heavy blows of the pandemic, bolstered by strong semiconductor and biomedical production activities. Other sectors such as finance and insurance, and information and communications, have also remained on steady growth paths.

READ: Some economic bright spots remain for Singapore despite the overall challenging conditions

This shows that diversification has paid off, according to Ms Jung Sung Eun from Oxford Economics, who added: “Given its small domestic economy, Singapore will benefit from keeping its economy diverse and open.”

OCBC’s head of treasury and research Selena Ling echoed that it has always been “part of the Singapore philosophy to grow as many engines of growth as possible” to provide a buffer during different industry cycles.

“But we have to diversify smartly because we are a small country,” she said. “There can only be so many buckets to put your resources into.”

What then can Singapore focus on?

Manufacturing may be one area for further development if the current bright spots are to go by. This as the current engines of growth within the sector - electronics, precision engineering and biomedical clusters - are likely to keep revving, said Ms Ling.

The semiconductor industry will remain supported by rapid growth of cloud usage for remote working and home entertainment like video streaming and gaming, while the biomedical space is set to benefit from high demand for instruments and test kits, as well as critical supplies such as masks and medical equipment, she noted.

A keen focus on technology also means Singapore is well-positioned to strengthen its manufacturing sector, by boosting productivity for lower-end activities and growing higher-value processes, other observers said.

Already, it has a strong base in advanced manufacturing with industries such as precision engineering and biomedical sciences. And the country is doing more.

Mr Heng, at an Industry 4.0 trade show last month, stressed that Singapore is committed to developing cutting-edge capabilities, such as robotics, to become a "more digital and more resilient” advanced manufacturing base in Asia for the world.

READ: Commentary: Manufacturing is still a key engine of growth for many countries

Mr Douglas Foo, president of the Singapore Manufacturing Federation (SMF), said: “Not just advanced manufacturing, (growth will also come from) lean manufacturing and the adoption of new business models to seek out new revenue channels made possible with technology.”

SMF has set a target for the sector to contribute 30 per cent of Singapore’s overall gross domestic product (GDP) by 2030, but said this may only be possible if more industries are included in the sector.

Manufacturing has evolved, explained Mr Foo, citing non-traditional segments such as additive manufacturing bearing much potential to raise the sector’s output. Other industries like agriculture are also applying the latest manufacturing technology to improve production.

“Therefore, it is possible to achieve the 30 by 30 goal, only if the manufacturing sector is less defined,” he said.

DBS senior economist Irvin Seah certainly thinks the sector can form a bigger component of Singapore’s future economy.

Manufacturing accounted for nearly 30 per cent of GDP in the early 2000s but that has since fallen to about one-fifth. There is scope to increase this to at least 25 per cent, he said.

“Manufacturing has always been an instrumental part of Singapore’s growth but over the years, its share of GDP has been falling. Given how it has been the key driver of growth during the pandemic, it raises the question of whether we should raise (the share). I think we should.”

READ: 6,370 job openings in manufacturing, marine and offshore sectors despite downturn

Conversations with observers of the Singapore economy also threw up two overarching themes - technology and sustainability. Both will spawn a myriad of opportunities in multiple industries, they said.

The former will only become more pervasive with essential services such as healthcare seeing a rise in telemedicine services. Even traditionally brick-and-mortar industries such as retail and food services, have gone digital to survive amid the pandemic.

Sustainability will be a “long-term theme that impacts Singapore’s economic structure”, according to Mr Seah.

“As the world’s focus on sustainability grows, there will be demand for related technology, product and infrastructure,” he said. This ranges from infrastructure to guard against rising sea levels, as well as technologies for electric vehicles, harnessing clean energy and ramping up food security.

The financial space is already grasping this new reality and its implications for investment, said Ms Ling, with the Monetary Authority of Singapore (MAS) playing an active role in positioning the country as an “industry leader” in this aspect.

For instance, the MAS announced a US$2 billion investment last November to develop green markets. The central bank also supported the launch of the country’s first institute dedicated to green finance research and talent development.

READ: Commentary: Forces of climate action are reshaping finance in Singapore and around the world

Ms Jung said as green energy is likely to be a key growth sector moving forward, Singapore can do more to promote research and development in related industries, such as renewable energy, electric vehicle manufacturing and sustainable building.

There can also be incentives to encourage private sector investment in this field, she added.

The Government has certainly set its sight on this area, with Mr Heng highlighting sustainability as part of the country’s refreshed economic strategy. The Ministry of Sustainability and the Environment also said it expects 55,000 “new and upgraded” jobs to be created over the next ten years as the country pursues sustainable development, including about 4,000 in the next year.

On the other hand, the waning of some industries could also change the make-up of the Singapore economy.

The brick-and-mortar retail space, for instance, is in for more pain as the COVID-19 pandemic “only solidified the way forward for online shopping”, said Mr Seah.

STAY NIMBLE AND OPEN

On top of the cherry picking, observers said the crux is for the Singapore economy to remain nimble.

“I think the catchword going forward is adaptability ... Singaporeans and Singapore businesses should have the flexibility to adapt to rapidly changing circumstances,” said Mr Gee.

The country also needs to leverage on its strengths as a business hub, he added.

“We should recognise that we are and have already established ourselves as a hub for many necessary and integral things for the global economy. We can continue to be a stable, secure and trusted hub, with seamless connections.”

However, there is competition.

Mr Thomas Willemsen, senior vice-president of Asia Pacific at Japanese pharmaceutical giant Takeda, pointed out that some pharmaceutical firms have decided to locate their headquarters for Asia or emerging markets in Shanghai.

He said there are many benefits to locating in Singapore: "The environment, education, security and lifestyle are already top of the charts so I don't think you can necessarily make it so much better but I think you should also not try to scale back on these.

“More limitations on, let's say, foreign experts (coming) to Singapore will be not good because at some point, Singapore is also competing. Singapore cannot be the hub choice forever.”

Mr Seah also stressed the need for the country to deepen its linkages within Southeast Asia.

The rise of its closest neighbours means that Singapore “may no longer be the favoured destination”. “In order to leverage on the regional growth, we have to be out there and invest more heavily in ASEAN so that we can benefit directly,” he added.

WHAT ABOUT JOBS?

Domestically, the workforce will also have to keep up in step with the transformation.

Already, the economic fallout has caused a double whammy to workers. One is the greater risk of losing their jobs as companies cut back on capacity and restructure.

WATCH: Badly hit by COVID-19, when will Singapore's jobs market recover? An explainer

For a start, Singapore’s jobless rate had shot up to a 16-year high, at 3.6 per cent, in September, while retrenchments - at 20,450 so far - were nearly double those for the whole of 2019. Economists have warned that while the labour market will bottom out by the end of this year, it will remain subdued until the middle of next year.

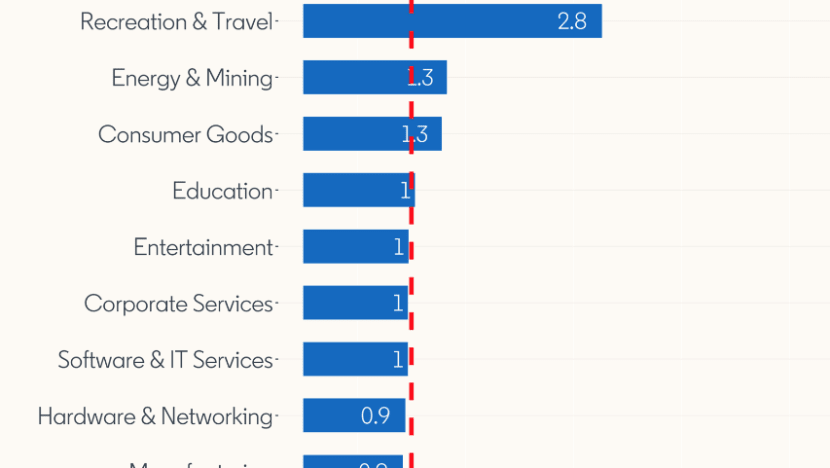

Recruitment, while having recovered somewhat since the second quarter, has stayed muted. Business networking site LinkedIn found that the hiring rate - calculated by the number of hires divided by the number of LinkedIn members in Singapore - was only 5 per cent more in September compared to the same period in 2019. In February, the rate was nearly 50 per cent.

On job portal Indeed Singapore, while postings had gone back up after a decline in the middle of the year, in October it was still six per cent less than the total in the same period last year.

“While the economy is gradually reopening, many businesses are still unable to operate at full capacity due to safe distancing restrictions,” explained LinkedIn’s Asia-Pacific vice-president of talent and learning solutions Feon Ang.

LinkedIn also found that in September, job seekers in industries that were severely impacted by the virus - particularly construction and recreation & travel - were much more likely to apply to jobs outside of their current industry compared to pre-COVID-19 days.

Secondly, many jobs that were lost may never come back. In a report he published back in June, Mr Seah said the pandemic has hastened the pace of restructuring the Singapore economy from its decade-long journey to just a couple of months.

More recently, in the latest World Economic Forum Future of Jobs 2020 report that surveyed 29 companies with operations in Singapore among nearly 300 worldwide, firms in Singapore indicated that roles ranging from bank tellers and accountants, to data entry clerks and factory workers were increasingly redundant in their organisation.

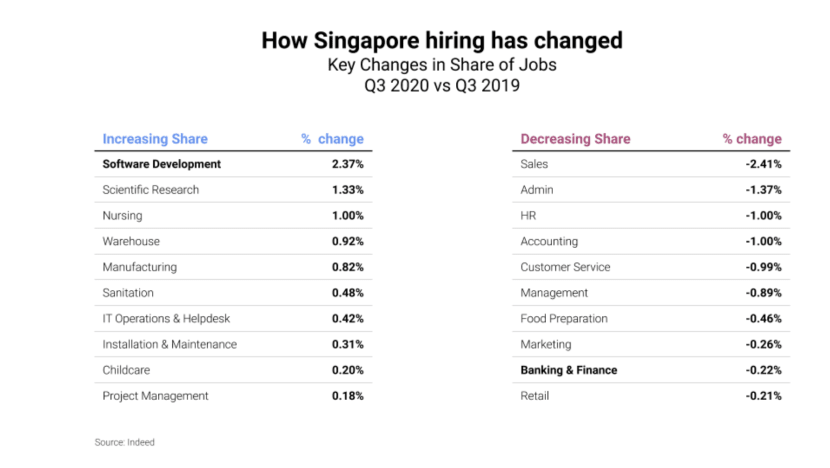

Meanwhile, people with deep technological skills - data analysts, digital marketers and Internet of Things Specialists - are in high demand.

Similarly, Indeed Singapore found that hiring activity of traditional professional services employees - those in sales, administrative, human resource and accounting - fell the most in the third quarter year-on-year, while demand for medical, logistics, scientific and technology roles grew, its Asia-Pacific economist Callam Pickering said.

“The outbreak of COVID-19 has accelerated the digital transformation of companies and changed the way we work almost overnight as organisations adapt their operations to comply with the safety requirements,” said recruitment agency ManpowerGroup’s country manager Linda Teo.

To help workers cope with the rapid changes, the Ministry of Manpower has put out weekly Jobs Situation Reports since August, where it outlines the number of available job and training openings in various sectors including retail, manufacturing, and logistics. For instance, the latest release signaled there were 6,370 manufacturing job openings as of mid-October.

READ: As COVID-19 speeds up automation, what does the future hold for non-tech job seekers?

However, the deeper issue lies in a skills gap. Referring to an internal survey conducted with about 539 SMF members, Mr Foo said that though three quarters of them pointed out they are still hiring because they need individuals with specific skills in areas like software engineering, robotics and precision grinding, such talent is mainly available overseas.

And while almost nine out of 10 of these members are willing to reskill their workforce, most of the necessary training courses are only available overseas - making them nearly impossible to attend with travel restrictions in place, Mr Foo said.

Authorities have tried to fill the sudden void that emerged during this period. According to SkillsFuture Singapore, 12,950 training opportunities under the SGUnited Skills programme opened up in July and August. Over 13,000 people signed up for them in the same period.

But training will take time. In a previous interview with CNA, HL Bank’s Jeff Ng said that job seekers may not be able to keep up with how fast the restructuring is occurring right now.

READ: COVID-19: Switching careers a challenge for some job seekers despite opportunities

“I think during normal times, there could be a slow transition from the lower value-added economy to a more higher value-added one, and definitely there's a lot of time for workers to slowly train and adapt to these changing conditions,” the bank’s senior treasury strategist said.

“But at this current moment where the pace of change (is) least five to 10 times more … one challenge workers face is the rapid retraining in order to adapt with these fast-changing times.”

LinkedIn’s Ms Ang agreed, adding that many job seekers may not know where to begin finding new roles that are relevant to their current skills or how to pick up new ones so that they can switch industries.

Takeda’s 500-odd workforce in Singapore currently has a fair amount of foreigners here to provide the necessary skills and experience, Mr Willemsen said. While Singaporeans have educational and language advantages, they need to also be willing to work outside of the country and have a “genuine curiosity … to explore other cultures and other markets”.

He said headcount here would see a “moderate increase overtime” as it prepares to launch its dengue fever vaccine in 2022 and develop its research and development activities. Its ongoing series of divestments has minimal impact on the office here, he assured.

READ: Five tips for job seekers - from learning new skills to taking a contract position

Mr Waterhouse said it is a mixed bag in his company. While there are roles in his company that require an engineering background, they have also welcomed mid-career switchers from the likes of the oil and gas industry, and others with no experience in additive manufacturing.

“You’d start doing the more practical work of handling the powders (raw materials in powder form), handling the machines … then learning about the machines, then maybe moving into the design side,” he said.

The upside of the pandemic is that it has become easier to hire, Mr Waterhouse said. There is now a pool of older, “very capable” workers looking for jobs. And fresh graduates, who are usually gunning for positions in multinational corporations, have become more open about joining a small business like his.

READ: Challenging job-hunting landscape as recruitment agencies see fewer vacancies and more applications

One of them is Mohd Nasir Ja’apar, who joined 3D Metalforge in July after losing his job as a quality engineer in the oil and gas field four months earlier. He is now in a similar role in his new firm - something the 15-year oil and gas veteran never imagined.

“The term (additive manufacturing) is so alien to me,” the 47-year-old said. When a career coach first suggested interviewing with the firm, he thought it was about toy-making, not manufacturing industrial parts out of digital files.

But after working with robotic arms and observing how the metal components are being printed over the past three months, he is genuinely excited about where he is right now - even the 20 per cent pay cut does not bother him.

“It’s the next big thing,” he said. “I’m excited by the possibilities of the technology and the huge growth potential this industry has.”

BOOKMARK THIS: Our comprehensive coverage of the coronavirus outbreak and its developments

Download our app or subscribe to our Telegram channel for the latest updates on the coronavirus outbreak: https://cna.asia/telegram