commentary Commentary

Commentary: Why residential property prices won’t be coming down despite cooling measures

Over 50 project launches, unleashing 20,000 units, are expected in 2019, but it doesn’t mean prices will come down, says Edmund Tie & Company’s Darren Teo.

Private property in Singapore (File photo: Gaya Chandramohan)

SINGAPORE: Prior to the latest cooling measures introduced in July 2018, the last time similar regulations were rolled out to moderate the residential private property market was in 2013 with the introduction of the Total Debt Servicing Ratio (TDSR).

The TDSR sought to encourage financial prudence among borrowers and strengthen credit underwriting practices by financial institutions, by limiting monthly mortgage payments to no more than 60 per cent of one’s income, and consequently curtail the amount one can borrow to purchase a property.

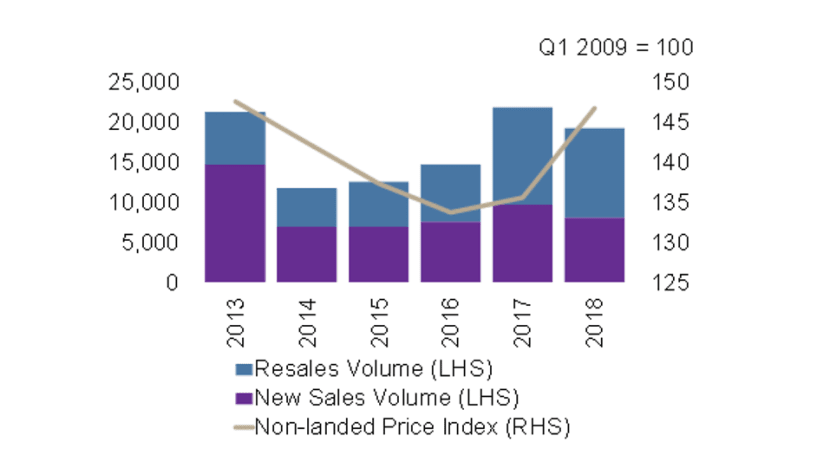

Subsequently, the total sales of residential non-landed properties fell by more than 44 per cent and the private property price index dipped by 3.5 per cent in 2014.

A NEW NORMAL, A BOOM IN 2017 AND 2018

However, the market began picking up again in the second quarter of 2017 – fuelled in part by the relaxation of the seller’s stamp duty (SSD) in March that year, which reduced the amount of time a property owner can sell his place without incurring stamp duties from four to three years, as well as a residential collective sale fever that commenced approximately in May 2017.

In short, it was starting to feel like buyers were beginning to accept those property curbs as “a new normal”.

This was reflected in the residential private property price index that year, which reversed from a contraction of 2.6 per cent in 2016 to a growth of 1.3 per cent in 2017. The volume of transactions jumped by around 48 per cent over the same period.

Residential en bloc sales also surged to S$8.4 billion, up by more than seven times from 2016.

This momentum carried over to 2018 with total sales climbing up by 2.5 per cent year-on-year by the second quarter as well as the price index soaring to a 9.3 per cent year-on-year. In just six months, en bloc sales reached S$10.4 billion before Jul 5, 2018.

READ: Who’s buying private property after last year’s cooling measures? A commentary

A similar trend has been observed after the Government’s introduction of the latest cooling measures in July 2018.

Total sales volume has since almost halved, although prices have remained relatively stable with the price index rising by just 0.5 per cent over the last two quarters of 2018.

READ: Property cooling measures — examining the case for a ‘sledgehammer’

The key question remains whether buyers and developers will get used to this newer normal – or whether the cooling measures make it a buyer’s market for those looking for a home if the property market remains in limbo and developers, stuck with huge land bank, now feel pressured to resort to fire sales to sell off units.

HERE’S WHY PRICES WILL REMAIN STABLE

My opinion, however, is that residential private property prices will remain stable despite the introduction of cooling measures for three key reasons.

First, most developers launching upcoming project launches in 2019 had paid high prices for land during the en bloc fever.

Second, developers will likely be more willing to maintain prices and accept a lower sell-down rate rather than resort to discounting, which may devalue the overall project and disappoint earlier buyers who paid higher prices.

A development with more than 300 units is typically launched in stages. Developers tend to offer early bird discounts to attract buyers and gradually increase prices in subsequent stages until they sell all units.

If they decide to offer further discounts for remaining units in the later sale stages, earlier buyers and investors would suffer a paper loss and fearing a similar outcome, think twice before buying from the same developer.

Third, although developers may be incentivised to resort to heavy discounting to sell all remaining units within five years of being awarded the land, so as to recoup the remissible portions of developer’s ABSD, which is sizable at 25 per cent (an increase from the previous 15 per cent), Edmund Tie and Company’s analysis of URA’s data suggests that the number of developments reaching the five-year development deadline from now until 2020 is relatively low - totalling less than 200 units.

READ: Higher buyer’s stamp duty a wealth tax with mixed impact on the property market, a commentary

Instead, developers will aim to position their projects more competitively rather than dish out steep discounts despite the large supply of properties expected this year, with more than 50 projects and 20,000 units likely to be launched.

Apart from early bird discounts, they will likely offer higher sales commissions to agents, and deferred payment arrangements for completed projects to boost sales.

In fact, even within such a busy landscape, projects that are competitively priced, well-located and with good amenities, such as The Tre Ver condominium, may even see price increases for subsequent launches.

Taken together, I expect potential downward pressure for the resale market of older, less well-located and well-amenitised estates, due to stiff competition from new project launches.

WHY UNWINDING THE COOLING MEASURES MAY BE A COMPLEX EXERCISE

While the Government’s cooling measures in 2013 and 2018 have been relatively effective in curbing market exuberance and excessive rises in prices, there may be unforeseen implications.

First, unwinding the current cooling measures may be more challenging. Any minor re-calibration or relaxation to policies may unleash pent-up demand that quickly drives up price and transaction volume, as was the case in 2017.

Buyers and investors tend to interpret such moves as an end to further tightening and anticipate that higher demand will drive further price increases.

There is a significant inherent demand for private residential units for buyers who purchase property for owner occupation and long-term investment, whose decisions may be less swayed by property curbs due to their stronger financial positions.

With rising incomes in Singapore, the number of households that fit this group of such owners and investors have been on the uptick. There were more than 178,000 Singapore households earning more than S$20,000 per month as at end 2018 according to Singstat, a figure that has seen an average growth of about 10,000 each year since 2009.

In my view, these cooling measures have not dampened Singaporeans’ longstanding love affair with real estate as a tangible investment and as an inheritance for their children.

READ: The outlook for the Singapore property market, an episode on CNA's The Pulse podcast

Wealthy foreigners have also been watching the Singapore market closely, especially higher-end residences located in the core city region, which are seen as good investments and even trophy assets.

It’s noteworthy that the number of properties sold for S$4 million and above jumped by more than 30 per cent in 2018 compared to 2017.

Foreign buyers may only make up 5 to 6 per cent of the total sales volume but remain a significant source of latent demand, especially when one considers the longer-term plans for more residential spaces in the Central Business District, outlined in the URA draft Master Plan 2019.

READ: Would you want to raise a family in Singapore’s CBD? A commentary

Adding to this inherent demand for property are households who have profited during the en bloc sales over the past two years, who may be looking to upgrade to pricier residences or remain in proximity to their previous place of residence.

Third, the Government’s active approach to intervene with property curbs to ensure a stable and sustainable market effectively keeps property capital appreciation in line with economic and wage growth.

Although such interventions reduce speculation and volatility by smoothing out returns on investment in residential properties, they also make private property an attractive long-term investment asset class for buyers with a low-risk profile.

Fourth, the fact remains that developers’ demand for land is cyclical. Many have replenished their land banks with en bloc sites, which has a potential development yield of up to 25,000 new units, equal to circa three years’ supply based on a conservative average sale rate of 8,000 units per annum.

But another round of heightened en bloc activity may occur again over the next one to two years after the current developments diminish, thought prices will likely remain moderated.

READ: Behind dashed hopes of Mandarin Gardens en bloc sale, unbridled speculation and wishful thinking, a commentary

In all, what these conditions mean is that Singapore residential private property market prices are expected to remain neutral, although there is a slight advantage to buyers in terms of the wide range of new project launches to choose from.

In fact, the cooling measures may have just made Singapore property a less attractive asset class for investors with a high-risk appetite.

Darren Teo is Head of Research at Edmund Tie & Company.